Trade Alert - (TSLA) February 8, 2023 - STOP LOSS - SELL

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline.

Trade Alert - (TSLA) – STOP LOSS

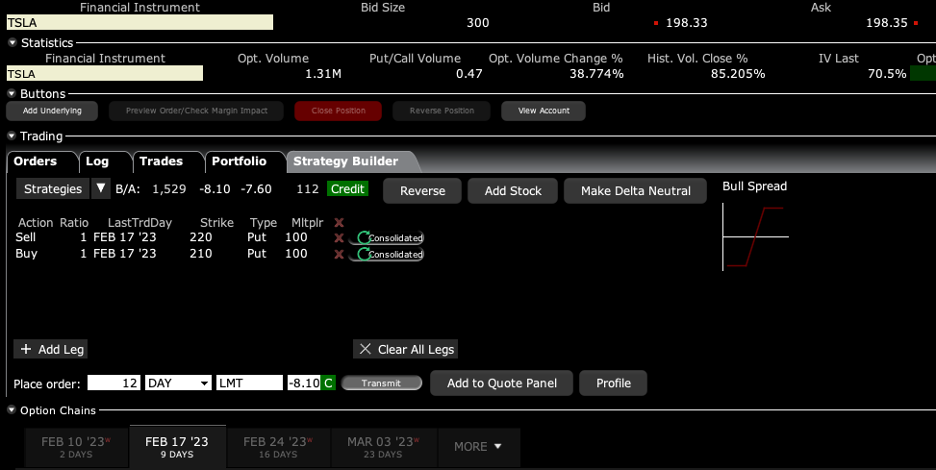

SELL the Tesla (TSLA) February 2023 $210-$220 in-the-money vertical bear put spread at $8.00 or best

Closing Trade

2-8-2023

expiration date: February 17, 2023

Portfolio weighting: 10% weighting

Number of Contracts = 12 contracts

When the most volatile stock in the market starts to move against you, you get the heck out of there. Even though Tesla shares have doubled in five weeks, they are still rising.

I am going to cap my losses at a low level in case this one starts to run away.

Tesla is now the most widely owned stock in the world and accounts for a staggering 6% of the options market. With an eye-popping 74% implied volatility compared to only 19% for the Volatility Index ($VIX) those figures should rise.

Therefore, I am selling the Tesla (TSLA) February 2023 $210-$220 in-the-money vertical bear put spread at $8.00 or best.

DO NOT USE MARKET ORDERS UNDER ANY CIRCUMSTANCES.

Simply enter your limit order, wait five minutes, and if you don’t get done, cancel your order and lower your offer by 10 cents with a second order.

Elon Musk really checkmated the rest of the EV industry with his 20% price cut, which is 35% after adding in newly qualifying government subsidies. This morning, Tesla will still be the most profitable auto company in the world, even after the price cuts.

Ford Motors (F) threw in the towel and cut the price of their EV Mustang by 10%. The problem is that other EV makers lack the parts for an aggressive market share strategy and lose money on what EVs they do make.

Tesla Q4 sales came in short, delivering 405,278 and 1.3 million for all of 2023. The slight miss took the shares down an astounding 14%, a huge overreaction. The stock was on January 1 selling for 22 times 2023 earnings and 11 times 2025 earnings, compared to an average of 17 times earnings for the top four tech companies.

That’s an eye-popping 35% discount to big tech. It’s certainly worth taking a risk going long here for a company that is still growing earnings by 40% a year.

Put spreads this far in the money trade all over the map but give this your best shot.

Tesla shares plunged last year because Elon Musk sold an additional $3.6 billion worth of shares in December, bringing his total for the year to a mind-numbing $40 billion, according to SEC filings.

After my ballistic 86.62% profit in 2022, I am in a mood to start out 2023 with a bang, and this is the best trade I can think of to do that.

With this trade, I am willing to bet that Tesla shares will not rise above $220 by the February 17 option expiration in 13 trading days. That would be 120% above the January 3 low for one of the world’s largest companies.

I am also betting that a company that is growing sales at 50% year and earnings expanding at an incredible 40% a year.

Tesla will remain the top EV maker for the next decade easily.

Here are the specific trades you need to exit this position:

Sell 12 February 2023 (TSLA) $220 puts at….............…….…$22.00

Buy to cover short 12 February 2023 (TSLA) $210 puts at…$14.00

Net proceeds:………………………….……….….................…………$8.00

Loss: $8.00 - $9.10 = $1.10

(12 X 100 X $1.10) = $1,320.

If you are uncertain about how to execute an options spread, please watch my training video by clicking here.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep-in-the-money spread trades can be enormous.

Don’t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Keep in mind that these are ballpark prices at best. After the alerts go out, prices can be all over the map.