Trade Alert - (TSLA) June 10, 2025 - TAKE PROFITS - SELL

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline.

Trade Alert - (TSLA) - TAKE PROFITS

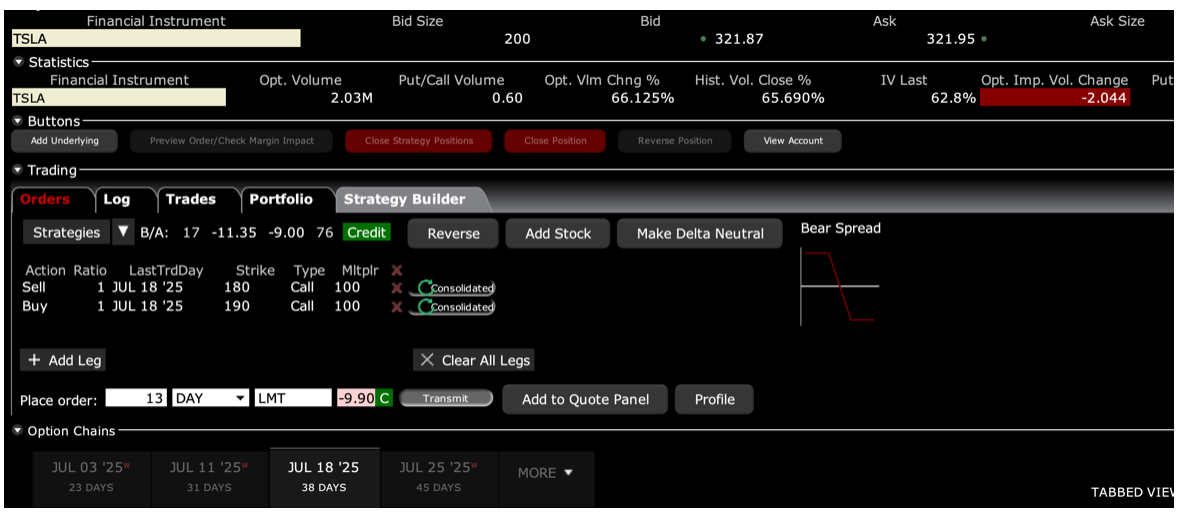

SELL the Tesla (TSLA) July 2025 $180-$190 in-the-money vertical bull call debit spread at $9.90 or best

Closing Trade

6-10-2025

expiration date: July 18, 2025

Portfolio weighting: 10% weighting

Number of Contracts = 13 contracts

This trade has been a real eye-popper.

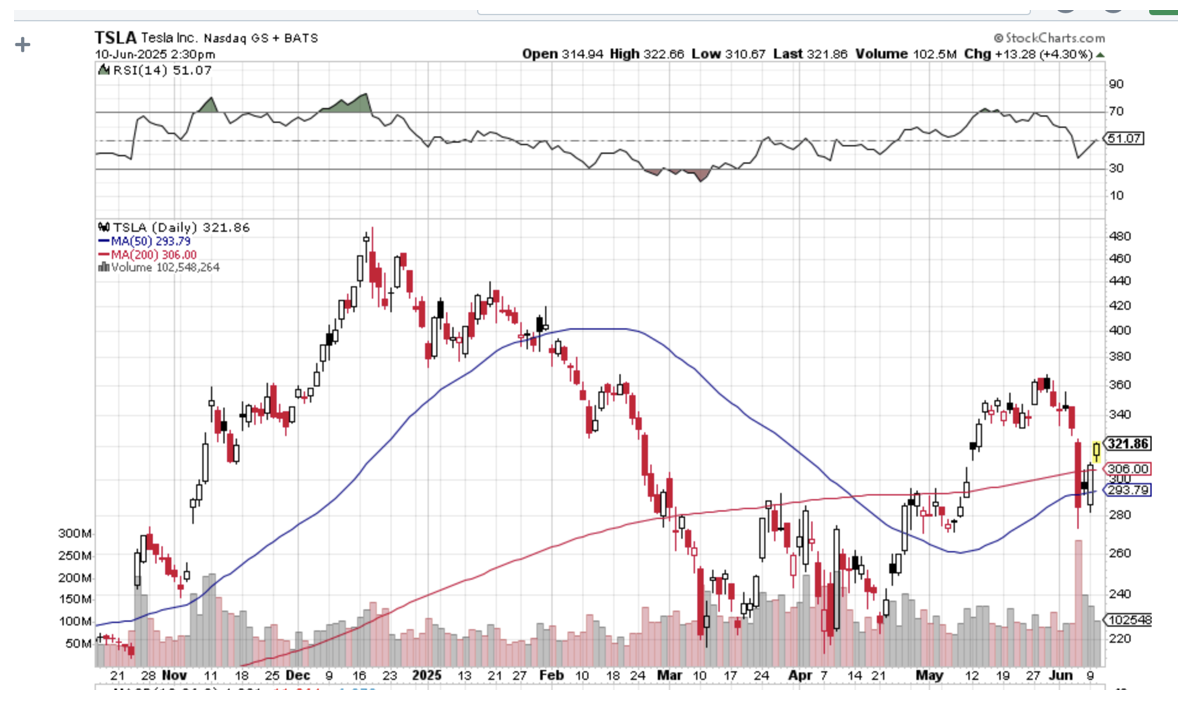

We have seen the most dramatic selloff in option implied volatilities across the entire market in history in just the last 2 trading days. In Tesla’s case, implied plunged from 85% to 62%. We also managed to catch a ballistic $55, or 19.6% move up in the shares at the same time.

This is how being aggressive during market panics really pays off.

As a result, we have attained 93.3% of the maximum potential profit in a one-month spread in only 2 trading days. The risk/reward in continuing for 27 more trading days until the July 18 option expiration is no longer favorable. I haven’t seen this in my 50-year career in trading options.

A headline from the trade war can hit any time, and we have a monster US Treasury bond auction on June 12.

On June 12, Tesla launches its long-awaited robotaxi business in Austin, Texas. The total US market for taxis is estimated at only $70 billion a year. Alphabet has a two-year head start with its Waymo service, with 1,500 self-driving Jaguar EVs on the road in San Francisco, and it is authorized to start operating in another ten cities. The robotaxi will never become a major profit source for Tesla.

Therefore, I am selling the Tesla (TSLA) July 2025 $180-$190 in-the-money vertical bull call debit spread at $9.90 or best.

Tesla shares would have to drop to a new low for the year, or a massive $110, or 37% from here in 29 trading days, for us to lose money on this trade.

DO NOT USE MARKET ORDERS UNDER ANY CIRCUMSTANCES.

Simply enter your limit order, wait five minutes, and if you don’t get done, cancel your order and lower your offer by 55 cents with a second order.

If you don’t want to sit in front of a computer screen all day or live in a foreign time zone when the US stock market is closed, such as Australia, or don’t want to sit in front of a screen all day, simply enter a spread of Good-Until-Cancelled orders overnight, like $9.90, $9.85, and $9.80. You should get done on some or all of these.

With this trade, I was willing to bet that Tesla shares would not fall below $190 by the July 18 option expiration in 29 trading days.

Here are the specific trades you need to close out this position:

Sell 13 July 2025 (TSLA) $180 calls at……………….…….......…$144.00

Buy to cover short 13 July 2025 (TSLA) $190 calls at……..….$134.10

Net Proceeds:……………………….………………………................……$9.90

Profit: $9.90 - $8.50 = $1.40

(13 X 100 X $1.40) = $1,820 or 16.47% in 2 trading days

If you are uncertain about how to execute an options spread, please watch my training video by clicking here.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep-in-the-money spread trades can be enormous.

Don’t execute the legs individually, or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Keep in mind that these are ballpark prices at best. After the alerts go out, prices can be all over the map.