Trade Alert - (TSLA) March 25, 2019 - BUY

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline.

Trade Alert - (TSLA) – BUY

BUY the Tesla (TSLA) April 2019 $300-$320 in-the-money vertical BEAR PUT spread at $17.80 up to $18.50

Opening Trade

3-25-2019

expiration date: April 18, 2019

Portfolio weighting: 10%

Number of Contracts = 5 contracts

The news is out this morning that new Tesla car registrations in the major states are falling off a cliff. California, New York, and even Texas are the major culprits.

The company says it is because the ramp-up in mass production of the Tesla 3 is the main reason, and that car registrations, in any case, are a deep lagging indicator (I bought a Model X P100D in Nevada in November and it is still not registered).

Analysts say it is because the electric car subsidy was chopped in half by the Trump administration this year from $7,500 to $3,750 per vehicle, and it is going to zero next year, thus demolishing the Tesla 3 market for entry-level low-end buyers.

For whatever reason, I believe that the shares will break two-year support on the charts and plunge to new lows. At the very least, Tesla shares are capped for the time being.

I am therefore buying the Tesla (TSLA) April 2019 $300-$320 in-the-money vertical BEAR PUT spread at $17.80 or best.

Don’t pay more than $18.50 for this position or the risk/reward will tip against you.

This is a bet that Tesla shares will not rise above the $300 strike price by the April 18 options expiration date in 14 trading days. That would be a total rise of 15.38% from the current level, or $38.

If you don’t do options, sell short a small position the stock outright for a quick trade. There is no ETF equivalent for this trade.

As much as this looks like a great short term trade, long term I love Tesla and see it as a potential ten bagger from current price levels. Tesla will become the world’s largest car company within a decade and become the first car company with a $1 trillion market valuation.

When I pulled up to the Fremont factory last week, I couldn’t believe what I found. There was a version 3 supercharger that would top up my battery at the staggering rate of 1,000 an hour!

That meant that with 50 miles of range left on my 300-mile range Model X battery, I could get a full charge in 15 minutes! The electric power was coming down the charging cable so fast that it had to be liquid cooled.

I pinched myself to make sure I hadn’t fallen into a Star Trek movie. The V3 supercharger will soon be available across the country. No other car company is close to achieving something like this.

The fact is that I have been subjected to an unrelenting torrent of bad news, rumors, and envy since I first bought the shares at $16.50 ten years ago. I ignore them all and just look at the numbers. Here they are.

Tesla has increased its total production from 125 when I bought my first Model S1 in 2009 to 245,519 in 2018. It should hit 500,000 by the end of this year when the Shanghai factory comes online.

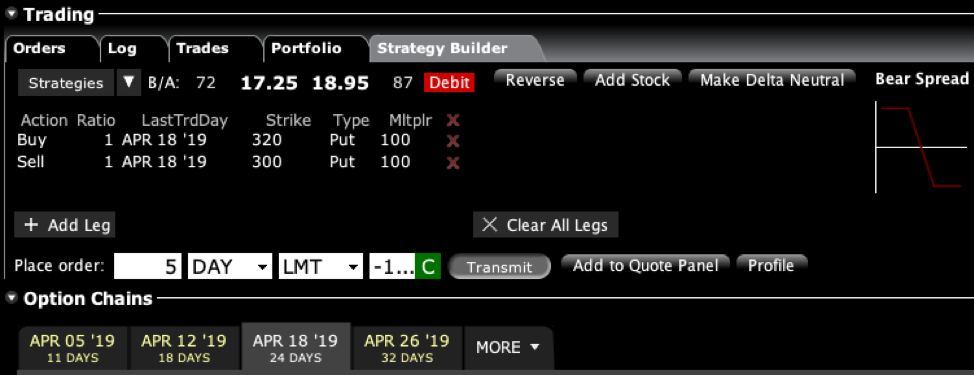

Here are the specific trades you need to execute this position:

Buy 5 April 2019 (TSLA) $320 puts at………….………$61.00

Sell short 5 April 2019 (BA) $300 puts at………….$43.20

Net Cost:……………………..…….………..………….….....$17.80

Potential Profit: $20.00 - $17.80 = $2.20

(5 X 100 X $2.20) = $1,100 or 12.36% in 14 trading days.

To see how to enter this trade in your online platform, please look at the order ticket above, which I pulled off of Interactive Brokers.

If you are uncertain on how to execute an options spread, please watch my training video on How to Execute Vertical Call and Put Debit Spreads by clicking here.

You must be logged into your account to view the video.

Please keep in mind that these are ballpark prices only. There is no telling how much the market can move by the time you get this.

Be sure you've signed up for our FREE text alert service. When seconds count, this feature offers a trading advantage. In today's market, investors need every advantage they can get.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you.

The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

Don't execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile close to expiration.

If you don't get done, don't worry. There are another 250 Trade Alerts coming at you over the coming 12 months.