Trade Alert - (TSLA) March 6, 2023 - BUY

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline.

(TSLA) - BUY

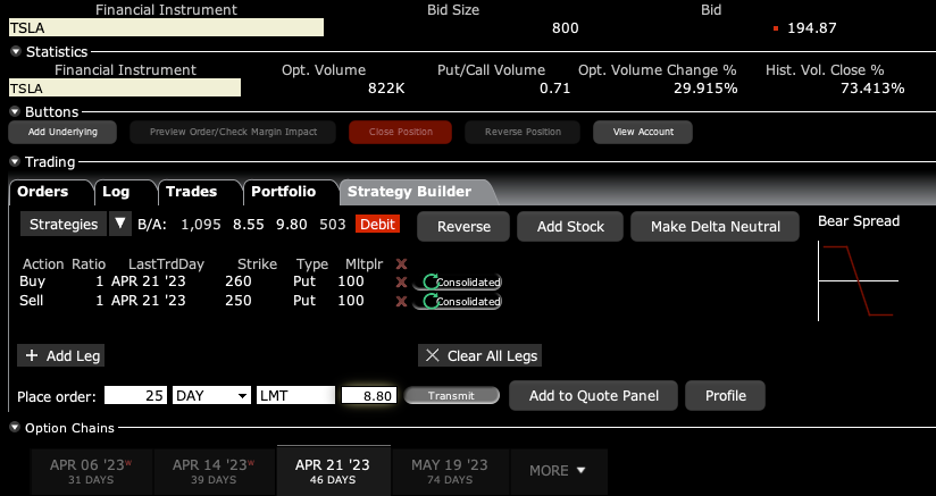

Buy the Tesla (TSLA) April 2023 $250-$260 in-the-money vertical bear put debit spread at $8.80 or best

Opening Trade

3-6-2023

expiration date: April 21, 2023

Portfolio weighting: 20% double weighting

Number of Contracts = 25 contracts

I think the next upside breakout for Tesla is more than a month off, and probably several months.

As much as I love Tesla for the long term, the stock is wildly overbought for the short term. It is the greatest two-month creation of shareholder equity in stock market history, some $360 billion.

A price war has broken out in EVs for now, so the near-term risk for Tesla shares is to the downside, even though I think we eventually will make it to $1,000.

Therefore, I am buying the Tesla (TSLA) April 2023 $250-$260 in-the-money vertical bear put spread at $8.80 or best.

Don’t pay more than $9.30 or you’ll be chasing.

DO NOT USE MARKET ORDERS UNDER ANY CIRCUMSTANCES.

Simply enter your limit order, wait five minutes, and if you don’t get done, cancel your order and increase your bid by 10 cents with a second order.

After markets have big moves like we saw in January, you tend to get no moves for a couple of months. With the highest implied volatility in the market at 78%, a short Tesla strangle is far and away the best way to play this. This is the first leg in that strangle.

We also have the autonomous driving recall of 360,000 Tesla vehicles here to trade against. The Volatility Index ($VIX) is now down to $18 and looks like it may break down, giving us a few extra coins on this trade. Boredom is contagious.

The selloff was prompted by rising fears of a debt default by the House of Representatives this summer which have taken interest rates dramatically higher. As a result, Tesla has had to raise interest rates on company-financed new sales from 2.0% to 5.0%.

Strong residence on the charts at the 200-day moving average at $223.13 also provides a further argument for the short-term bear case for Tesla.

Tesla is now the most widely owned stock in the world and accounts for a staggering 6% of the options market.

I think it’s safe to double up my short here $50 in the money with only 19 days left until expiration.

Elon Musk really checkmated the rest of the EV industry with his 20% price cut, which is 35% after adding in newly qualifying government subsidies. This morning, Tesla will still be the most profitable auto company in the world, even after the price cuts.

Tesla Q4 sales came in short, delivering 405,278 and 1.3 million for all of 2023. Put spreads this far in the money trade all over the map but give this your best shot.

With this trade, I am willing to bet that Tesla shares will not rise above $250 by the April 21 options expiration in 29 trading days.

Here are the specific trades you need to execute this position:

Buy 25 April 2023 (TSLA) $260 puts at……...….…$67.00

Sell short 25 April 2023 (TSLA) $250 puts at…….$58.20

Net cost:………………………….……….………..........……$8.80

Potential Profit: $10.00 - $8.80 = $1.20

(25 X 100 X $1.20) = $3,000, or 13.64% in 29 trading days.

If you are uncertain about how to execute an options spread, please watch my training video by clicking here.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep-in-the-money spread trades can be enormous.

Don’t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Keep in mind that these are ballpark prices at best. After the alerts go out, prices can be all over the map.