Trade Alert - (TSLA) November 12, 2019 - STOP LOSS - SELL

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline.

Trade Alert - (TSLA) – STOP LOSS

SELL the Tesla (TSLA) December 2019 $360-$370 in-the-money vertical BEAR PUT spread at $6.80 or best

Closing Trade

11-12-2019

expiration date: December 20, 2019

Portfolio weighting: 10%

Number of Contracts = 12 contracts

Tesla has risen 96% since June, making it far and away America’s largest car company with a $63 billion market capitalization. It turns out that taking a short position when the shares were up an eye-popping 55% in a month wasn’t such a great bet after all.

And while the stock is wildly overbought, it is apparently not overbought enough. The buzz about the release of its Model Y pickup truck due out next week has the potential to push the stock up to a new all-time high. There is also a massive short squeeze underway as Tesla was one of the most heavily shorted stocks in the entire market, with an incredible 30% of its outstanding of the float out on loan.

Adding fat to the fire is the fact that the Mad Hedge Market Timing Index has been hanging around the nosebleed 90 level for a week. This incredible over buying has not been seen since the top of the Dotcom bubble in 2000. This is one of the most aggressive “RISK ON” periods in history.

Of course, all this is due to the twin hyper stimulus of ultra-low interest rates, with US real rates recently dragged back down to zero, and the supposed resolution of the China trade war. These are strictly temporary events that can’t last in the face of plunging corporate earnings. We knew all this was coming, which is why I had only one short position.

I am therefore selling the December 2019 $360-$370 in-the-money vertical BEAR PUT spread at $6.80 or best. To continue on from here, the risk/reward is no longer favorable.

This was a bet that Tesla shares would not rise above the $360 strike price by the December 20 option expiration in 36 trading days.

All this does is cancel out the profits of my other long position in Boeing (BA) which has risen a meteoric $45 since we bought it, and which expires in three trading days on Friday. That still leaves us in excellent share for 2019.

It looks like my ten-bagger scenario for Tesla is rolling out sooner than expected. I believe Tesla will eventually reach $2,500 a share. By the way, my Model X did an outstanding job driving me and the Boy Scouts to Yosemite last weekend, needing only a single recharge.

Here are the specific trades you need to execute to obtain a $10,000 position:

Sell 12 December 2019 (TSLA) $370 puts at………......….………$31.00

Buy to cover short 12 December 2019 (TSLA) $360 puts at….$24.20

Net Cost:………………………….………....…………....................….....$6.80

Loss: $8.60 - $6.80 = $1.80

(12 X 100 X $1.80) = $2,160

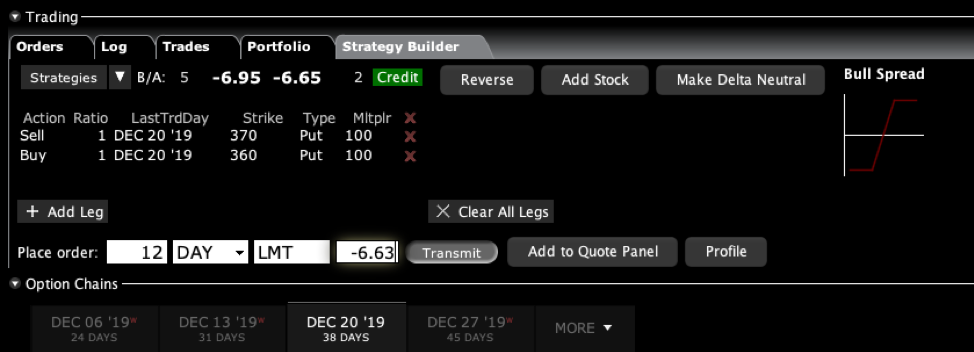

To see how to enter this trade in your online platform, please look at the order ticket above, which I pulled off of Interactive Brokers.

If you are uncertain on how to execute an options spread, please watch my training video on How to Execute Vertical Call and Put Debit Spreads by clicking here.

You must be logged into your account to view the video.

Please keep in mind that these are ballpark prices only. There is no telling how much the market can move by the time you get this.

Be sure you've signed up for our FREE text alert service. When seconds count, this feature offers a trading advantage. In today's market, investors need every advantage they can get.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you.

The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

Don't execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile close to expiration.

If you don't get done, don't worry. There are another 250 Trade Alerts coming at you over the coming 12 months.