Trade Alert - (VST) November 19, 2024 - BUY

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline.

Trade Alert - (VST) – BUY

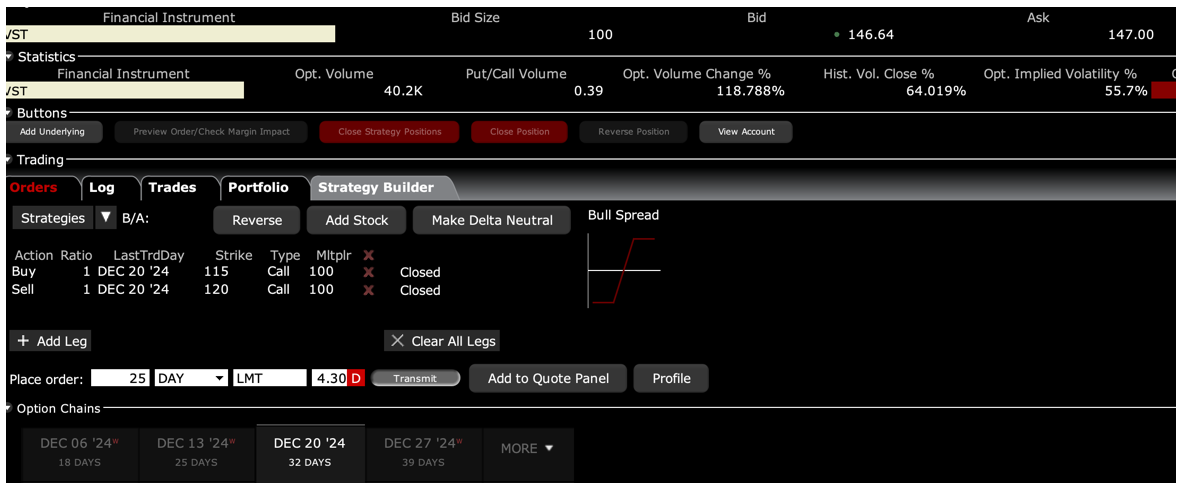

Buy the Vistra Energy (VST) December 2024 $115-$120 in-the-money vertical bull call debit spread at $4.30 or best

Opening Trade

11-19-2024

expiration date: December 20, 2024

Portfolio weighting: 10% weighting

Number of Contracts = 25 contracts

With my position in Cameco (CCJ) already at max profit, I am more than happy to take profits and roll the money into Vistra Corp. (VST).

With this position, I am maintaining my exposure to the nuclear renaissance, which will be unfolding over the next few years. The prospect of easing regulation in the energy sector in the coming years has put a turbocharger on this sector.

Vistra Corp. is one of the preeminent nuclear power plants in the United States, and one of the most rapidly expanding, with four operating plants.

We also have an enormous advantage with this trade in that the options are sporting a sky-high 56% implied volatility.

Therefore, I am buying the Vistra Corp (VST) December 2024 $115-$120 in-the-money vertical bull call debit spread at $4.30 or best.

DO NOT USE MARKET ORDERS UNDER ANY CIRCUMSTANCES.

Simply enter your limit order, wait five minutes, and if you don’t get done, cancel your order and increase your bid by 10 cents with a second order.

Do not pay more than $4.60 or you will be chasing.

If you live in a foreign time zone when the US stock market is closed, such as Australia, or don’t want to sit in front of a screen all day, simply enter a spread of Good-Until-Cancelled orders overnight, like $4.30, $4.40, $4.50, and $4.60. You should get done on some or all of these.

Vistra recently received permission from the Nuclear Regulatory Commission. Comanche Peak, a two-unit facility, is the third of Vistra's four nuclear plants to receive its license extension from the NRC. Comanche Peak units 1 and 2 can now operate through 2050 and 2053, respectively.

The company's Beaver Valley Nuclear Power Plant units 1 and 2 in Pennsylvania are licensed through 2036 and 2047, and Davis-Besse in Ohio is licensed through 2037. Perry Nuclear Power Plant in Ohio filed its application for renewal in 2023 and is currently in the NRC review process.

With this trade, I am willing to bet that Vistra Corp. shares will not fall below $120 by the December 20 option expiration in 23 trading days.

To learn more about Vistra Energy, please their website at https://vistracorp.com

Here are the specific trades you need to execute this position:

Buy 25 December 2024 (VST) $115 calls at……….....…$34.00

Sell short 25 December 2024 (VST) $120 calls at…….$29.70

Net cost:………………………….……….…………................…$4.30

Potential Profit: $5.00 - $4.30 = $0.70

(25 X 100 X $0.70) = $1,750 or 16.28%

If you are uncertain about how to execute an options spread, please watch my training video by clicking here.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep-in-the-money spread trades can be enormous.

Don’t execute the legs individually, or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Keep in mind that these are ballpark prices at best. After the alerts go out, prices can be all over the map.