Trade Alert - (W) September 6, 2019 - SELL-TAKE PROFITS

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline.

Tech Trade Alert - (W) – SELL – TAKE PROFITS

SELL Wayfair Inc. (W) September 2019 $125-$130 in-the-money vertical BEAR PUT spread at $4.40 or best

Closing Trade

9-6-2019

expiration date: September 20, 2019

Portfolio weighting: 10%

Number of Contracts = 23 contracts

Wayfair is a company that buys growth and has an unsustainable business model.

A famous Wall Street bank put out a note the other day anointing this stock as one of their best growth buys, I still don’t like the company.

That note caused shares to mushroom by 8% and now I am using this down day of around 3% to exit with a solid profit.

These growth tech companies are volatile and price action is important, I would suggest exiting this trade now and going in for another put spread with higher strikes if there is another move up.

When you look at this company, costs are out of control and I believe in this brave new world where investors are looking for high-quality balance sheets, Wayfair fails miserably.

They are effectively the inferior home décor version of Amazon but substantially further behind than Amazon.

We needed another bear position to balance out the portfolio in this very precarious market and this is a good one.

Wayfair Inc. engages in the e-commerce business in the United States, Europe, and internationally. It provides approximately 14 million products for the home sector under various brands. The company offers a selection of furniture, décor, decorative accents, housewares, seasonal décor, and other home goods.

Revenue has soared to $8 billion on a trailing-12-month basis, the loss on the bottom line widened to $677 million over the past year.

The second-quarter earnings results were in line with expectations, but the stock has performed poorly since the report, declining by about 4%.

The net loss widened, reflecting aggressive spending in advertising and new CastleGate warehouse facilities to drive growth. The company reported a net loss of $181.9 million, while free cash flow was a negative $91.5 million.

Management guided for even higher spending in advertising and capital expenditures in the third quarter while calling for revenue growth to decelerate into the mid-30s percentage range.

I would not hold this company long term.

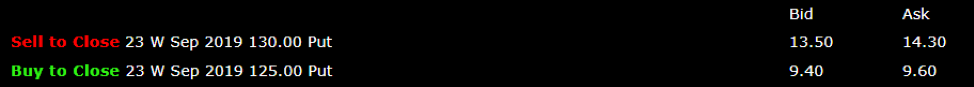

Sell 23 September 2019 (W) $130 put at………….......………$13.90

Buy to cover short 23 September 2019 (W) $125 put at..….$9.50

Net Proceeds:………………………….………..………….…............$4.40

Profit: $4.40 - $4.15 = $0.25

(23 X 100 X $0.25) = $575 or 5.75%

To see how to enter this trade in your online platform, please look at the order ticket below, which I pulled off of Interactive Brokers.

If you are uncertain on how to execute an options spread, please watch my training video on “How to Execute a Vertical Bull Call Spread” by clicking here.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

Don’t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Keep in mind that these are ballpark prices at best. After the alerts go out, prices can be all over the map.