Trade Alert - (WPM) January 14 , 2021 - SELL-TAKE PROFITS

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline.

Trade Alert - (WPM) – TAKE PROFITS

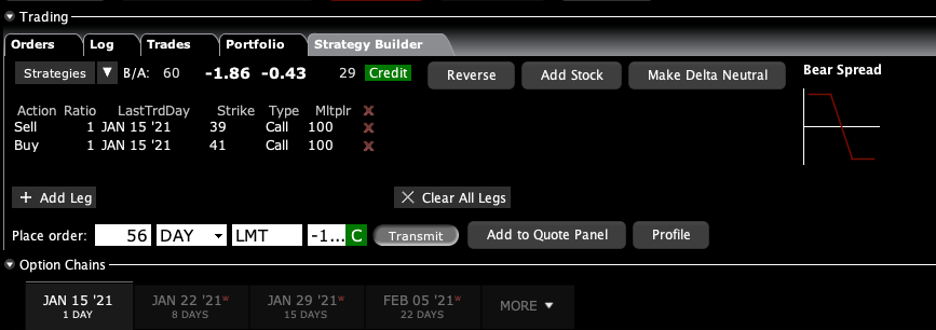

SELL the Wheaton Precious Metals (WPM) January 2021 $39-$41 in-the-money vertical Bull Call spread at $1.85 or best

Closing Trade

1-14-2021

expiration date: January 15, 2021

Portfolio weighting: 10%

Number of Contracts = 56 contracts

I am bailing on my (WPM) position today, even though we only have a mere one day left to expiration. With the upper strike price only pennies away, the risk/reward has dropped to 50/50, which is not worth doing.

The first thing they teach you in flight school is that there are old pilots, there are bold pilots. But there are no old, bold pilots.

Precious metals have performed poorly for the past two weeks due to the bond market collapse and soaring interest rates. Precious metals hate competition from interest rates because they yield zero. I knew that bonds were going to fall, but $8 points in a week is extreme.

Precious metals will have their day, but not yet. I hate unloading this position as I expect the inflation rate to hit 3% by June and quantitative easing to continue unabated, and gold and silver will soar.

I am therefore selling the Wheaton Precious Metals (WPM) January 2021 $39-$41 in-the-money vertical Bull Call spread at $1.85 or best.

Long term players may keep their stock.

By coming out here, you get to take home a modest $280.

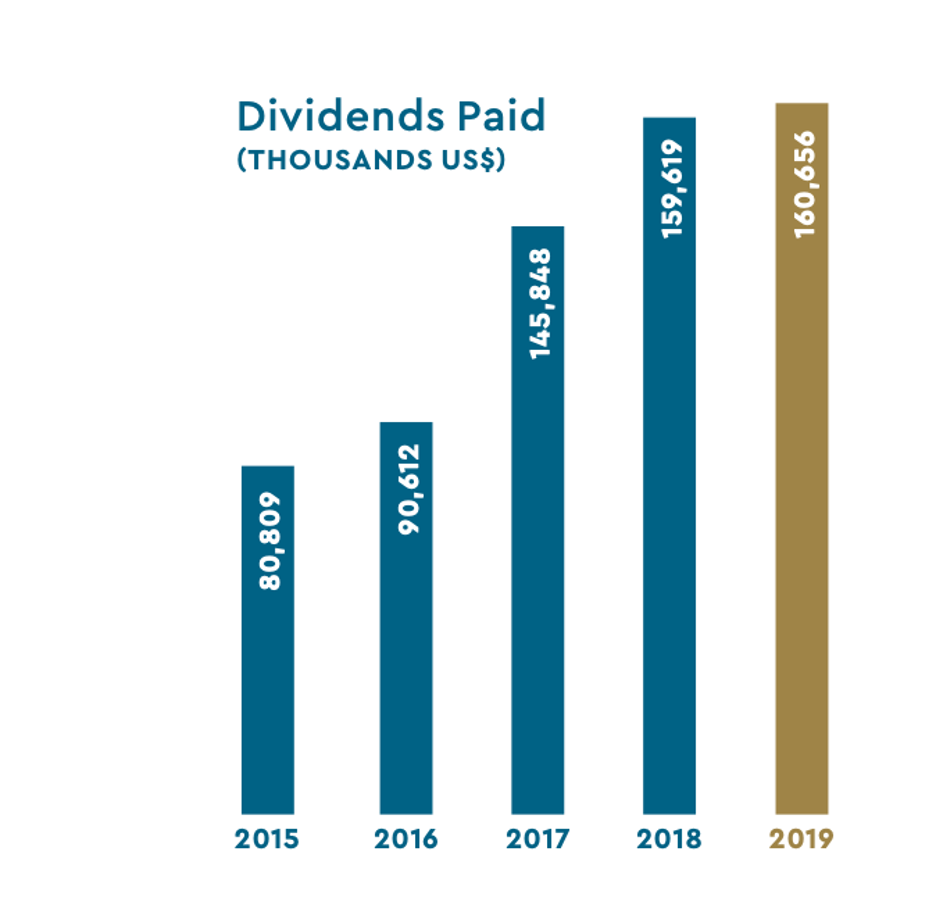

Wheaton Precious Metals Corp. is a multinational precious metals dividend streaming company, also known as a royalty trust. It indirectly produces over 26 million ounces a year via short term options and contracts with mining companies all over the world, including Mexico, Portugal, The US, Chile, and Peru. It is, in effect, the best leveraged play on silver out there.

To learn more about the operation of Wheaton Precious Metals Corp, please visit their site by clicking here.

Silver is a great industrial play and if you believe in the global economic recovery, you want to be loading the boat.

It is used in electronics and solar panels, which are about to get a big boost from the new president. Every Tesla requires 20 pounds of silver, which will more than double production next year from 500,000 to 1.1 million units.

And yes, it is still used for jewelry, which gets bought more during economic recoveries.

Silver tends to lag gold, which has already started to move. When it plays catch-up, it rises twice as fast as gold.

DO NOT USE MARKET ORDERS UNDER ANY CIRCUMSTANCES.

Simply enter your limit order, wait five minutes, and if you don’t get done, cancel your order and lower your offer by 5 cents with a second order.

This was a bet that the Wheaton Precious Metals (WPM) would not fall below $41 by the January 15 option expiration day in 9 trading days.

Here are the specific trades you need to exit this position:

Sell 56 January 2021 (WPM) $39 calls at………..........….………$2.75

Buy to cover short 56 January 2021 (WPM) $41 calls at……..$0.90

Net Proceeds:……………………..…….………..…………..........….....$1.85

Profit: $1.85 - $1.80 - $0.05

(56 X 100 X $0.05) = $280

If you are uncertain on how to execute an options spread, please watch my training video by clicking here.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

Don’t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Keep in mind that these are ballpark prices at best. After the alerts go out, prices can be all over the map.