Watch Those Monetary Aggregates!

Call me a nerd, but instead of spending my Sundays watching the NFC playoffs, I pour over data analyzing the monetary aggregates. This is so I can gain insights into the future performance of assets classes. What I am seeing these days is not just unusual; it?s bizarre. Call it a double reverse, a Hail Mary, and a Statue of Liberty all combined into one.

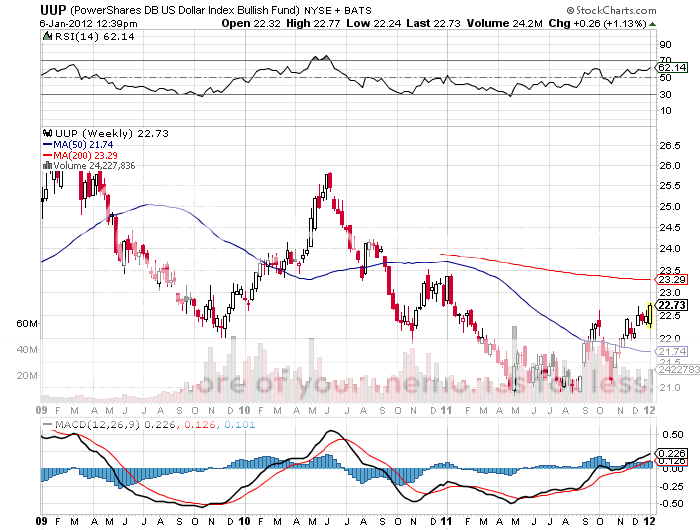

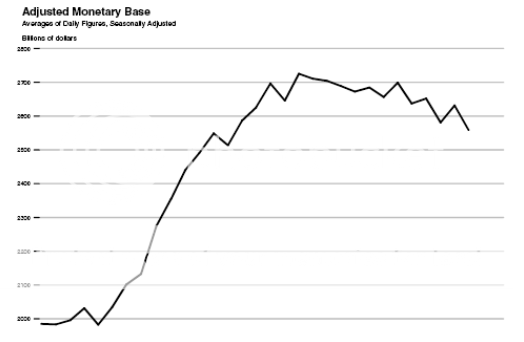

You can clearly see the impact of QE2 at the end of 2010 on the chart below, which caused the monetary base to explode and triggered a six month love fest for all risk assets. Hard asset prices, like energy, commodities, the grains, and precious metals did especially well, leading to fears of resurging inflation. This prompted the European Central Bank to commit a massive policy blunder by raising interest rates twice. The US dollar (UUP) was weak for much of this time.

When quantitative easing ended in June, not only did the base stop growing, it started shrinking. Hard assets rolled over like the Bismarck, and gold peaked in August. No surprise that when you take away the fuel, the fire goes out. And guess what else happened? The dollar began an uptrend that continues unabated.

So what happens next? Given the continuing strength of the economic data, I think that the prospects of a QE3 have been greatly diminished. Not only has it been taken off the back burner, the flame has been extinguished and the pot put back into the cupboard.

Needless to say, if this trend continues it will have a deflationary impact on the global economy as a whole,? and ?RISK ON? assets specifically. This is great news for the dollar. It?s simply a question of supply and demand. Print fewer dollars and you create a supply shortage, forcing bidders to pay up. This augurs poorly for the non-dollar currencies, especially the Euro (EUO), which you should be heavily short. What! I?m already short the Euro? Fancy that!

Dad Was Always a Great Monetarist