Welcome the Concierge Banker to the Crypto Industry

If you want to insulate yourself from the daily gyrations of cryptocurrency but still gain exposure to the economic infrastructure that supports it, there is a clear historical lesson in the rise and collapse of Silvergate Capital Corporation (SICPQ).

You never needed to open a cold wallet or custody a digital asset to participate in what Silvergate represented. The company, through Silvergate Bank, operated as a regulated U.S. bank providing fiat services to cryptocurrency exchanges, brokers, and institutional investors. It held a full bank charter and positioned itself not as a speculative crypto participant, but as financial plumbing for the digital asset economy.

For several years, that positioning appeared durable. Digital assets embedded themselves into global markets, and demand for compliant fiat on-ramps and off-ramps expanded alongside them. Silvergate built its franchise around this demand, offering real-time U.S. dollar settlement between crypto exchanges and institutional counterparties through its proprietary payments network. As participation increased, liquidity clustered inside the system, reinforcing customer dependence and operational stickiness.

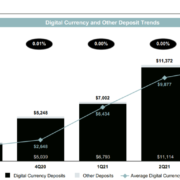

Deposit growth followed industry expansion. Institutional crypto firms maintained large, non-interest-bearing balances to support trading, custody, and settlement activity. Those deposits funded securities portfolios and lending activity tied to crypto markets, producing strong net interest income during periods of market stability. The model worked as long as confidence held and liquidity remained abundant.

The vulnerability emerged from concentration. Silvergate’s funding base was overwhelmingly composed of crypto-related deposits that were uninsured, institutional, and highly sensitive to market stress. When confidence in centralized crypto intermediaries weakened, deposit outflows accelerated. Meeting those withdrawals required selling securities into unfavorable market conditions, eroding capital, and compressing liquidity in a self-reinforcing cycle.

The bank’s exposure was compounded by leverage products secured by digital asset collateral. While structurally conservative by traditional banking standards, these products intensified balance sheet sensitivity during periods of volatility. The same mechanisms that once amplified growth compressed margins and capital when market conditions reversed.

Competition did not arrive in the form many anticipated. Large financial institutions such as JPMorgan Chase (JPM) and Morgan Stanley (MS) did not need to aggressively fund crypto markets to exert pressure. Their diversified funding, deep liquidity, and regulatory insulation allowed them to wait while specialists absorbed sector-specific risk.

At its peak, Silvergate serviced a broad network of crypto-native and institutional firms, including Binance.US, Coinbase (COIN), Fidelity Digital Assets, PayPal (PYPL), and CME Group (CME). These relationships reflected genuine demand for crypto-aligned banking infrastructure, but they did not immunize the institution from systemic liquidity risk.

Silvergate ultimately exited the banking system through voluntary liquidation, ending its role as a crypto-focused financial intermediary. The broader digital asset market persisted. Banking services reallocated. Infrastructure adapted.

As of 2026, the lesson is not that crypto banking lacks demand, but that demand alone does not confer durability. Financial institutions whose balance sheets are tightly coupled to a single volatile sector must manage liquidity, concentration, and confidence with exceptional discipline. When those elements fail to align, network effects reverse as efficiently as they once compounded.

Silvergate’s legacy now sits as a structural case study in how regulated finance intersects with digital asset markets, and where that intersection can fracture under stress.