What Hot?and Not

My friend, Tom Dorsey of the technical research boutique Dorsey Wright, inundates me daily with a never ending stream of market sensitive data which has been helping me make some of my more successful market calls. For example, when the S & P 500 hundred broke 1,380 in April, he completely nailed the 1,280 bottom in the current move.

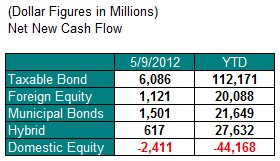

So, I thought I?d pass on the asset class performance table below for the last 1, 6, and 12 months for your edification. The top performing three categories are all in bonds, with the 30 year Treasury easily taking the number one spot at 35%. They have continued the hot streak this year, clocking 7% year to date. All equity classes are showing negative YOY returns, not a surprising result in the middle of a lost decade in a low growth economy.

Which asset class gets the booby prize? No surprise that its European equities, down a hair raising 21%, whose travails have been eloquently detailed in these pages.

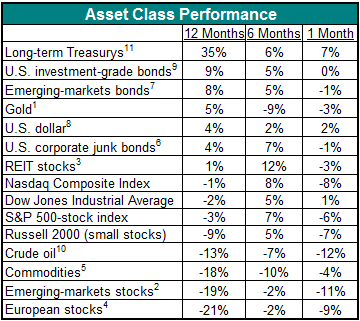

You can see this performance mirrored in the mutual fund cash flows table next. Money continues to pour into fixed income like Niagara Falls, with the taxable sector soaking up a stunning $112 billion in cash this year. The money is flocking to debt at negative real interest rates. This has been at the expense of domestic equity mutual funds, which suffered $44 billion in outflows. I liken this to driving 80 miles an hour, but only looking in the rear view mirror. It can only end in tears.

These numbers are a major reason why I turned bearish so early this year. Retail investors clearly aren?t drinking the Kool-Aid any more. It further bolsters my belief that the stock markets permanently lost a generation of investors after the gut churning trauma of the 2008 crash. The disastrous Facebook (FB) IPO just threw more fat on the equity bonfire.

Finally, for the sake of levity, Tom listed all of the possible responses to be heard around a Memorial Day BBQ, and the strategic response you should adopt. Read it for a good post-holiday laugh. To visit Tom?s ever useful website please click here at http://www.dorseywright.com/ .

Watch Out for That BBQ Advice