When The Market Gives Back What It Once Took Away

If Wall Street had a confessional booth, I'd be first in line. "Forgive me, market gods, for I underestimated how quickly sentiment could shift."

When I last wrote about Abbott Laboratories (ABT), the market was treating this medical device powerhouse like last week's leftovers—despite growth that would make most CEOs weep with joy.

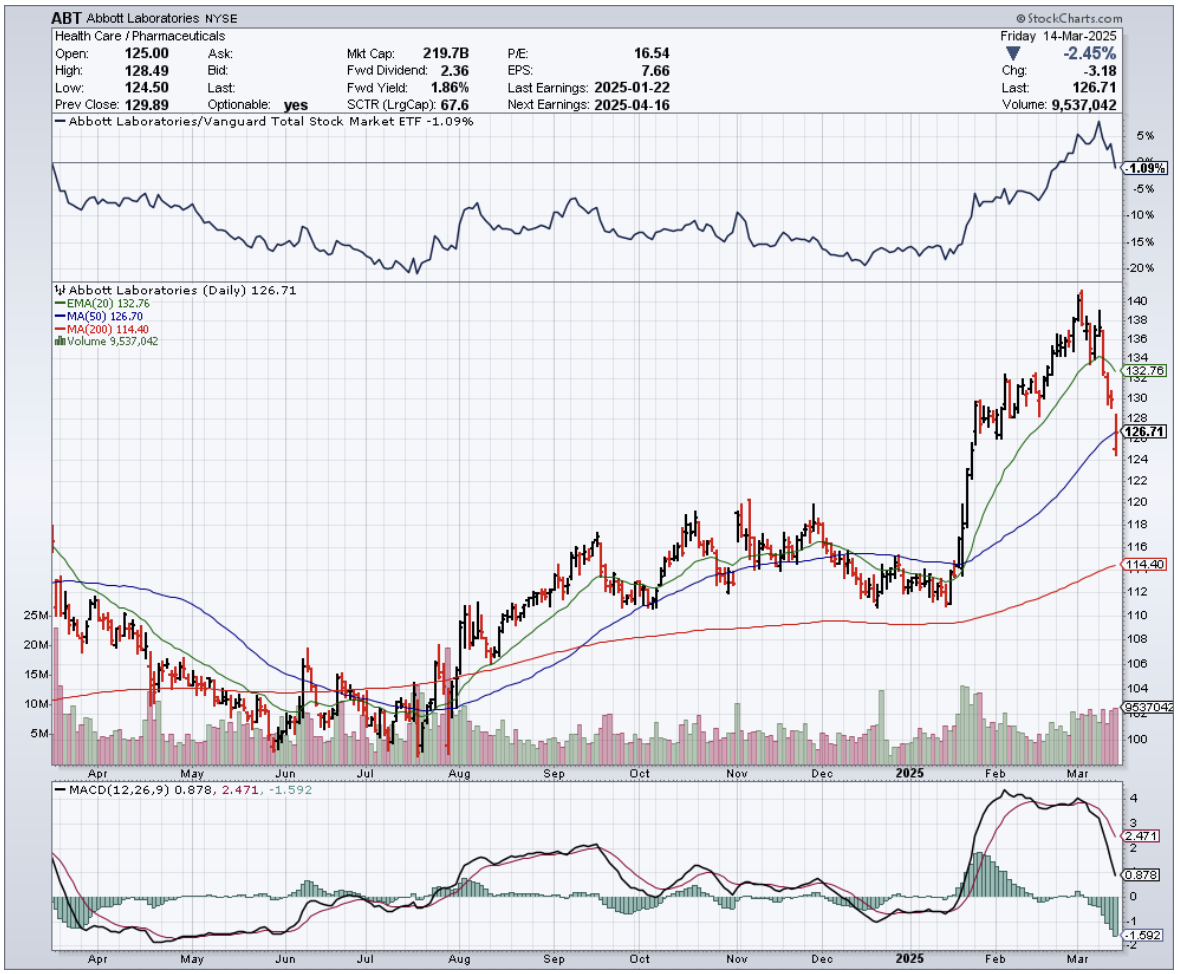

Fast forward a few months, and Abbott's stock has rocketed 25%, outpacing the broader medical device sector by about 20%.

It has kept stride with Boston Scientific (BSX) while leaving Intuitive Surgical (ISRG) and Stryker (SYK) eating dust.

This kind of market whiplash reminds me of reporting from Tokyo trading floors in the 1980s—fortunes changing direction faster than a day trader after espresso, fundamentals barely shifting while sentiment performed aerial gymnastics.

So what changed? Abbott became a flight-to-safety darling.

While economic storms gather, it sits comfortably in its non-elective procedure fortress, with minimal tariff exposure and a recent legal victory reducing liability concerns.

The irony? Sentiment has now sprinted ahead of business performance. While Abbott remains a leader, its valuation leaves little room for missteps.

And if I'm overpaying for med-tech, I might as well reach for Boston Scientific instead, where growth is comparable but the valuation looks more reasonable.

Abbott’s fourth-quarter results weren’t showstopping, but they were reassuring.

Revenue landed slightly below expectations in some areas, but crucial segments—like Medical Devices—delivered strong results. Meanwhile, profit margins surprised pleasantly, reinforcing Abbott’s operational strength.

Overall revenue grew 9% organically, with Medical Devices leading at 14% growth.

The Diagnostics division posted just 1% growth, but that’s misleading—strip out COVID-19 testing effects, and underlying growth jumps to 6%.

Margins impressed, too. Gross margin improved to 56.9%, and adjusted operating income climbed 10%.

Abbott even managed a narrow revenue beat while missing slightly on EBITDA and free cash flow, largely due to tax timing that caught most analysts off guard.

I've spent decades analyzing companies across multiple sectors, and I can tell you Abbott’s medical device business deserves genuine admiration.

It maintained 14% growth from start to finish—a remarkable consistency while competitors slowed from 9.5% to 9.2% growth during the same period.

Looking at the fourth-quarter specifics, Structural Heart shone with 23% growth, outpacing Boston Scientific’s 20% and Medtronic’s 12%.

The Diabetes segment posted an impressive 20% growth, more than doubling DexCom’s 8%. Even in slower segments like Cardiac Rhythm (7%) and Neuromodulation (8%), Abbott still outperformed key competitors.

The bottom line: Abbott is executing at an exceptional level across its device portfolio.

Even its Diagnostics business, with 6% underlying growth, holds up well against Roche’s 8% and substantially outperforms Siemens Healthineers’ anemic sub-1% and Danaher’s 2% contraction.

There are three developments that investors should be paying attention to.

First, Abbott’s exposure to new tariffs is minimal—just 5% of COGS from Mexico and 1% from China. This translates to a low single-digit EPS impact, barely a rounding error in today’s environment.

Second, TriClip may have more growth potential than I previously thought. Recent data from Edwards Lifesciences’ (EW) competing Evoque device showed no mortality benefit and only modest hospitalization improvements.

This lets Abbott position TriClip as the safer approach without sacrificing quality-of-life benefits.

Third—and most significant—Abbott won a crucial legal victory in October regarding its infant formula.

A jury unanimously found the company not at fault in a necrotizing enterocolitis case, though the judge recently granted a new trial.

With 10,000 cases still pending, this development could strengthen Abbott’s settlement position and potentially cap damages below $1 billion—substantial but manageable.

I expect slight moderation next year, but Abbott should still deliver 7% growth over the next three to five years.

Newer products like Lingo (blood glucose monitoring for non-diabetics) are performing well, with significant potential in Amulet and upcoming PFA and lithotripsy offerings.

On margins, I expect EBITDA to climb above 28% within four years, with free cash flow margins reaching high-teens to low-20%.

This should drive high single-digit to low double-digit FCF growth—performance that typically earns management teams effusive praise.

Valuation, however, is challenging after the recent surge. My former 5x revenue multiple only gets to around $125, while a more aggressive 6x model approaches $150—making me about as comfortable as a cat in a dog show.

I’m surprised by how quickly sentiment shifted on Abbott, likely due to investors seeking safety amid economic uncertainty.

Whether this outperformance has staying power remains uncertain, but Abbott is certainly delivering growth that matches or exceeds competitors across most business lines.

For now, I'm watching Abbott with the same fascination I once had for Sierra mountain expeditions—impressed by the ascent but keenly aware that the air gets thinner the higher you climb.

After all, what's that old market adage? Oh right—the view is spectacular, but nobody rings a bell at the top.