Your Next Miracle Drug Was Written In Python

I had an interesting conversation with my daughter last week during one of her rare appearances from her computer science lab. She was telling me about her latest project - using artificial intelligence to predict protein folding, something that used to take months and now happens in hours.

"Dad," she said, looking up from a bowl of ramen that probably cost me 50 cents, "this is going to change everything about how we make medicine."

She's right, and it got me thinking about the transformation happening in clinical trials - a market currently valued at $57.76 billion that's expected to more than double by 2032.

We're looking at a 7.1% compound annual growth rate, but these numbers only tell part of the story.

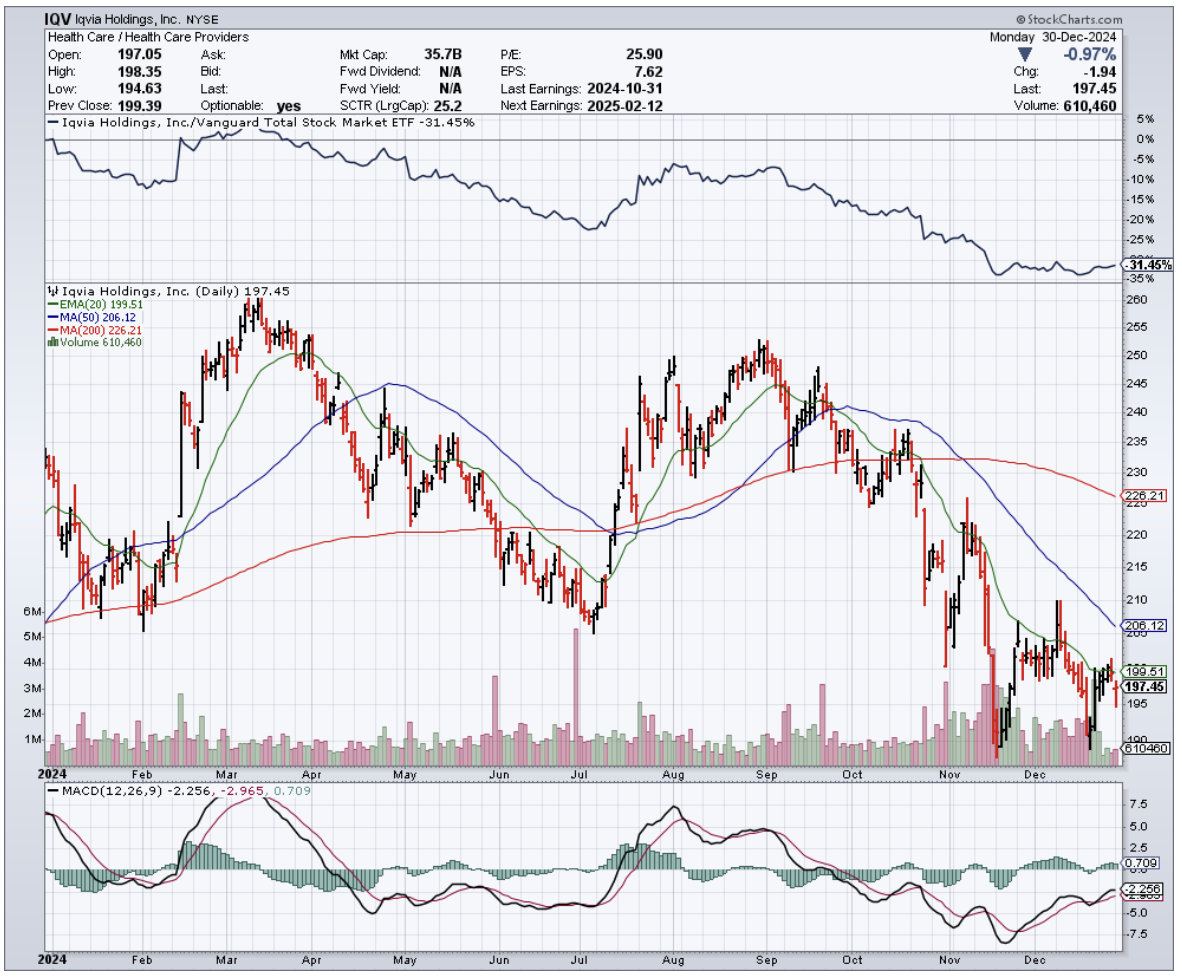

I spent some time digging through the data and talking to folks at companies like IQVIA (IQV), where they're using AI to match patients to trials 40% faster than traditional methods.

Think about that for a second - we’re looking at a process that used to take months now happening in weeks, while managing to maintain the kind of accuracy that makes FDA regulators sleep well at night.

Speaking of the FDA, they're cooking up new diversity action plans that aim to make clinical trials look more like actual America. It's definitely the right thing to do, but like most regulatory shifts, it's moving at the speed of government bureaucracy.

This is keeping Contract Research Organizations (CROs) on their toes, though the smart ones are already adapting.

Take Exscientia (EXAI), for example. They're not just using artificial intelligence - they are letting this technology design drug candidates that are already in clinical trials. It's like having a thousand researchers working 24/7 without coffee or bathroom breaks.

But before you rush to buy companies in this sector, it pays to remember that not everyone in this space is thriving.

Charles River Laboratories (CRL) and Icon (ICLR) have been dealing with declining revenues faster than a tech startup burning through venture capital.

The global biotechnology market itself tells an interesting story. Currently valued at $1.55 trillion, it's expected to grow at nearly 14% annually through 2030.

Meanwhile, AI is estimated to generate up to $110 billion in annual economic value for the pharmaceutical industry. That's not pocket change, even by Silicon Valley standards.

Last weekend, while refinishing an antique desk I picked up at an estate sale (turns out it's worth more than my first car), I got a call from a biotech analyst friend. He was worried about the shift in clinical trial geography.

Europe's share of global trials has dropped from 22% to 12% over the past decade, while Asia-Pacific is becoming the new hotspot.

Companies like Parexel (PRXL) and Headlands Research are capitalizing on this trend, particularly in China and India, where regulatory frameworks are streamlining faster than a Formula 1 pit crew.

The traditional factors that used to drive this industry - pure research horsepower and deep pockets - are being replaced by computational efficiency and AI-driven insights.

It's similar to what happened in the financial markets when algorithmic trading took over from floor traders. The winners will be those who adapt fastest to this new reality.

Looking ahead to 2025 and beyond, I'm watching two potential party crashers: a return of regulatory uncertainty and the ever-present possibility of a new pandemic.

But barring these black swan events, we're looking at a sector that's transforming faster than my daughter's college curriculum.

Speaking of which, she just texted me about her latest assignment - using machine learning to optimize clinical trial protocols. Maybe I should start asking her for stock picks.