Featured Trades: (MY TAKE ON THE EURO), (FXE), (SPY)

1) My Take on the Euro. Entering 2011 as the currency that everyone loved to hate, the Euro has staged a dramatic comeback, much to the chagrin of hedge fund managers and traders alike. Since January, the troubled currency has rallied ten cents from $1.28 to $1.38. Is this the beginning of something big? Or has it shot its wad and headed for a spill?

I vote for the later. The euro is essentially winning the best deck chair on the Titanic contest, the fastest horse at the glue factory, and the prettiest girl at the ugly ball. It's really all about interest rate differentials. At the end of last year, the US economy was growing gangbusters, while Europe was in intensive care. That sent medium and long term American interest rates skyward, while those in Europe languished.

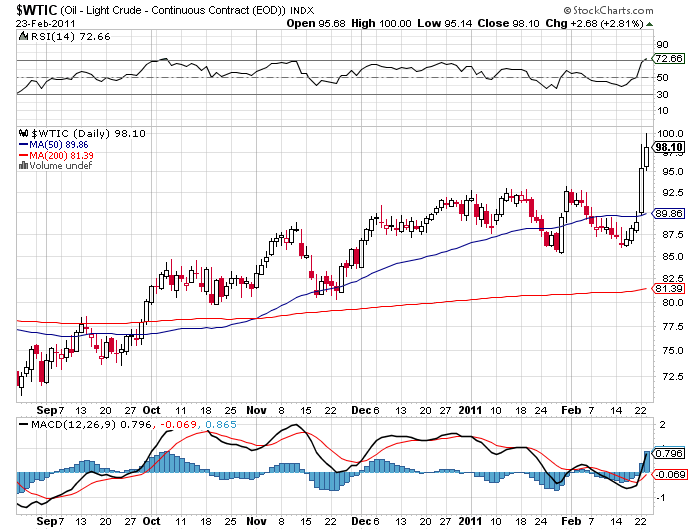

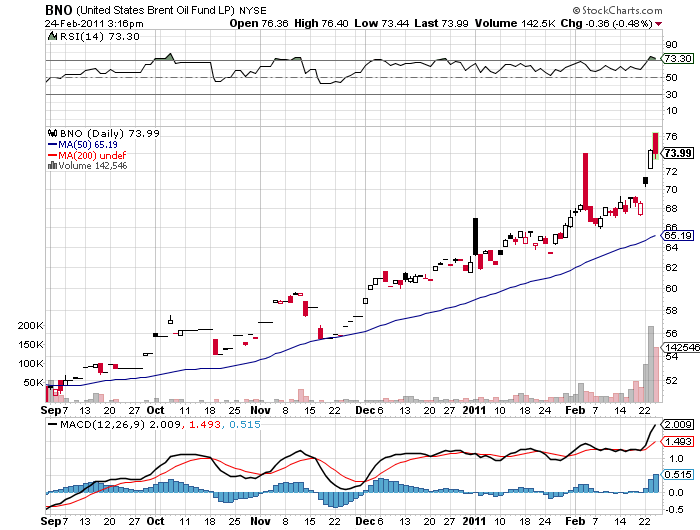

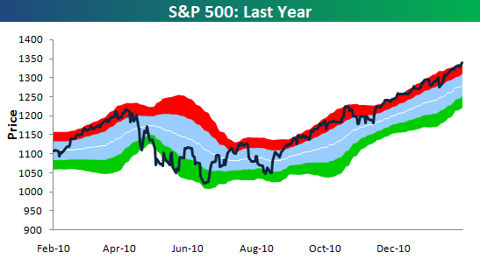

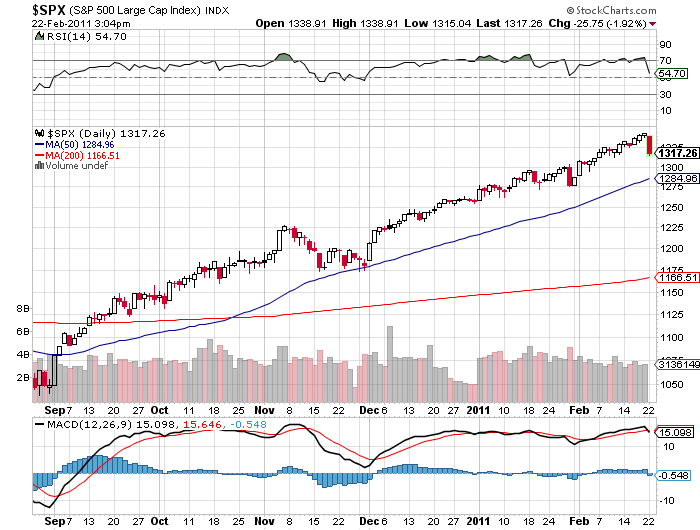

Now the tables have turned. High oil prices are starting to act as a drag on the US, causing economists to rapidly pare back forecasts. Treasury bonds have come back from the dead, bringing the yield on the ten year from 4.70% down to 4.4%. In the meantime, European Central Bank officials have been jawboning the Euro up, threatening interest rate hikes to deal with imagined inflation, no matter that such a policy would be insane to pursue. Hence, we are seeing Euro strength and dollar weakness.

There is another wrinkle to the Euro story here. You would think that high oil prices would be Euro negative, as the continent is a massive importer from that troubled part of the world. But what do Arabs do with the dollars they get for this oil? They buy Euros in order to keep their reserves in a diversified spread. That is why the lurch in crude to $112 in Europe was accompanied by the Euro move to $1.38. This is why the traditional flight to safety bid for the dollar failed to show this time, as it has in all previous oil crises. Some of this spill over buying also explains why the Japanese yen has recently been strong, holding on to the ?81 handle, despite its dismal fundamentals.

How does this party end? US stocks rally once again, US bonds tank, and oil takes a rest, falling well back into the nineties. That could then take the Euro back down to the bottom of its ten dent trading range. A put on the Euro has become a de facto call on US stocks. That's when we test the lower end of the European currency's recent trading range.

-

-

This Party Will Not End Well for the Euro