Featured Trades: (IS JAPAN GETTING READY TO BLOOM?),

(TM), (NSANY), (FANUY), (CAJ), (KMTUY), (FXJ),(YCS)

1) When to Buy Japan? It has been three months since the horrific Japanese tsunami, the economy is in free fall, and radiation is still lingering in the air and water. It now appears that the beleaguered nation's GDP shrank at a 4% rate, in line with my own expectations, but far worse than anyone else's. The down leg of the 'V' is well underway. When does the up leg begin, and when should we start positioning for it?

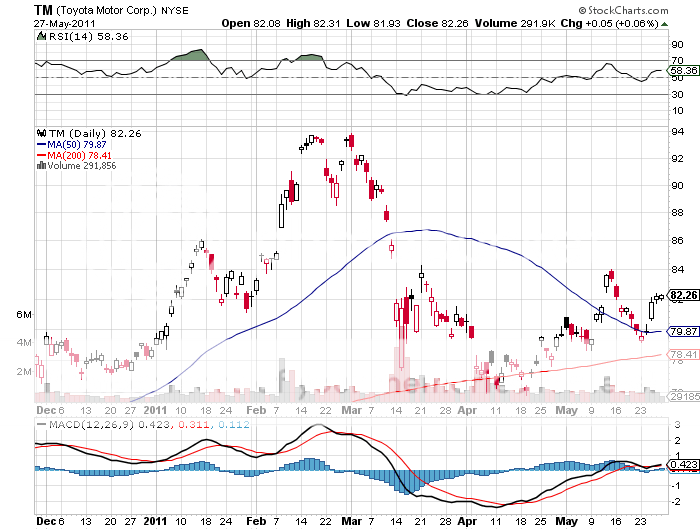

One need look no further than Toyota's Motor's stunning year on year decline in domestic sales of -69%. Consumers in the US want to buy their fuel efficient cars, but sought after models are in short supply. Power shortages have been a major headache, and additional nuclear shut downs have exacerbated the problem. A 28 week, $60 billion buying spree of Japanese stocks has ground to a halt, taking the Nikkei down 10%.

The government has already passed two supplementary budgets to get reconstruction underway, one for $50 billion and a second for $125 billion. The Bank of Japan has carried out quantitative easing worth $500 billion; nearly triple the Federal Reserve's own recent QE2 efforts on a per capita basis.

Surging loan demand indicates that these efforts are yielding their desired results. Companies are moving away from their famous kamban 'just in time' inventory system towards a 'just in case' model that provides a bigger buffer against unanticipated disasters. This is a net positive for the economy.

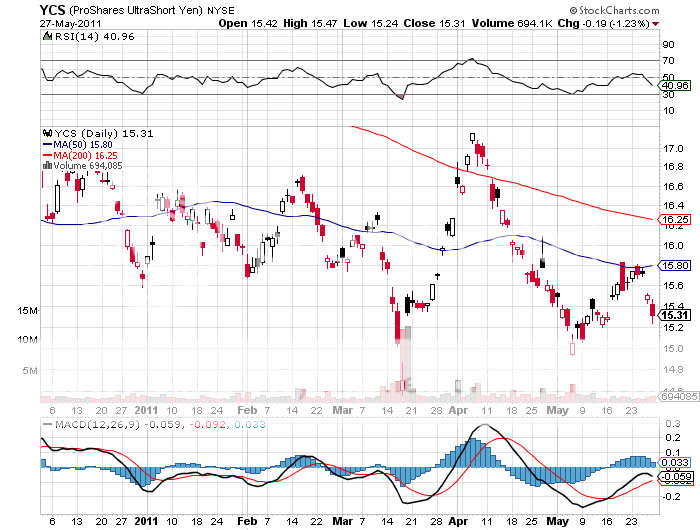

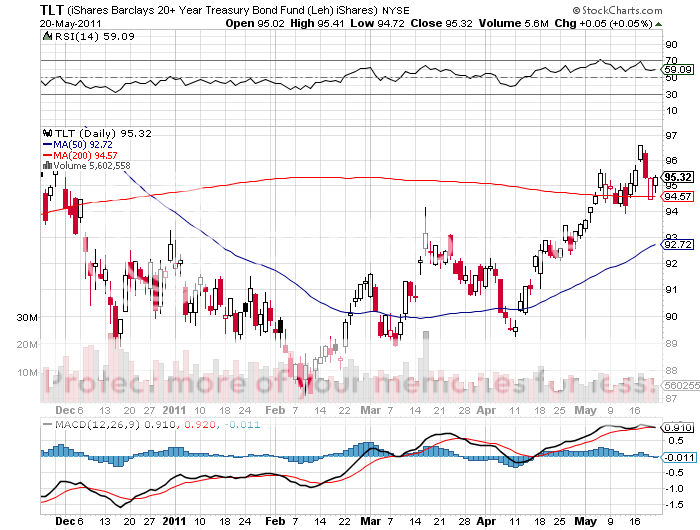

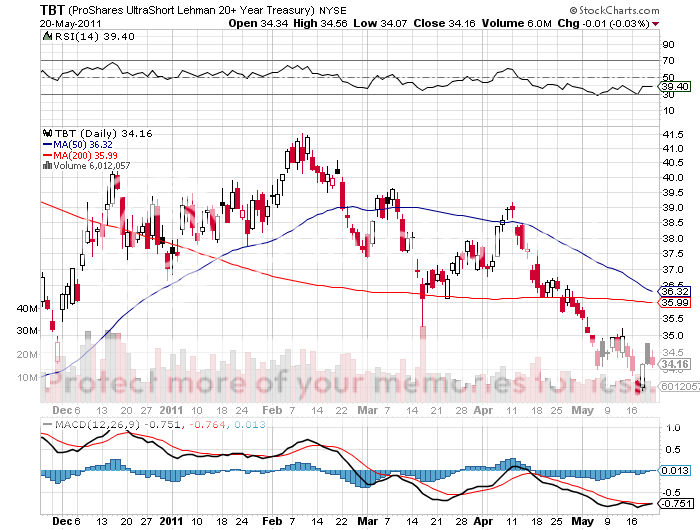

This Godzilla sized stimulus is expected to deliver GDP growth in 2012 as high as 3%, taking it to the top of the pack of developed nations. That will prompt rally of at least 20% in the Japanese stock market. What's more, widening interest rate differentials between Japan and the US should finally start to weaken the yen, giving a further boost to the economy and to stocks. This burst in business activity should also enable the country to flip from chronic deflation to inflation, and will?? knock the wind out of Japanese government bonds, now yielding a pitiful 1.11% for the ten year.

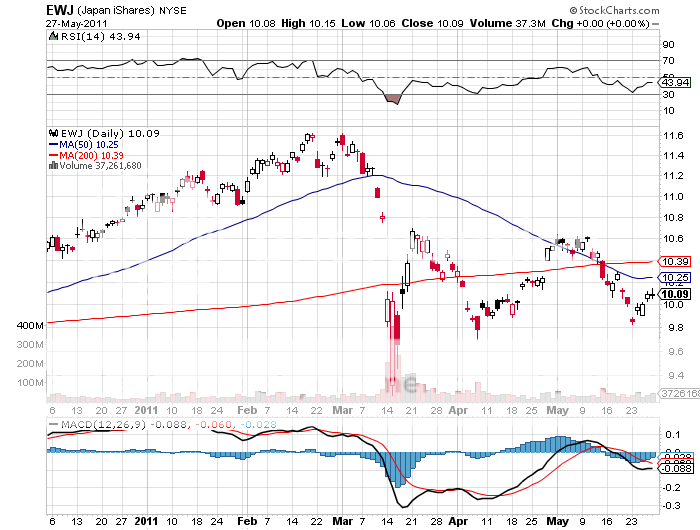

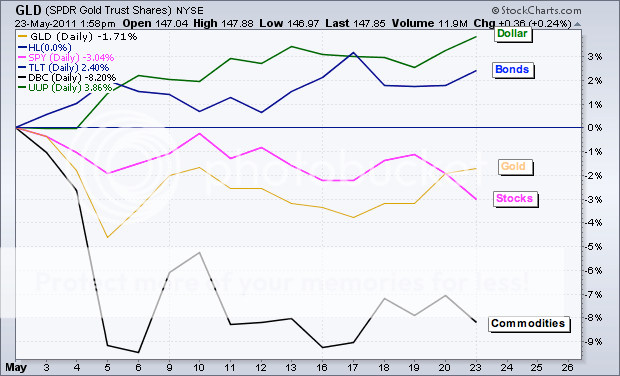

So when do we pull the trigger? If my theory is correct and we get a multi month 'RISK OFF' trade that deflates all asset prices, then you want to hold off for now. But I can see a final bottoming of prices sometime this summer. The easy play here is to buy the ETF (EWJ).

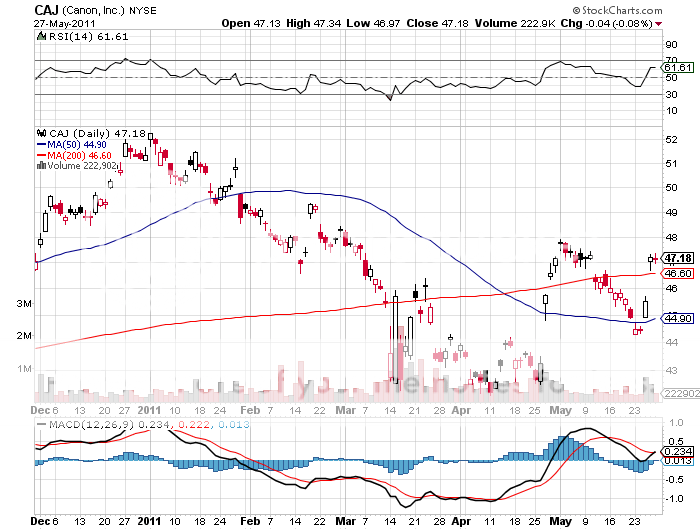

The next level of commitment includes the five best of blue chips I mentioned in March, Toyota Motors, (TM), Nissan Motors (NSANY), Fanuc (FANUY), Canon (CAJ), and Komatsu (KMTUY). Keep in mind that you will want to hedge your currency here through buying puts on the (FXJ) and through the 2X (YCS), as a weak yen will be part of a winning recipe.

-

-

-

-

Is Japan Getting Ready to Bloom?