When I was remodeling my 160 year old London house, the chimney was in desperate need of attention. After the bricklayer crawled up the fireplace, he found a yellowed and somewhat singed envelope addressed to Santa Claus. Thinking it was placed there by my kids, he handed it over to me. In it was a letter dated Christmas, 1910 asking for a Red Indian suit.

Europeans have long had a fascination with our Native Americans. So in preparation for my upcoming European strategy luncheon tour I thought I would get myself up to date about our earliest North American residents.

Business is booming these days on Indian reservations, or it isn?t, depending on where they live. Of the country?s 565 reservations, some 239 have moved into the casino business and the cash flow has followed. In 2010, Indian gaming reaped some $26.7 billion in revenues, or some $9,275 per indigenous native. That is a stunning 44% of America?s total casino revenues.

Some, like the Pequot tribe?s massive Foxwood operation just two hours from New York City, now the world?s largest casino, once had money raining down upon it. But the casino grew so large that it entirely occupied the diminutive Connecticut reservation allocated to it by an obscure 17th century.

During the salad days, the profits were so enormous that an annual $250,000 stipend was paid to each officially registered tribal member. A poker boom helped. No surprise that the tribe grew from 167 to 665 members during the last 30 years. Today, the operation is burdened with $2.5 billion in debt, thanks to some bad investments and an ill-timed expansion.

Casinos in more rural locations in the far west distant from population centers have fared less well. Those that contracted out for professional management from Las Vegas and Atlantic City firms, like Harrah?s, MGM, and Caesars, earn a modest living. But the reservations attempting local management on their own fall victim to inefficiencies, incompetence, corruption, over hiring of locals, and outright theft. Believe it or not, it is possible to lose money in the casino business, and some have had to shut down.

Overbuilding is another problem. It Northern New Mexico you can find several casinos within five miles of each other competing for the same customer. Most of their clients (read losers) are in fact local tribal members, the same individuals these houses are intended to help.

The 326 tribes that avoided the casino industry do so at the cost of a big hit to their standard of living. That explains why Native American median household income reaches only $35,062, compared to $50,046 for the US as a whole. Many, like the numerous Hopi, shun it because of their religion.

Without gambling there are few economic opportunities on the reservations. The parched conditions of the west limit farming. Unemployment runs as high as 80% on some reservations, such as the White Mountain Apaches. As a result, a high proportion of the country?s 2.9 million Native Americans are wards of the federal government, living on food stamps and other government handouts.

That?s not how it was supposed to be. The first modern reservation was set up for the Navajo tribe in 1851 at a baking hell hole on the Pecos River, with the intention of enforcing a primitive form of apartheid to insure their survival. Today, they are the most populous tribe, with 160,000, owning the largest reservation, at 24,000 square miles, mostly in Arizona.

Those who signed treaties early survived, which gave them status as an independent nation but ceded all matters regarding defense to the federal government. In fact the Iroquois, Sioux, and the Chippewa separately declared war on Germany during WWII. Some even issue their own passports. Those that didn?t had to settle for much smaller reservations, or got wiped out.

In 1975, congress passed the Indian Self-Determination Act, which devolved power from the government to the tribes. Florida?s Seminole tribe won the right to open a casino in court in 1981, which was confirmed by the Supreme Court in 1987. After that, it was off to the races, with Indian bingo parlors sprouting across the country.

During the 19th century Indian wars when hundreds of thousands died, the practice was to attack a wagon train, kill all the men, marry the women, and adopt the children. As a result, I am descended from three different tribes, the Delaware, Sioux, and the Cherokee, as are about a quarter of native Californians my age. So I tried to cash in on government largess by applying for tribal scholarships to go to college.

It was to no avail. Only those who can trace their lineage to a 1941 Bureau of Indian Affairs census and are one eighth Native American can qualify. When whites married Indians 150 years ago, the common practice was to baptize them and give western names, making their origins untraceable. They were also pretty casual with marriage records in the Wild West. Jumping over a broom didn?t exactly make it into the courthouse records. But we still have many of the wedding photos and know who they are.

I never did find out if that little boy got his Red Indian suit for Christmas, but I hope he did.

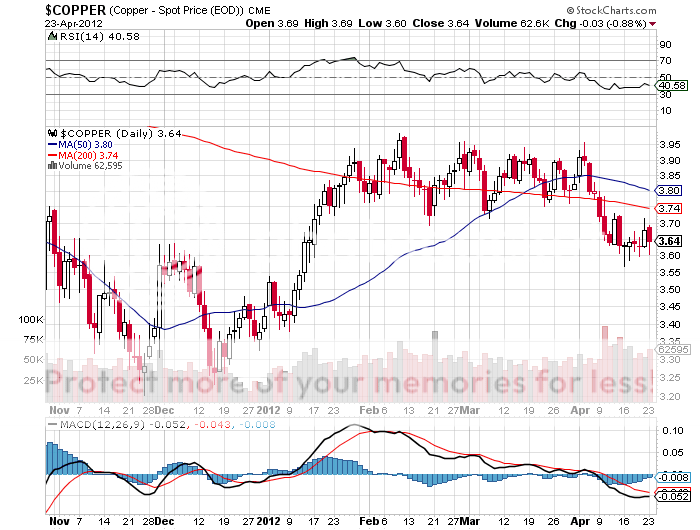

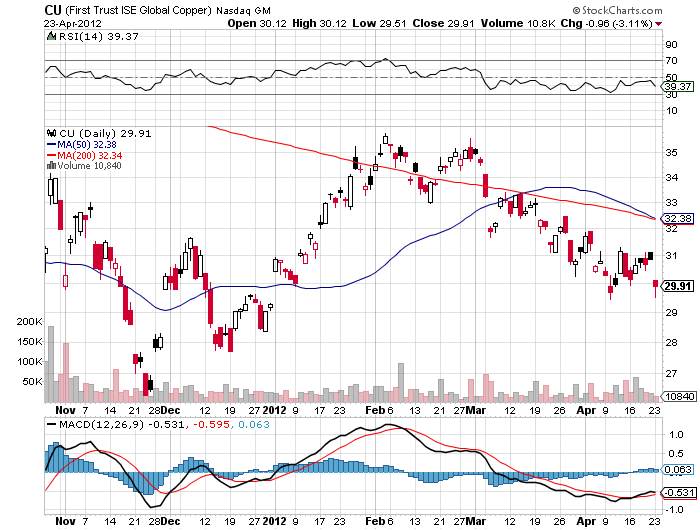

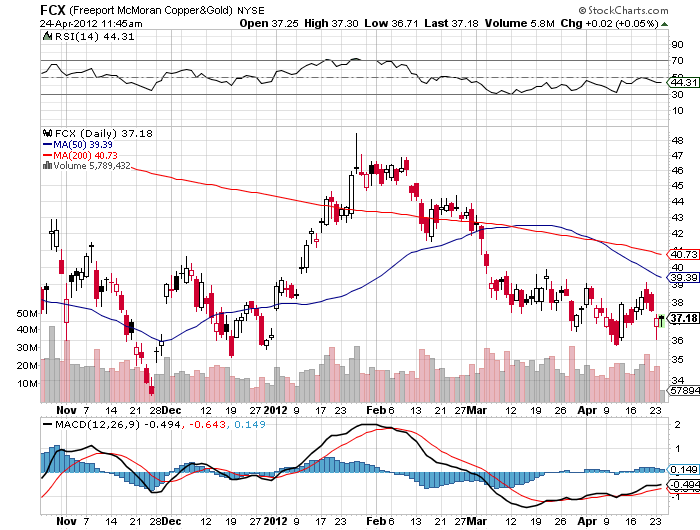

So, Should I Double Down?