Below, please find subscribers’ Q&A for the April 30 Mad Hedge Fund Trader Global Strategy Webinar, broadcast from Incline Village, NV.

Q: Why is the Australian dollar not moving against the US dollar as much as the other currencies?

A: Australia is too closely tied to the Chinese economy (FXI), which is now weak. When the Chinese economy slows, Australia slows. Australia is basically a call option on the Chinese economy. So they're not getting the ballistic moves that we've seen in, say, the Euro and the British pound, which are up about 20%. Live by the sword, die by the sword. If you rely on China as your largest customer for your export commodities, you have to take the good and the bad.

Q: I see we had a terrible GDP print on the economy this morning, down 0.3%. When are we officially in a recession?

A: Well, the classical definition of a recession is two back-to-back quarters of negative GDP growth. We now have one in the bank. One to go. And this quarter is almost certain to be much worse than the last quarter, because the tariffs basically brought all international trade to a complete halt. On top of that, you have all of the damage to the economy done by the DOGE cuts in government spending. Approximately 80% of the US states, mostly in the Midwest and South, are very highly dependent on Washington spending for a healthy economy, and they are going to really get hit hard. So the question now is not “do we get a recession?”, but “how long and how deep will it be?” Two quarters, three quarters, four quarters? We have no idea. Even if trade deals do get negotiated, those usually take years to complete and even longer to implement. It just leaves a giant question mark over the economy in the meantime.

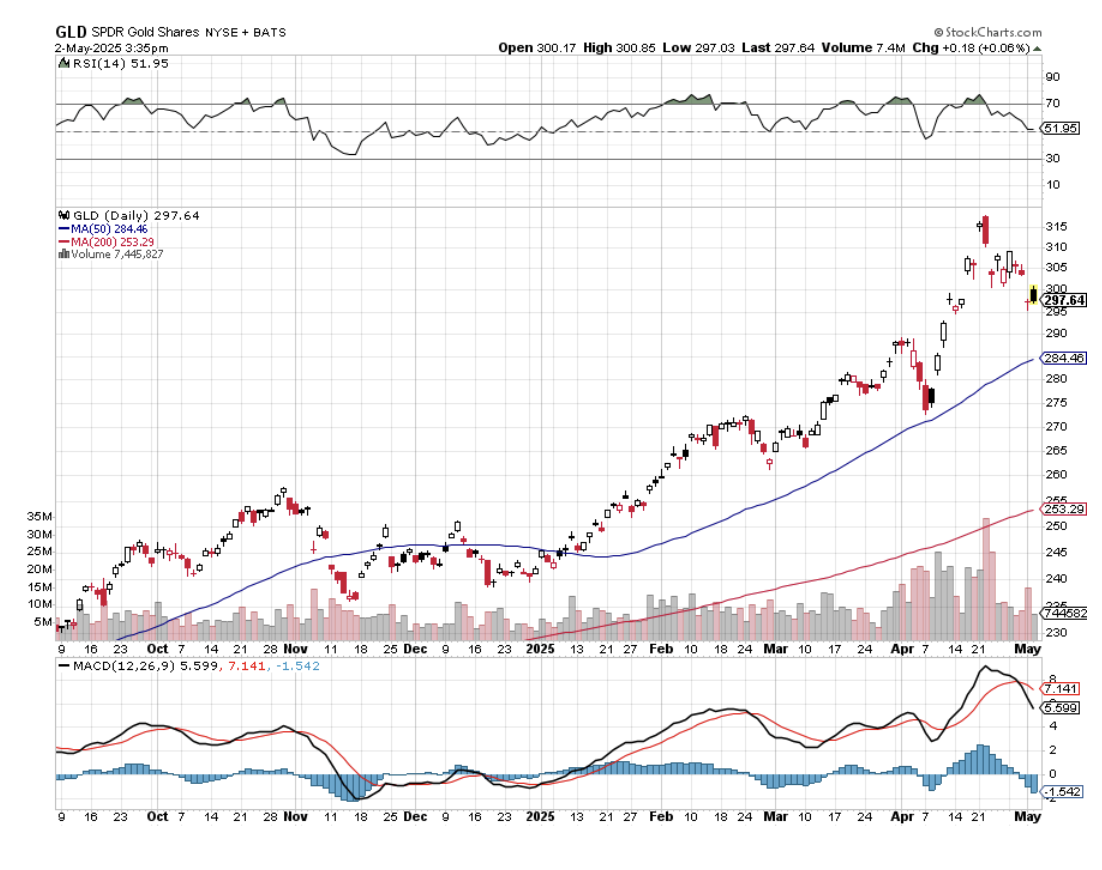

Q: Is SPDR Gold Trust (GLD) the best way to play gold, or is physical better?

A: I always go for the (GLD) because you get 24-hour settlement and free custody. With physical gold, you have to take delivery, shipping is expensive, and insurance is more expensive. Plus, then you have to put it in a vault. Private vaults have a bad habit of going bankrupt and disappearing with your gold. You keep it in the house, and then if the house burns down, all your gold is gone there. Plus, it can get stolen. There's also a very wide dealing spread between bid and offer on physical gold coins or bars; usually it's at least 10%, often more. So I often prefer the ease of trading with the GLD, which owns futures on physical gold, which is held in London, England. So that is my call on that.

Q: Is ProShares Ultra Silver (AGQ) the leveraged silver play?

A: It absolutely is, but beware: (AGQ) is only good for short, sharp rises because the contango and the storage operating costs of any 2x are very, very high—like 10% a year. So, good if you're doing a day trade, not good for a one-year hold. Then you're just better off buying silver (SLV).

Q: What is more important with the Fed's mandate—unemployment or fear of inflation?

A: That's an easy one. Historically, the number one priority at the Fed has been inflation. That is their job to maintain the full faith and credit of the U.S. Dollar, and inflation erodes the value, or at least the purchasing power of the US dollar, so that has always historically been the priority. Until we see inflation figures fall, I think the chance of them cutting interest rates is zero, and we may not see actual falls until the end of the year, because the next influence on prices is up because of the trade war. The trade war is raising prices everywhere, all at the same time. So that will at least add 1 or 2% to inflation first before it starts to fall. You can imagine how if we get a 6% inflation rate, there's no way in the world the Fed can cut rates, at least for a year, until we get a new Fed governor. So that has always historically been the priority.

Q: Do you think the 10-year yield is going down to 5%?

A: You know, we're really in a no-man's-land here. Recession fears will drive rates down as they did yesterday. I haven't even had a chance to see where the bond market is this morning because. So, rates are rising on a recessionary GDP, which is the worst possible outcome. Rates should be falling on a recessionary GDP print. Of course, Washington’s efforts to undermine the U.S. dollar aren't helping. Threatening to withhold taxes on interest payments to foreign owners is what caused the 10% down move in bonds in one week—the worst move in the bond market in 25 years. So, the mere fact that they're even thinking about doing something like that scares foreign investors, not only from the bond market, but all US investments period. And certainly, we've seen some absolutely massive stock selling from them.

Q: Why won't the market go down to 4,000 in the S&P 500?

A: Absolutely, it could; that is definitely within range. That would put us down 30% from the February highs, it just depends on how long the recession lasts. If you just get a two-quarter shallow recession, we could bounce off 4800 for the (SPX) until we come out. If the recession continues for several quarters, and it's looking like it will, then 4,000 is definitely within range. So, it's all about the economy. And remember, stocks are expensive. They don't get cheap until we get a PE multiple of 16, and even then, that alone, just a multiple shrinkage would take us down to 4,000.

Q: Would it be a good idea to buy the S&P 500 (SPY) as it falls?

A: I'm getting emails from readers asking if it's time to buy Nvidia (NVDA) or time to buy Tesla (TSLA). What I've noticed is that investors are constantly fighting the last battle. They're always looking for what worked last time, and that does not succeed as an investment strategy. As long as I'm selling rallies, I'm not even thinking about what to buy on the bottom. The world could look completely different on the other side. The MAG-7 may not be the leadership in the future, especially with the Trump administration trying to dismantle four out of seven companies through antitrust, and the rest are tied up in the trade wars. So, tech is still expensive relative to the main market, and we're going to need to look for new leaders. My picks are going to be mining shares, gold, and banking. Those are the ones I'm looking to buy on dips, but right now, cash is king unless you want to play on the short side. Being paid 4.3% to stay away sounds pretty good to me, especially when your neighbors have 30% losses. You know, I've heard of people having all of their retirement funds in just two stocks: Nvidia and Tesla, and they're getting wiped out. So, you don't want to become one of them.

Q: After a tremendous run in Gold, is Silver a better risk-reward right now?

A: I would say yes, it is. Silver has been lagging gold all year because central banks, the most consistent buyers for the past decade, buy gold—they don't buy silver. But what we may be in store for here now is a prolonged sideways move in gold while the technicals catch up with it. And in the meantime, the money goes elsewhere into silver and Bitcoin. That's my bet.

Q: Is Apple (APPL) a no-touch now?

A: I’d say yes. The trade war is changing by the day, and Apple probably does more international trade than any other company in the world. Also, Apple gets hit with recessions like everybody else. There was a big front run to buy Apple products ahead of tariffs—my company bought all its computer and telephone needs for the whole year ahead of the tariffs. We're not buying anything else this year. And I would imagine millions more are planning to do the same, so you could get some really big hits in Apple earnings going forward.

Q: Should I sell my August Proshares Short S&P 500 (SH) LEAPS?

A: No, I would keep them. If the (SPX) IS trading between 5,000 to 5,800, your $4-$42 SH LEAPS should expire at max profit in August, so I'm hanging on to mine. Next time we take a run at 5,000, you should be able to get out of your SH LEAPS at 80% to 90% of the max profit.

Q: What car company stock will do the best in a high-tariff global economy?

A: Tesla (TSLA), because 100% of their cars are made in the US with 90% US parts (the screens come from Panasonic in Japan). Their foreign components are only about 10%, so they can eat that. For General Motors (GM), it's more like 30% of all components are made abroad, and they can't eat that; their profit margins are too low. (GM) expects to lose $5 billion because of tariffs. By the way, the profit margins on Tesla have fallen dramatically from 30% down to 10% in two years, so it's not like they're in great shape either. Also, Tesla hasn’t had a CEO for ten months, which is why the board is looking for a replacement.

Q: Is it a good time to buy the dip in oil (USO)?

A: Absolutely not. Oil is the most sensitive sector to recessions, because if you can't sell oil, you have to store it, very expensively. It costs 30 to 40% a year to store oil—that's the contango; and once all the storage is full, then you have to cap wells, which then damages the long-term production of the wells. I think at some point you will expect an announcement from Washington to refill the Strategic Petroleum Reserve, which was basically sold by Biden at $100 a barrel. You can now get it back for $60. That may not be a bad idea if you're going to have a strategic petroleum reserve. What's better is just to quit using oil completely, which we were on trend to do.

Q: Will interest rates drop by year-end?

A: They may drop by year-end once unemployment runs up to 5% or 6% —which is likely to happen in a recession—and inflation starts to decline, even if it declines from a higher level. Even if they don't cut by year end, they'll still cut in a year when the president can appoint a new Fed governor. What the Trump really needs to do is appoint Janet Yellen as the Fed governor. She kept interest rates near zero for practically all of her term. We need another Yellen monetary policy.

Q: The job market here seems to be slowing quite fast. Is there any way this will rebound and stave off recession?

A: No, there is not. Companies are going to be looking to cut costs as fast as they can to offset the shrinkage in sales, but also to help cope with tariffs. So no, the job market is actually surprisingly strong now. That means future data releases are probably going to get a lot worse. In April, we saw job gains in Health care, adding 51,000 jobs. Other sectors posting gains included transportation and warehousing (29,000), financial activities (14,000), and social assistance. I highly doubt any of these sectors will show gains next month.

Q: What about nuclear energy plays?

A: I like them, partly because people are buying stocks like Cameco Corp (CCJ) as a flight to safety commodity play, like they're buying gold, silver, and copper. But also, this administration is supposed to be deregulation-friendly, and the only thing holding back nuclear (at least new modular reactors) is regulation. That and the fact that no one wants to live next door to a nuclear power plant, for some strange reason.

Q: What do I think about natural gas (UNG)?

A: Don't touch. Don't buy the dip. All energy plays look terrible right here, going into recession.

Q: What are your thoughts on manufacturing returning to the U.S? And how will that affect the stock market?

A: I think there's zero chance that any manufacturing returns to the U.S. Companies would rather just shut down than operate money-losing businesses. You know, if your labor cost goes from $5 to $75 an hour, there's no chance anyone can make money doing that, and no shareholders are going to want to touch that stock. That is the basic flaw in having a government where no one is actually running a manufacturing business anywhere in the government. They don't know how things are actually made. They're all real estate or financial people.

To watch a replay of this webinar with all the charts, bells, whistles, and classic rock music, just log in to www.madhedgefundtrader.com , go to MY ACCOUNT, click on GLOBAL TRADING DISPATCH, then WEBINARS, and all the webinars from the last 12 years are there in all their glory.

Good Luck and Good Trading

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader