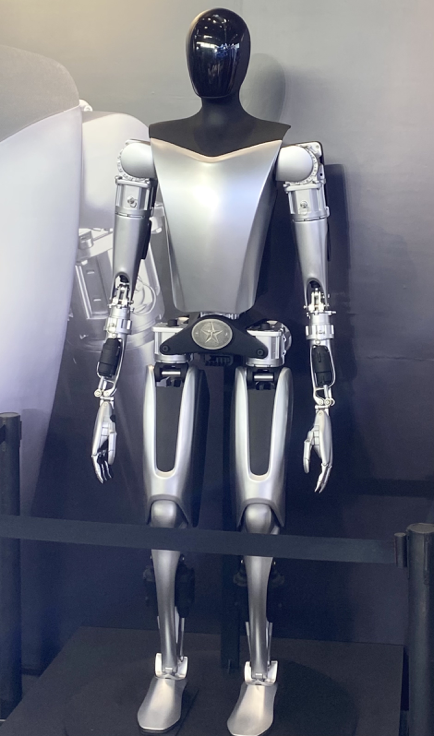

“It’s going to be a shock when we wake up one morning and learn that China got to the moon while we were suing each other,” said Elon Musk, founder of PayPal, Space X, Tesla, Solar City, The Boring Company, Neuralink, and owner of “X”, the former Twitter.