“Our clients used to think in weeks and days. Today, it’s not even hours-- they think in minutes,” said John Schutz of Wells Fargo, the largest financial advisor in Minnesota, with $1.2 billion in assets.

“Our clients used to think in weeks and days. Today, it’s not even hours-- they think in minutes,” said John Schutz of Wells Fargo, the largest financial advisor in Minnesota, with $1.2 billion in assets.

“China thinks strategically. We think reactively,” said Stephen Roche, former chairman of Morgan Stanley Asia, and my friend and former mentor.

“Data is the new oil,” said Dr. Kai-fu Lee, a leading Chinese artificial expert.

“When a business manufactures and distributes a non-essential consumer product, the customer is the boss,” said Oracle of Omaha Warren Buffet.

“The market is untradeable now. We are one tweet away from a new all-time high, or a 10% correction,” said a hedge fund friend of mine.

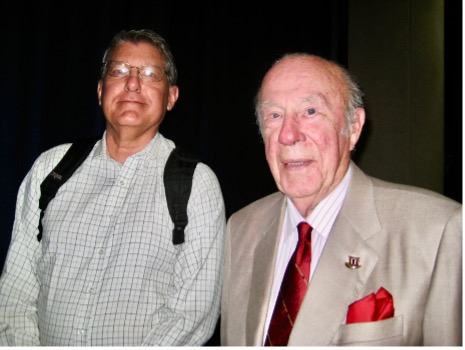

“Trust is the coin of the realm. When trust was in the room, whatever room that was – the family room, the schoolroom, the locker room, the office room, the government room, or the military room – good things happened,” said my late friend, US Treasury Secretary George Schultz.

All Roads lead to gold right now,” said technical analyst Carter Braxton Bragg.

"The three most harmful addictions are heroin, carbohydrates, and a monthly salary," said Nassim Nicholas Taleb, author of Antifragile: Things That Gain from Disorder

If the 2020 election was a math problem, it would read like this. “If you’re going down a river at 20 miles per hour and your canoe loses a wheel, how much pancake mix would it require to re-shingle your roof.”

“A string of wonderful numbers times zero will always equal zero. Don’t count on getting rich twice,” said Warren Buffet's partner, the 99-year-old Charlie Munger.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.