2 Fintech Bets to Jump On

I cannot overstate the importance of digital financial innovation to the success of PayPal (PYPL) and Synchrony Financial (SYF).

Consumers are rapidly adopting technologies that enable contactless commerce and expect engagement along their digital purchase journeys.

These fintech firms are leveraging robust digital assets and continuously investing to ensure their partners are well-positioned in this rapidly evolving dynamic.

These investments include the capabilities to empower SaaS and seamless integration with partners' digital assets, enable customer choice at the point of sale, enhance contactless experiences, facilitate a seamless and easy application process, bring the in-store experience to a customer's digital devices for applications and payment, and integrate financing office throughout the entire digital shopping experience.

They also continue to make headway in digital penetration of all aspects of the customer journey.

Lockdown requirements and 14-day quarantine are forcing consumers to resort to online transactions for payment networks, online lending, money transfers, business-to-business payments, personal finance, banking, and more.

The key factor driving the growth of the fintech market is high investments in technology-based solutions by banks and other financial institutions. In addition, infrastructure-based technology and APIs (application programming interface) are reshaping the future of fintech.

The behavioral changes induced by the pandemic, such as online shopping and cashless payments, are here to stay and will continue to propel fintech’s growth this year and beyond.

PYPL is one of the most entrenched digital payment operating technology platforms that enables digital and mobile payments on behalf of consumers and merchants worldwide.

It has more than 361 million active users globally and is available in more than 200 markets around the world, enabling consumers and merchants to receive money in more than 100 currencies.

The overperformance of late is not a fluke, in just the last quarter, PYPL added more than 15.2 million new accounts. Its top-line has increased 25% year-over-year to $5.46 billion.

The company is now doing total payment volume (TPV) of $247 billion, growing 38% from the year-ago quarter.

Profitability is another check off the list with EPS for the third quarter coming in at $0.86, rising 121% year-over-year.

The company has been propelled by a spike in e-commerce sales and is one of the preeminent fintech stocks in the U.S.

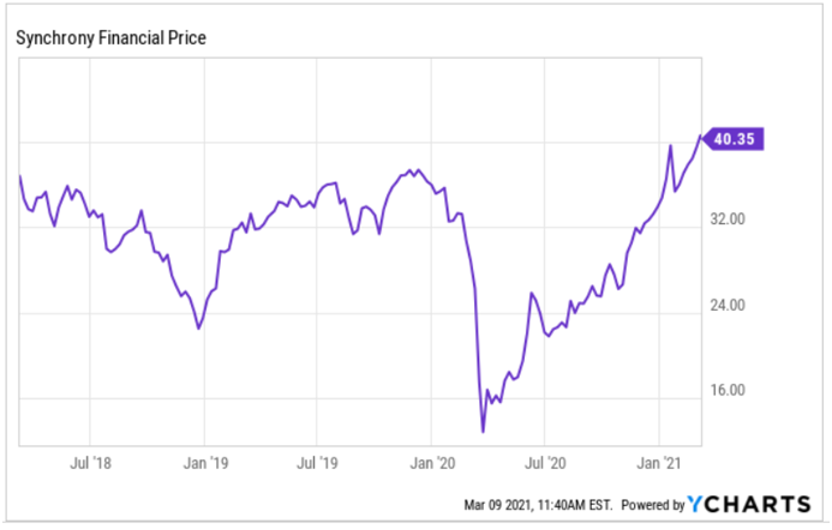

A less entrenched name but worth a speculative look is Synchrony Financial (SYF).

SYF delivers a wide range of specialized financing programs as well as innovative digital banking products across key industries including retail, home, auto, travel, and pet care.

They have a private labeled credit card business with around 60% of SYF applications done digitally during the fourth quarter and grew 18% in mobile channel applications. In Retail Card, 51% of total sales occurred online. Finally, approximately 65% of payments were made digitally.

Synchrony is the 10th-largest credit card issuer in the U.S., with a roughly 2% market share.

But unlike other issuers, Synchrony primarily issues store credit cards, which offer users rewards and benefits.

Synchrony offers more than 100 of these store cards, including the Amazon.com Store Card, which can only be used for Amazon purchases, as well as cards from Lowe's, Banana Republic, Ashley Furniture, and Sam's Club.

Synchrony also offers about 30 store-branded cards that can be used on the broader Mastercard (MA) or Visa (V) network. Among them are the Nissan Visa card and the PayPal Cashback Mastercard.

Synchrony saw earnings plummet to $286 million in the first quarter, down from $731 million in the fourth quarter of 2019. Then, earnings dropped to a low of $46 million in the second quarter before climbing back up to $313 million in the third quarter.

But they rebounded in the fourth quarter of 2020 with earnings surging to $738 million signifying an expansion from pre-pandemic performances.

The Venmo card is also a huge growth opportunity and the possibility of linking up with other fintech groups to create attractive products.

Synchrony added 25 new relationships in 2020, including two major deals that should drive growth in 2021 and beyond.

One was with PayPal to launch the Venmo credit card fueled by Visa.

Venmo is PayPalʻs hugely popular mobile app to send and receive money.

The Venmo credit card, which can be used virtually, provides Venmo users with cashback on purchases and comes with a QR code that allows contactless payments.

Synchrony also signed two other major credit card deals with Walgreens and Verizon.

The Walgreens relationship gets Synchrony into the health space, which allows people to pay for health and wellness expenses at some 225,000 different healthcare providers.

The company also acquired Allegro Credit, a provider of point-of-sale consumer financing for audiology products and dental services, to be part of the growing CareCredit network.

The other big move last year was launching the Verizon Visa card, which offers benefits and discounts for Verizon customers.

Synchrony and PayPal are dynamic fintech companies with savory futures.

PayPal is the bigger and safer bet of the two, but Synchrony will benefit more if their risks turn out well because the law of large numbers isn’t counting against them yet.