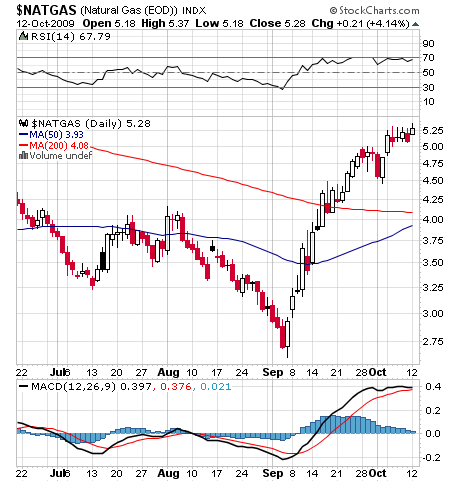

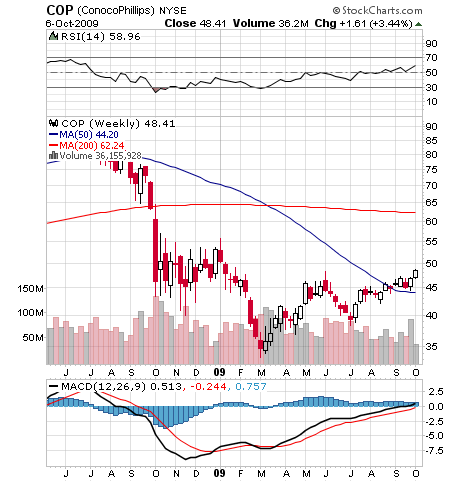

October 14, 2009Featured Trades: (NATURAL GAS), (CHK),

(DATA BASE SEARCH), (REGIONAL BANKS),

(DOLLAR BILLS)

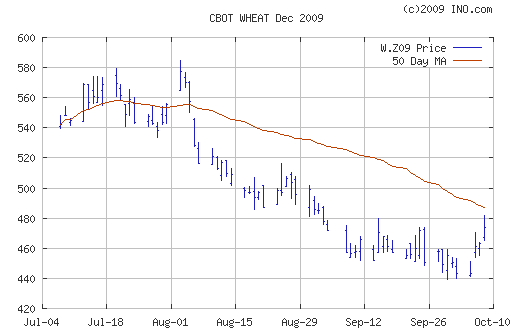

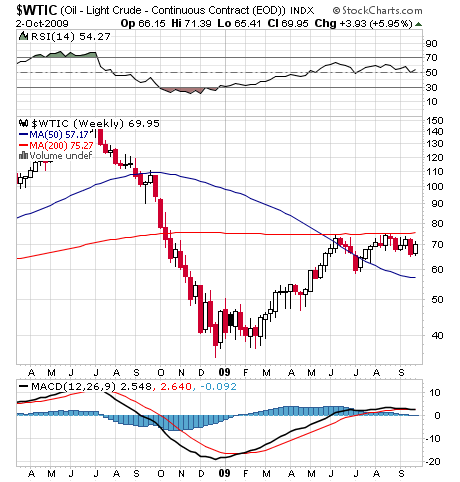

1) I received another scratchy, crackling cell phone call from my drilling buddy in the Texas natural gas fields today. You could almost hear the dust on the line. The doubling of prices in the last month is totally bogus, and is nothing more than a short covering rally ahead of the seasonally strong run up to winter. Storage facilities are completely full, and while the production cutbacks have been substantial, they are still not enough. Some companies, like Chesapeake (CHK), are even suicidally boosting production in a desperate attempt to offset falling prices with jacked up volumes, at everyone else?s expense. This is all setting up a fabulous short selling opportunity, possible in early December, once the winter draws are priced in. There is still a huge risk that production will overwhelm storage as more new unconventional shale and tight gas deposits are brought on line, leading to another collapse in prices. A retest of the September lows is a gimme, and the $1 handle is still a possibility. So those of you who were nimble enough to bite a hunk out of the recent pop in CH4, better use any strength to cash in positions. I?d love to get more out of my friend, but I don?t think my aged, arthritic back could take another three hours driving down washboard roads in?? a beat up pickup truck with no springs.

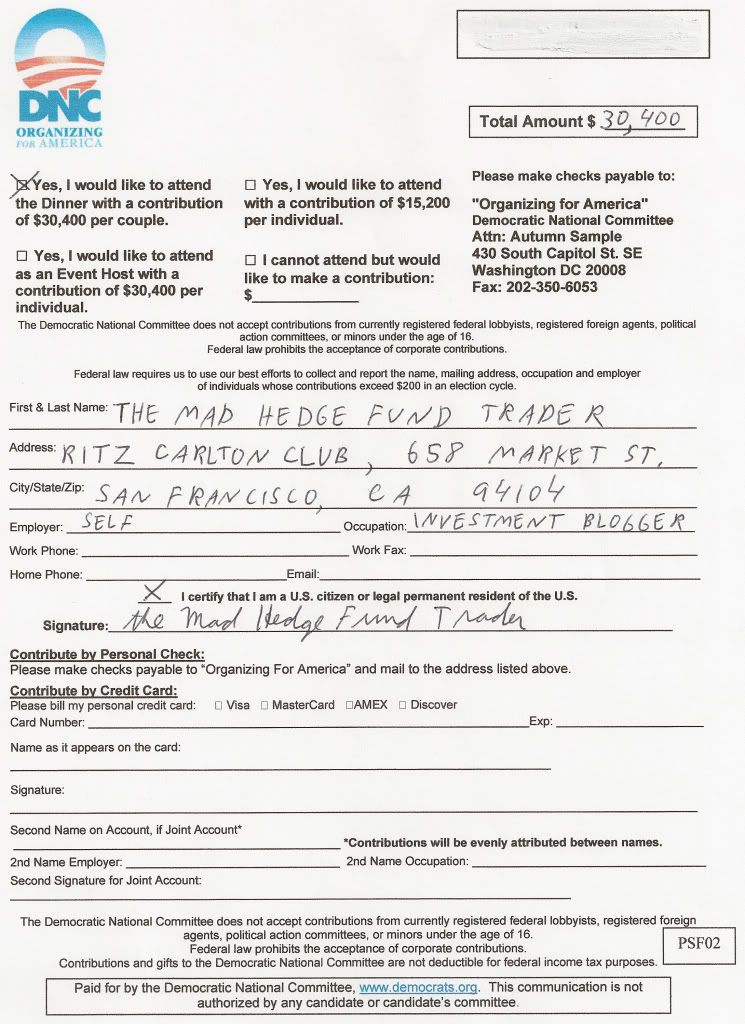

2) Paid subscribers should be aware that you can use The Mad Hedge Fund Trader?s Data Base Search at any time by clicking here at http://madhedgefundradio.com/Data_Base_Search.html . Simply type in any stock symbol, company name, or individual name, and all references going back to February, 2008 will pop up. The original purpose was to enable potential investors to track what I was saying about specific markets, sectors, and securities over time, and see if I knew what I was talking about, or if I was just making it all up. I use it myself daily to track down data I know is lurking in there somewhere, like the number of BTU?s in a ton of coal, global electric power generation, or the price of cherries in California. The search engine is powered by Google (GOOG), so you will see text ads on the same topic cleverly placed alongside anything you find. The only limitation is that entries be at least three characters long. So instead of entering just ?X,? you?ll have to type in the full name ?US Steel.? I have in fact written about 350,000 words in the past 21 months, or about half the length of War and Peace. It took Tolstoy six years to write his epic about Napoleon?s invasion of Russia in 1812, and no one made a dime off of his stock tips. Try it, you?ll like it.

3) I have really been avoiding financials for the last few months after they had their dead cat bounces. However, I had to listen to MidSouth Bank CEO Rusty Cloutier when he spoke on CNBC. His 24 branch bank, with a market cap of only $103 million, is based in Lafayette, LA, one of my old stomping grounds, and home of the world?s greatest touff? and shrimp gumbo. He says that ?Unless we break up the big banks and get back to sound banking principles we are going to relive this over and over again??.Free enterprise has to have the right to fail??.Allan Greenspan and his administration have some problems they have to ??fess up to.? With the current system of megabanks ?They get the gain and we get the pain??.I?m regulated now by 13 agencies of the US government and I don?t know that I need a 14th.??? Regional Banks have really been taking it on the kisser this year, with 99 going under, four times the previous year?s rate. The FDIC has turned into an effective stealth undertaker, checking into local motels under assumed names, marching in at the Friday afternoon close with court orders in hand, and selling assets at fire sale prices to a healthy competitor by Monday morning. None of the government owned banks have been targeted by the federal agency yet. There?s no one who can read you a riot act like a Southern regional banker.

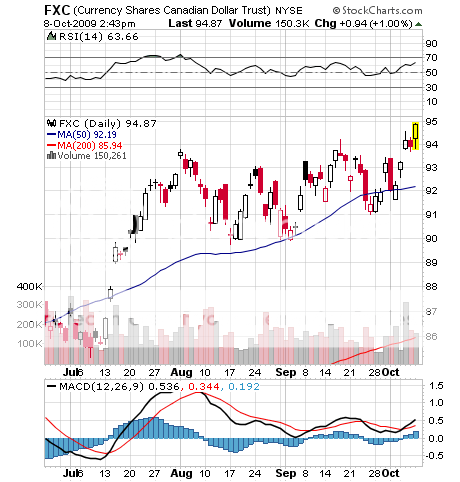

4) If you want to impress your friends with your vast knowledge of financial matters, then here are the Latin translations of the script on the backside of a US dollar bill. ?ANNUIT COEPTIS? means ?God has favored our undertaking.? ?NOVUS ORDO SECLORUM? translates into ?A new order has begun.? The Roman numerals at the base of the pyramid are ?1776.? The better known ?E PLURIBUS UNUM? is ?One nation from many people.? The basic design for the cotton and linen currency with red and blue silk fibers, which has been in circulation since 1957, carries enough symbolism to drive conspiracy theorists to distraction. An all seeing eye? The darkened Western face of the pyramid? And of course, the number ?13? abounds. Thank Benjamin Franklin for these cryptic symbols, and watch Nicholas Cage?s movie National Treasure. The balanced scales in the seal are certainly wishful thinking and a bit quaint. Study the buck closely, because there are going to be a lot more of them around.

?By thinking at the 30,000-foot-level about asset classes, investors will get much better results from their portfolios,? said Steven M. Sears, vice president for asset allocation at PIMCO, the world?s largest bond fund.

or

or  ?

?