I have been following your trades for a while, to the tune of several hundreds of thousands in profits. Kindly sign me up to the "A" team. Even after investing for over 30 years, some as a Wall St. pro, I need help with this market. Keep up the good work.

BF

Desperate homeowners counting on a "V" shaped recovery in residential real estate prices to bail them out better first take a close look at global demographic data, which tells us there will be no recovery at least another 15 years.

I have been using the US Census Bureau's population pyramids as long leading indicator of housing, economic, and financial market trends for the last four decades. They are easy to read, free, and available online at http://www.census.gov/ . It turns out that population pyramids are something you can trade, buying the good ones and shorting the bad ones. For example, these graphical tools told me in 1980 that I had to sell any real estate I owned in the US by 2005, or face disaster. No doubt hedge fund master John Paulson was looking at the same data when he took out a massive short in subprime loans, earning himself a handy $4 billion bonus in 2007.

To see what I am talking about, look at the population pyramid for Vietnam. This shows a high birth rate producing ever rising numbers of consumers to buy more products, generating a rising tide of corporate earnings, leading to outsized economic growth without the social service burden of an aged population. This is where you want to own the stocks and currencies.

I?m Avoiding Japan Like the Plague. Now look at the world's worst population pyramid, that for Japan (EWJ). These three graphs show that a nearly perfect pyramid drove a miracle stock market during the fifties and sixties, which I remember well, when Japan had your textbook high growth emerging market economy. That changed dramatically when the population started to age rapidly during the nineties. The 2007 graph is shouting at you not to go near the Land of the Rising Sun, and the 2050 projection tells you why.

By then, a small young population of consumers with a very low birth rate will be supporting the backbreaking burden of a huge population of old age pensioners. Every wage earner will be supporting one retiree. Think low GDP growth, huge government borrowing, deflation, collapsing bond markets, a depreciating yen, and terrible stock and housing markets. If you are wondering why I believe that a short position in the yen should be a core position in any portfolio for the next decade, this is a big reason. Dodge the bullet. Enjoy their food and hot tubs, but not their stocks.

Brace yourself. The US is turning into Japan. (SPX) As a silver tsunami of 80 million baby boomers retires, they will be followed by only 65 million from generation "X". The intractable problems that unhappy Japan is facing will soon arrive at our shores. Boomers, therefore, better not count on the next generation to buy them out of their homes at nice premiums, especially if they are still living in the basement rent free. They are looking at best at an "L" shaped recovery, which is a polite way of saying no recovery at all.

What are the investment implications of all of this? Get your money out of America, Europe, and Japan, and pour it into Vietnam, China, India, Brazil, Mongolia, Indonesia, Mexico, Malaysia? and other emerging markets with healthy population pyramids. You want the wind behind your investment sails, not in your face with hurricane category five violence. Use any serious dip to load the boat with the emerging market ETF (EEM) and individual emerging market ETF?s.

The ?Graying? of America Bodes Ill for Investors

Vietnam is a Paradise for Demographic Investors. Now that we have figured out that Vietnam is a great place to invest, take a look at the Van Eck Groups Vietnam Index Fund (VNM). The venture invests in companies that get 50% or more of their earnings from that country, with an anticipated 37% exposure in finance, and 19% in energy. This will get you easily tradable exposure in the country where China does its offshoring, as wages there are now one third of those in the Middle Kingdom.

Vietnam was one of the top performing stock markets in 2009. It was a real basket case in 2008, when zero growth and a 25% inflation rate took it down 78% from 1,160 to 250. This is definitely your E-ticket ride. Vietnam is a classic emerging market play with a turbocharger. It offers lower labor costs than China, a growing middle class, and has been the target of large scale foreign direct investment. General Electric (GE) recently built a wind turbine factory there. You always want to follow the big, smart money. Its new membership in the World Trade Organization is definitely going to be a help. If they can only get their inflation under control then they could be a real winner.

I still set off metal detectors and my scars itch at night when the weather is turning, thanks to my last encounter with the Vietnamese, so it is with some trepidation that I revisit this enigmatic country. Throw this one into the hopper of ten year long plays you only buy on big dips, and go there on a long vacation. If you are looking for a laggard emerging market that has not participated in this year?s meteoric move up, this one fits the bill nicely. Their green shoots are real. But watch out for the old land mines.

There is a Happy Ending for the US. Unlike Japan, the US is not plunging into a multigenerational black hole. After the 80 million baby boomers are long gone, and 65 million Gen Xer?s have picked up homes at rocked bottom prices, they will be followed by 85 millennials, those who are now in the early twenties. When this generation reaches its speaking spending years, starting around 2025, they will have to chase the limited housing stock offered for sale by the Gen Xer?s.

As there will be a shortfall of 20 million homes, this should spark one of the greatest bull markets in residential real estate of all time. Furthermore, there will also be a severe labor shortage in America, leading to soaring wages and a reversal of a then 40 year long decline in American standards of living. We could see the return of a golden age similar to what we last saw in the 1950?s. So use the next leg down in residential real estate triggered by the next recession and the crash of 2012-2013 to pick up a home at a knocked down, distressed price. It could mark a century low in real house prices.

Come join me for lunch at the Mad Hedge Fund Trader?s Global Strategy Update, which I will be conducting in Orlando, Florida on Thursday, November 10, 2011. An excellent meal will be followed by a wide ranging discussion and an open ended question-and-answer period.

I?ll be giving you my up-to-date view on stocks, bonds, currencies, commodities, precious metals, and real estate. And to keep you in suspense, I?ll be throwing a few surprises out there too. Tickets are available for $275.

I?ll be arriving at 11:00 and leaving late in case anyone wants to have a one on one discussion, or just sit around and chew the fat about the financial markets.

The lunch will be held at a private club in downtown Orlando that will be emailed with your purchase confirmation.

I look forward to meeting you, and thank you for supporting my research.

I received an urgent call from my friend at Fidelitrade (http://fidelitrade.com/) this morning, a leading dealer in 1,000 ounce bars of gold and silver. He had just been cleaned out of the 1,000 ounce silver bars at $34,930 each, and there was nothing in the pipeline. What the hell was going on with silver?

I tried to calm him down with my usual measured, rational, global, cross asset class explanation, and made the following points:

*An interim solution, or at least some progress, seems imminent in the European debt crisis. Any solution means a European style quantitative easing and a TARP, and we here in the US already know how positive those can be for risk assets.

*My friend at the Swiss National Bank told me yesterday that this resolution should send the Euro down to parity against the dollar (click here for ?Get Ready to Short the Euro Again?). This is prompting massive European buying by panicky individuals across the entire precious metals spectrum. That?s where his silver 1,000 ounce bars went.

*Now that gold is, in effect, a paper asset, it can ride on the coattails of American stocks in a rally that now looks to carry on until year end, and possibly into January.

*My meeting with the Chinese government last week confirmed my belief that the People?s Bank of China is going to sit on the bid for gold and silver looking to increase their holdings of hard assets as a hedge against a weak dollar in a future recession. At least this is what I told them to do.

*When I went to buy a stack of Chinese one ounce silver panda coins in Shenzhen, there was a one hour wait at the store. I usually buy a dozen of these to use as tips and bribes to buy my way across the Middle Kingdom to get the information I need. When I asked others in line why they were buying, they told me they were moving money out of real estate into silver because of the recent sharp markdowns in new condo prices. Gold coins are too expensive for someone who earns only $500 a month.

*Gold seems to be taking another run at the old high of $1,922. If the ?RISK ON? trade continues, it might even make it. Then the hot money will rotate into the next natural target, silver, which has so far lagged gold?s move. That makes silver a great ?catch up? play.

*The technical set up for silver is looking really interesting. As I write this with the (SLV) at $33.60, it looks like we are just about to break the 50 day moving average to the upside. If successful, then the 200 day moving average at $35.60 is a chip shot. Break that, and we could fill in the $10 of air on the chart created by the September crash and gap all the way up to the old high, just short of $50.

*Having discounted a recession over the summer that was never going to happen, risk assets are now ?undiscounting? it.

*In the meantime, economic data across a broad front are going from flat to showing a gradual improvement. Corporate earnings that were expected to grow at 13% actually came in closer to 17%. Since 50% of the final demand for silver is for industrial purposes, this is a great play on a recovery.

*Traders are getting sick to death of listening to all of this BS about Europe, which is largely being exaggerated by journalists jonesing from free continental vacations. Ignore Europe, just buy the dips in all risk assets, and turn off CNBC.

My friend said thanks, and indicated that he would spend the afternoon scouring the marketplace for more silver bars and coins of any description, promising to renew his subscription to Macro Millionaire.

The conversation prompted me to do a quickie analysis of the options market and look for some inviting plays. Since I am 80% in cash, and up 47% on the year, I have plenty of room to take a flyer here. That led me to the Silver ETF (SLV) January $35 calls. Here are the numbers I came up with:

*A run up to just the 200 day moving average takes the $35 calls to $3.00, up 33%.

*A move to fill the September gap takes silver to $39 and the options to $5.00, up 120%.

*A run to the old high under $50 takes the options to $15, assuming there is no time premium left by the time we get there, a return of 670%.

I am going to use a stop loss here of $30 on the underlying. Those who can?t do options, just buying the (SLV) ETF outright here makes a ton of sense. Adrenaline junkies can even consider the double leveraged silver ETF (AGQ). Just make sure you fasten your seat belt.

The Silver Panda

Please Take a Number and Wait in Line

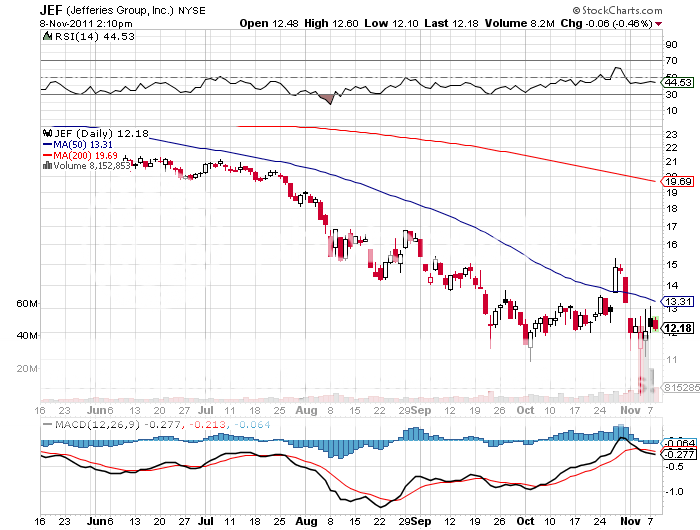

I have an unusually sensitive nose. Maybe that is because it is so big. It is particularly attuned to detecting bullpucky in broker research reports. So when an analyst recently downgraded the mid-level broker, Jeffries & Co (JEF), on the back of its European debt exposure, the stench was overwhelming.

I went to the website at http://www.jefco.com/ and had a quick look at the balance sheet and income statement. The leverage was a conservative 12:1 and earnings were growing nicely. But when I looked at the chart, it had chapter 11 written all over it, the stock plunging 40% in days. Things were just not adding up.

So I called someone I knew in senior management. The European problems were being vastly exaggerated. Total positions amounted to 2% of assets, and these were all fully hedged, both by underlying security and duration. The firm was about to post its entire European portfolio on its website with every detail, down to the last CUSIP number, an unprecedented level of disclosure. There is no need for an emergency dilutive capital raise whatsoever. What?s more, he only knew of one client in his department who had pulled funds in the past week, and he would probably return, once the dust had settled.

It all had the makings of a classic bear raid to me. This is where some opportunistic traders spread false rumors about the health of a company in the hope of making some quick profits on the short side. With MF Global, once the world?s largest future broker, having gone bust on Monday, the market was particularly sensitive to this kind of news.

With any luck, a panic will ensue causing the decline to snowball and quickly take the share price to zero. If a few thousand people lose their jobs, and a few tens of thousands of shareholders get wiped out, that is tough luck. Such are the cruel and heartless ways of Wall Street in search of the eternal buck.

However, given JEF?s bold and decisive action, I didn?t think the bears would be successful this time. And, to me, that spells opportunity with a capital ?$O$?.

If the rest of the market reaches the same conclusions that I have, then the stock is poised to rocket. At the very least, it could rapidly return to the pre-rumor level of $15.50. That would cause the January, 2012 $11 calls to double from my current cost of $2.40. If Europe cools off a bit and the market and global risk assets take another leg up, you could get a lot more.

This is still a financial, a sector that I am not exactly enamored with. So I am going to limit this position in the calls to only a high risk allocation of 2.5% of my portfolio. There are still plenty of black swans out there looking for a place to land. For my notional ?virtual? $100,000 fund, this amounts to 10 contracts ($2,500/100/$2.40). With any luck, we?ll be out of this next week.

Newsletter subscribers should note that this is a trade alert that went out from my Macro Millionaire Service at opening last Friday, November 4, when the stock was trading at $11.30. Yes, this is the program with the model portfolio that is up 47% year to date. For those who wish to participate in Macro Millionaire, my highly innovative and successful trade mentoring program, please email John Thomas directly at madhedgefundtrader@yahoo.com . Please put ?Macro Millionaire? in the subject line, as we are getting buried in emails. Hurry up, because our software limits the number of subscribers, and we are running out of places.

You are Cleared for Landing

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. This is your chance to ?look over? John Thomas? shoulder as he gives you unparalleled insight on major world financial trends BEFORE they happen. Read more

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.