Global Market Comments

February 8, 2013

Fiat Lux

Featured Trade:

(HOW THIS MARKET WILL DIE),

(SPY), (SPX), (DOW AVERAGE), (AAPL), (QQQ),

(APRIL 12 SAN FRANCISCO STRATEGY LUNCHEON),

(THE CRUEL TRUTH ABOUT GOVERNMENT STATISTICS),

(TESTIMONIAL)

SPDR S&P 500

S&P Large Cap Index

Apple

Power Shares QQQ

The universal question in the market today was ?Why is it down? when all the news was good? The weekly jobless claims dropped 5,000 to 366,000, near a five-year low, confirming that the jobs recovery is still on track. Activist shareholder, David Einkorn?s, lawsuit against Apple (AAPL) to unfreeze its cash mountain should have boosted the market?s major buzz kill.

Sure, ECB president said that European growth would continue to slow. No news there, and certainly not enough to prompt a triple digit decline in the Dow.

The harsh truth is that after the near parabolic move we have seen since the beginning of the year, you don?t need a news event to trigger a market sell off. The mere altitude of the (SPX) at 1,515 should, alone, be enough to do it, a mere 3.8% off the all time high.

The fact is that almost every manager has seen the best start to his track record in decades. Prudence requires that one book some profit, deleverage, reduce risk, and take some money off the table at these euphoric highs.

That especially applies to myself. If I make any more than the 22% I have clocked so far in 2013, nobody will believe it anyway. So why risk everything I?ve made just to make another 20%. Who wants to start over again if the wheels suddenly fall off the market?

That is what prompted my flurry of Trade Alerts at the Thursday morning opening, which saw me bail on my most aggressive positions in the (SPY) and the (IWM), taking profits on my nearest money strikes. I did maintain the bulk of my portfolio, which is still in much farther out-of-the-money strikes, and in short positions in the Japanese yen. I also added to my short positions, buying out-of-the-money bear put spreads on the (SPY), betting that even if we continue up, it won?t be in the ballistic, devil may care fashion that we saw in January.

There are, in fact, real reasons out there for the market to fall. You need look no further than the calendar, which I eloquently outlined the dangers of, in my piece ?February is the Cruelest Month? (click here).

On March 1, the sequestration cuts hit. The 2% increase in payroll taxes has yet to be reflected in slower consumer spending. Federal income taxes have already gone up on those earning over $450,000 a year. This is important, as the top 20% of income earnings account for 40% of consumer spending, and consumer spending delivers 70% of all consumption.

Although it has been postponed by three months, we have a debt ceiling crisis looming that will have to result in spending cuts across the board. My favorite stealth drag on the economy, the paring back of major tax deductions, will be the next big issue to be fought over publicly (the oil depletion allowance versus alternative energy tax credits, and so on, and so on).

All of this adds up to a 1.5% reduction in US GDP growth this year. When you are starting with a feeble, tepid, and flaccid 2% rate, that does not leave much for us to live on. This is how disappointments turn into recession. IT is no empty threat, as many US corporations are seeing earnings slow, and could well disappoint with the next quarter?s results.

This is why I predicted an ?M? shaped year in my ?2013 Annual Asset Class Review? which I am still standing by (click here). We are already well into the heady run up to construct the left leg of the ?M?. Next comes the heart rending ?V? in the middle. Some analysts are amazed that we have gone this far in front of such daunting challenges and haven?t already collapsed. I think that is going to be April or May business, given the humongous cash flows we have witnessed.

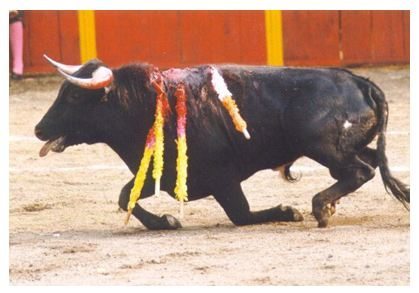

This Bull May Not Have Long to Live

Come join me for lunch at the Mad Hedge Fund Trader?s Global Strategy Update, which I will be conducting in San Francisco on Friday, April 12, 2013. An excellent meal will be followed by a wide-ranging discussion and an extended question and answer period.

I?ll be giving you my up to date view on stocks, bonds, currencies, commodities, precious metals, and real estate. And to keep you in suspense, I?ll be throwing a few surprises out there too. Tickets are available for $189.

I?ll be arriving at 11:00 and leaving late in case anyone wants to have a one on one discussion, or just sit around and chew the fat about the financial markets.

The lunch will be held at a private club in downtown San Francisco near Union Square that will be emailed with your purchase confirmation.

I look forward to meeting you, and thank you for supporting my research. To purchase tickets for the luncheons, please go to my online store at http://madhedgefundradio.com/store and click on ?luncheons.?

There have been complaints about the quality of government data as long as there have been stock markets. The US is not much better than emerging markets, like China, where numbers are subject to huge, after the fact revisions. A broker friend of mine emailed the conversation below, which has been circulating around the street. Enjoy.

Costello: I want to talk about the unemployment rate in America.

Abbott: Good subject. Terrible times. It's 7.8%.

Costello: That many people are out of work?

Abbott: No, that's 14.7%.

Costello: You just said 7.8%.

Abbott: 7.8% unemployed.

Costello: Right 7.8% out of work.

Abbott: No, that's 14.7%.

Costello: OK, so it's 14.7% unemployed.

Abbott: No, that's 7.8%.

Costello:?Wait a minute. Is it 7.8% or 14.7%?

Abbott: 7.8% are unemployed. 14.7% are out of work.

Costello: If you are out of work, you are unemployed.

Abbott: No, Congress said you can't count the "out of work" as the unemployed.?You have to look for work to be unemployed.

Costello:?But they are out of work!!!

Abbott: No, you miss his point.

Costello: What point?

Abbott: Someone who doesn't look for work can't be counted with those who look for work. It wouldn't be fair.

Costello: To whom?

Abbott: The unemployed.

Costello: But?all?of them are out of work.

Abbott: No, the unemployed are actively looking for work. Those who are out of work gave up looking and if you give up, you are no longer in the ranks of the unemployed.

Costello: So if you're off the unemployment roles, that would count as less unemployment?

Abbott: Unemployment would go down. Absolutely!

Costello: The unemployment just goes down because you don't look for work?

Abbott: Absolutely it goes down. That's how they get it to 7.8%. Otherwise it would be 14.7%. Our government doesn't want you to read about 14.7% unemployment.

Costello: That would be tough on those running for reelection.

Abbott: Absolutely.

Costello: Wait, I got a question for you. That means there are two ways to bring down the unemployment number?

Abbott: Two ways is correct.

Costello: Unemployment can go down if someone gets a job?

Abbott: Correct.

Costello: And unemployment can also go down if you stop looking for a job?

Abbott: Bingo.

Costello: So there are two ways to bring unemployment down, and the easier of the two is to have people stop looking for work.

Abbott: Now you're thinking like an economist.

Costello: I don't even know what the hell I just said!

Abbott: Now you're thinking like Congress.

So, Who?s on First?

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. Read more

Come join me for lunch at the Mad Hedge Fund Trader?s Global Strategy Update, which I will be conducting in San Francisco on Friday, April 12, 2013. An excellent meal will be followed by a wide ranging discussion and an extended question and answer period.

I?ll be giving you my up to date view on stocks, bonds, currencies, commodities, precious metals, and real estate. And to keep you in suspense, I?ll be throwing a few surprises out there too. Tickets are available for $189.

I?ll be arriving at 11:00 and leaving late in case anyone wants to have a one on one discussion, or just sit around and chew the fat about the financial markets.

The lunch will be held at a private club in downtown San Francisco near Union Square that will be emailed with your purchase confirmation.

I look forward to meeting you, and thank you for supporting my research. To purchase tickets for the luncheons, please go to my online store.

[button size="large" color=(blue) link="http://madhedgefundradio.com/buy-tickets-san-francisco-luncheon-april-12-2013/"]Order Luncheon Tickets[/button]

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. This is your chance to ?look over? John Thomas? shoulder as he gives you unparalleled insight on major world financial trends BEFORE they happen. Read more

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.