As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. Read more

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. This is your chance to ?look over? John Thomas? shoulder as he gives you unparalleled insight on major world financial trends BEFORE they happen. Read more

Global Market Comments

March 7, 2013

Fiat Lux

Featured Trade:

(APRIL 19 CHICAGO STRATEGY LUNCHEON),

(HERE COMES THE NEXT PEACE DIVIDEND), (AAPL), (USO), (SPX), (UUP), (TLT), (GLD), (SLV), (CU), (CORN), (SOYB)

Apple Inc. (AAPL)

United States Oil (USO)

S&P 500 Index (SPX)

PowerShares DB US Dollar Index Bullish (UUP)

iShares Barclays 20+ Year Treas Bond (TLT)

SPDR Gold Shares (GLD)

iShares Silver Trust (SLV)

First Trust ISE Global Copper Index (CU)

Teucrium Corn (CORN)

Teucrium Soybean (SOYB)

Come join me for lunch for the Mad Hedge Fund Trader?s Global Strategy Update, which I will be conducting in Chicago on Friday, April 19. A three-course lunch will be followed by a PowerPoint presentation and an extended question and answer period.

I?ll be giving you my up to date view on stocks, bonds, foreign currencies, commodities, precious metals, and real estate. And to keep you in suspense, I?ll be throwing a few surprises out there too. Enough charts, tables, graphs, and statistics will be thrown at you to keep your ears ringing for a week. Tickets are available for $199.

I?ll be arriving an hour early and leaving late in case anyone wants to have a one on one discussion, or just sit around and chew the fat about the financial markets.

The lunch will be held at a downtown Chicago venue on Monroe Street that will be emailed with your purchase confirmation.

I look forward to meeting you, and thank you for supporting my research. To purchase tickets for the luncheons, please go to my online store.

When communications between intelligence agencies suddenly spike, as has recently been the case, I sit up and take note. Hey, you don?t think I talk to all of those generals because I like their snappy uniforms, do you?

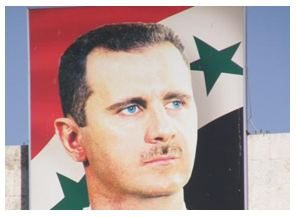

The word is that the despotic, authoritarian regime in Syria is on the verge of collapse, and is unlikely to survive more than a few more months. The body count is mounting, and the only question now is whether Bashar al-Assad will flee to an undisclosed African country or get dragged out of a storm drain to take a bullet in his head. It couldn?t happen to a nicer guy.

The geopolitical implications for the US are enormous.? With Syria gone, Iran will be the last rogue state hostile to the US in the Middle East, and it is teetering. The next and final domino of the Arab spring falls squarely at the gates of Tehran.

Remember that the first real revolution in the region was the street uprising there in 2009. That revolt was successfully suppressed with an iron fist by fanatical and pitiless Revolutionary Guards. The true death toll will never be known, but is thought to be in the thousands. The antigovernment sentiments that provided the spark never went away and they continue to percolate just under the surface.

At the end of the day, the majority of the Persian population wants to join the tide of globalization. They want to buy IPods and blue jeans, communicate freely through their Facebook pages and Twitter accounts, and have the jobs to pay for it all. Since 1979, when the Shah was deposed, a succession of extremist, ultraconservative governments ruled by a religious minority, have failed to cater to these desires

When Syria collapses, the Iranian ?street? will figure out that if they spill enough of their own blood that regime change is possible and the revolution there will reignite. The Obama administration is now pulling out all the stops to accelerate the process. Secretary of State Hillary Clinton has stiffened her rhetoric and worked tirelessly behind the scenes to bring about the collapse of the Iranian economy.

The oil embargo she organized is steadily tightening the noose, with heating oil and gasoline becoming hard to obtain. Yes, Russia and China are doing what they can to slow the process, but conducting international trade through the back door is expensive, and prices are rocketing. The unemployment rate is 25%.? Iranian banks are about to get kicked out of the SWIFT international settlements system, which would be a deathblow to their trade.

Let?s see how docile these people remain when the air conditioning quits running this summer because of power shortages. Iran is a rotten piece of fruit ready to fall of its own accord and go splat. Hillary is doing everything she can to shake the tree. No military action of any kind is required on America?s part.

The geopolitical payoff of such an event for the US would be almost incalculable. A successful revolution will almost certainly produce a secular, pro-Western regime whose first priority will be to rejoin the international community and use its oil wealth to rebuild an economy now in tatters.

Oil will lose its risk premium, now believed by the oil industry to be $30 a barrel. A looming supply could cause prices to drop to as low as $30 a barrel. This would amount to a gigantic tax $1.43 trillion tax cut for not just the US, but the entire global economy as well (87 million barrels a day X 365 days a year X $90 dollars a barrel X 50%). Almost all funding of terrorist organizations will immediately dry up. I might point out here that this has always been the oil industry?s worst nightmare.

At that point, the US will be without enemies, save for North Korea, and even the Hermit Kingdom could change with a new leader in place. A long Pax Americana will settle over the planet.

The implications for the financial markets will be enormous. The US will reap a peace dividend as large or larger than the one we enjoyed after the fall of the Soviet Union in 1992. As you may recall, that black swan caused the Dow Average to soar from 2,000 to 10,000 in less than eight years, also partly fueled by the technology boom. A collapse in oil imports will cause the US dollar to rocket.? An immediate halving of our defense spending to $400 billion or less and burgeoning new tax revenues would cause the budget deficit to collapse. With the US government gone as a major new borrower, interest rates across the yield curve will fall further.

A peace dividend will also cause US GDP growth to reaccelerate from 2% to 4%. Risk assets of every description will soar to multiples of their current levels, including stocks, bonds, commodities, precious metals, and food. The Dow will soar to 20,000, the Euro collapses to parity, gold rockets to $2,300 and ounce, silver flies to $100 an ounce, copper leaps to $6 a pound, and corn recovers $8 a bushel. The 60-year bull market in bonds ends.

Some 1.5 million of the armed forces will get dumped on the job market as our manpower requirements shrink to peacetime levels. But a strong economy should be able to soak these well-trained and motivated people right up. We will enter a new Golden Age, not just at home, but for civilization as a whole.

Wait, you ask, what if Iran develops an atomic bomb and holds the US at bay? Don?t worry. There is no Iranian nuclear device. There is no Iranian nuclear program. The entire concept is an invention of American intelligence agencies as a means to put pressure on the regime. The head of the miniscule effort they have was assassinated by Israeli intelligence two weeks ago (a magnetic bomb, placed on a moving car, by a team on a motorcycle, nice!).

If Iran had anything substantial in the works, the Israeli planes would have taken off a long time ago. There is no plan to close the Straits of Hormuz, either. The training exercises we have seen are done for CNN?s benefit, and comprise no credible threat.

I am a firm believer in the wisdom of markets, and that the marketplace becomes aware of major history changing events well before we mere individual mortals do. The Dow began a 25-year bull market the day after American forces defeated the Japanese in the Battle of Midway in May of 1942, even though the true outcome of that confrontation was kept top secret for years.

If the collapse of Iran was going to lead to a global multi decade economic boom and the end of history, how would the stock markets behave now? They would rise virtually every day, led by the technology sector and banks, offering no pullbacks for latecomers to get in. That is exactly what they have been doing since mid-December. If you think I?m ?Mad?, just check out the big relative underperformance of oil on the chart below.

Here?s The Next Big Short

Global Market Comments

March 6, 2013

Fiat Lux

Featured Trade:

(APRIL 12 SAN FRANCISCO STRATEGY LUNCHEON),

(INVESTING IN A STATE SPONSOR OF TERRORISM),

(AFK), (GAF), (EZA),

(THE LONG VIEW ON EMERGING MARKETS),

(EWZ), (RSX), (PIN), (FXI)

Market Vectors Africa Index ETF (AFK)

SPDR S&P Emerging Middle East & Africa (GAF)

iShares MSCI South Africa Index (EZA)

iShares MSCI Brazil Capped Index (EWZ)

Market Vectors Russia ETF (RSX)

PowerShares India (PIN)

iShares FTSE China 25 Index Fund (FXI)

Come join me for lunch at the Mad Hedge Fund Trader?s Global Strategy Update, which I will be conducting in San Francisco on Friday, April 12, 2013. An excellent meal will be followed by a wide-ranging discussion and an extended question and answer period.

I?ll be giving you my up to date view on stocks, bonds, currencies, commodities, precious metals, and real estate. And to keep you in suspense, I?ll be throwing a few surprises out there too. Tickets are available for $189.

I?ll be arriving at 11:00 and leaving late in case anyone wants to have a one on one discussion, or just sit around and chew the fat about the financial markets.

The lunch will be held at a private club in downtown San Francisco near Union Square that will be emailed with your purchase confirmation.

I look forward to meeting you, and thank you for supporting my research. To purchase tickets for the luncheons, please go to my online store at www.madhedgefundtrader.com/category/luncheons/.

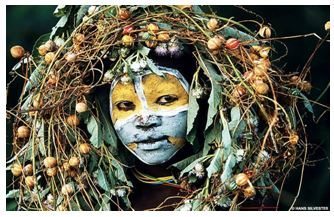

How about a country whose leaders have stolen $400 billion in the last decade and have seen 300 foreign workers kidnapped? Another country lost four wars in the last 40 years. Still interested? How about a country that suffers one of the world?s highest AIDs rates, endures regular insurrections where all of the Westerners get massacred, and racked up 5 million dead in a continuous civil war?

Then, Africa is the place for you, the world?s largest source of gold, diamonds, chocolate, and cobalt! The countries above are Libya, Nigeria, Egypt, and the Congo. Below the radar of the investment community since the colonial days, the Dark Continent has recently been attracting the attention of large hedge funds and private equity firms.

Goldman Sachs has set up Emerging Capital Partners, which has already invested $2 billion there. China sees the writing on the wall, and has launched a latter day colonization effort, taking a 20% equity stake in South Africa?s Standard Bank, the largest on the continent. There are now thought to be over one million Chinese agricultural workers in Africa.

The angle here is that all of the terrible headlines above are in the price, that prices are very low, and the perceived risk is much greater than actual risk.

Price earnings multiples are low single digits, cash flows are huge, and returns of capital within two years are not unheard of. These numbers remind me of those found in Japan during the fifties, right after it lost WWII.

The reality is that Africa?s 900 million have unlimited demand for almost everything, and there is scant supply, with many firms enjoying local monopolies. The big plays are your classic early emerging market targets, like banking, telecommunications, electric power, and other infrastructure.

For example, in the last decade, the number of telephones has soared from 350,000 to 10 million. It?s like the early days of investing in China in the seventies, when the adventurous only played when they could double their money in two years, because the risks were so high.

This is definitely not for day traders. If you are willing to give up a lot of short term liquidity for a high long term return, then look at the Market Vectors Africa Index ETF (AFK), which has 29% of its holdings in South Africa and 20% in Nigeria. There is also the SPDR S&P Emerging Middle East & Africa ETF (GAF). For more of a rifle shot, entertain the iShares MSCI South Africa Index Fund (EZA). Don?t rush out and buy these today. Instead, wait for emerging markets to come back in vogue. I will send you a trade alert when this is going to happen.

Meet Your New Business Partner

I managed to catch a few comments in the distinct northern accent of Jim O'Neil, the fabled analyst who invented the 'BRIC' term, and who has been kicked upstairs to the chairman's seat at Goldman Sachs International (GS) in London.

Jim thinks that it is still the early days for the space, and that these countries have another ten years of high growth ahead of them. As I have been pushing emerging markets since the inception of this letter in 2008, this is music to my ears.

By 2018 the combined GDP of the BRIC's; Brazil (EWZ), Russia (RSX), India (PIN), and China (FXI), will match that of the US. China alone will reach two thirds of the American figure for gross domestic product. All that?s required is for China to maintain a virile 8% annual growth rate for eight more years, while the US plods along at an arthritic 2% rate. China's most recent quarterly growth rate came in at a blistering 8%.

?BRIC? almost became the 'RIC' when O'Neil was formulating his strategy a decade ago. Conservative Brazilian businessmen were convinced that the new elected Luiz Ignacio Lula da Silva would wreck the country with his socialist ways. He ignored them and Brazil became the top performing market of the G-20 since 2000. An independent central bank that adopted a strategy of inflation targeting was transformative.

This is not to say that you should rush out and load up on emerging markets tomorrow. American big cap stocks are the flavor of the day, and as long as this is the case, emerging markets will continue to blend in with the wall paper. Still, with growth rates triple or quadruple of our own, they will not stay ?resting? for long.

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. This is your chance to ?look over? John Thomas? shoulder as he gives you unparalleled insight on major world financial trends BEFORE they happen. Read more

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.