As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. Read more

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. This is your chance to ?look over? John Thomas? shoulder as he gives you unparalleled insight on major world financial trends BEFORE they happen. Read more

Global Market Comments

April 17, 2013

Fiat Lux

Featured Trade:

(AMERICA?S DEMOGRAPHIC TIME BOMB),

(TRIBUTE TO A GIANT OF JOURNALISM, ROY ESSOYAN)

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. Read more

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. This is your chance to ?look over? John Thomas? shoulder as he gives you unparalleled insight on major world financial trends BEFORE they happen. Read more

Global Market Comments

April 16, 2013

Fiat Lux

Featured Trade:

(MAY 8 LAS VEGAS STRATEGY LUNCHEON),

(BIDDING FOR THE STARS), (DOW AVERAGE), (SPY),

(AN EVENING WITH TRAVEL GURU ARTHUR FROMMER),

(HAPPY BIRTHDAY IRS!)

SPDR S&P 500 ETF Trust (SPY)

Come join me for the lunch at the Mad Hedge Fund Trader's Global Strategy Update, which I will be conducting in Las Vegas, Nevada on Wednesday, May 8, 2013. An excellent meal will be followed by a wide-ranging discussion and an extended question and answer period.

I?ll be giving you my up to date view on stocks, bonds, currencies, commodities, precious metals, and real estate. I will also explain how I have been able to deliver a blowout 40% return since the November, 2012 market bottom. And to keep you in suspense, I?ll be throwing a few surprises out there too. Tickets are available for $179.

I?ll be arriving at 11:00 and leaving late in case anyone wants to have a one on one discussion, or just sit around and chew the fat about the financial markets. The PowerPoint presentation will be emailed to you three days before the event.

The lunch will be held at a major Las Vegas hotel on the Strip, the details will be emailed with your purchase confirmation. Please make your own hotel reservations, as business there is booming.

I look forward to meeting you, and thank you for supporting my research. To purchase tickets for the luncheons, please go to my online store.

A few years ago, I went to a charity fundraiser at San Francisco?s priciest jewelry store, Shreve & Co. The well-heeled masters of the universe bid for dates with the local high society beauties, dripping in diamonds and Channel No. 5. Well fueled with champagne, I jumped into a spirited bidding war over one of the Bay Area?s premier hotties, whom shall remain nameless. Suffice to say, she has a sports stadium named after her.

The bids soared to $12,000, $13,000, $14,000. After all, it was for a good cause, Pari Livermore?s California State Parks Foundation. But when it hit $12,400, I suddenly developed lockjaw. Later, the sheepish winner with a severe case of buyer?s remorse came to me and offered his date back to me for $14,000.? I said ?no thanks.? $13,000, $12,000, $11,000? I passed.

The current altitude of the stock market reminds me of that evening. If you rode gold (GLD) from $800 to $1,920, oil, from $35 to $149, and the (DIG) from $20 to $60, why sweat trying to eke out a few more basis points, especially when the risk/reward ratio sucks so badly, as it does now?

I realize that many of you are not hedge fund managers, and that running a prop desk, mutual fund, 401k, pension fund, or day trading account has its own demands. But let me quote what my favorite Chinese general, Deng Xiaoping, once told me: ?There is a time to fish, and a time to hang your nets out to dry.? That?s why my cash position has steadily been rising over the last few weeks.

At least then I?ll have plenty of dry powder for when the window of opportunity reopens for business. So while I?m mending my nets, I?ll be building new lists of trades for you to strap on when the sun, moon, and stars align once again.

As for that date? She eventually married one of California premier technology titans, an established billionaire in his own right, and now has two cute kids. It?s all part of life?s rich mosaic. And sorry, I?m not saying who because gentlemen don?t talk.

Travel guru, Arthur Frommer, says that now is the best time to travel in 20 years, thanks to a combination of a strong dollar and desperate price-cutting forced by the recession.

Three years after oil hit an historic peak at $148/barrel, when $500 fuel surcharges abounded, and the demise of the travel industry was widely predicted, costs in some countries, like Mexico and Costa Rica are 50% lower than a year ago. Talk about price elasticity with a turbocharger!

Frommer believes there are three sea change trends going on today. Business is moving away from the big three travel websites, Travelocity, Orbitz, and Priceline, who have more preferential side deals with airlines than can be counted, towards pure aggregator sites that almost always offer cheaper fares, like Kayak.com, Momondo.com, and farechase.yahoo.com.

There is a move away from traditional 48 person escorted bus tours towards small group adventures, like those offered by Gap Adventures, Intrepid Tours, and Adventure Center, that take parties of 12 or less on eye opening public transportation.

There has also been a huge surge in programs offered by universities that turn travelers into students for a week to study the liberal arts at Oxford, Cambridge, and UC Berkeley. His favorite was the Great Books programs offered by St. Johns University in Santa Fe, New Mexico. He says that the Internet has given a huge boost to international travel, but warns against user generated content, 70% of which is bogus and posted by the hotels and restaurants themselves.

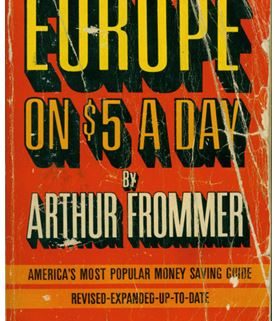

The 79-year-old Frommer turned an army posting in Berlin in 1952 into a travel empire that publishes 340 books a year, or one out of every four travel books on the market. I met him on a swing through the San Francisco Bay Area (his ticket from New York was only $150), and he graciously signed my original 1968 copy of Europe on $5 a Day, which was crammed in my backpack for two years.

Which country has changed the most in his 60 years of travel writing? France, where the citizenry have become noticeably more civil since losing WWII. Bali is the only place where you can still travel for $5/day, although you can see Honduras for $10. Always looking for a deal, Arthur's next trip is to Chile, the only country hes has never visited, because the currency there has crashed.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.