While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

July 8, 2013

Fiat Lux

Featured Trade:

(JULY 19 FRANKFURT STRATEGY LUNCHEON),

(THE TWO CENTURY DOLLAR SHORT),

(UUP), (FXY), (FXE), (FXB), (FXC), (FXA), (BNZ), (CYB)

(CNN?S JOHN LEWIS; THE DEATH OF A COLLEAGUE)

PowerShares DB US Dollar Index Bullish (UUP)

CurrencyShares Japanese Yen Trust (FXY)

CurrencyShares Euro Trust (FXE)

CurrencyShares British Pound Sterling Tr (FXB)

CurrencyShares Canadian Dollar Trust (FXC)

CurrencyShares Australian Dollar Trust (FXA)

WisdomTree Dreyfus New Zealand Dollar (BNZ)

WisdomTree Chinese Yuan (CYB)

Come join me for lunch for the Mad Hedge Fund Trader?s Global Strategy Update, which I will be conducting in Frankfurt, Germany on Friday, July 19, 2013. A three-course lunch will be followed by a PowerPoint presentation and an extended question and answer period.

I?ll be giving you my up to date view on stocks, bonds, foreign currencies, commodities, precious metals, and real estate. And to keep you in suspense, I?ll be throwing a few surprises out there too. Enough charts, tables, graphs, and statistics will be thrown at you to keep your ears ringing for a week. Tickets are available for $239.

I?ll be arriving an hour early and leaving late in case anyone wants to have a one on one discussion, or just sit around and chew the fat about the financial markets.

The lunch will be held at a prestigious private club not far for the Botanical Gardens, the details of which will be emailed to you with your purchase confirmation.

I look forward to meeting you, and thank you for supporting my research. To purchase tickets for the luncheons, please go to my online store.

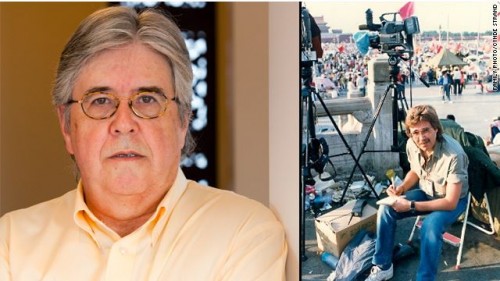

I was deeply saddened by the death of my old friend, CNN Asia correspondent, John Lewis, a legend in television journalism.

I first met John in Tokyo at the Foreign Correspondents? Club of Japan back in 1974, when he was a decorated Vietnam vet from Ohio trying to claw his way into TV, bootstrap style. Personable and easy going, he was one of the few in the club who got along with most of the cantankerous, suicidal, or just plain drunk writers there, and was often the first to step in to stop a fight. In those days you didn?t get fired in this rough and tumble business for punching out competitors.

At my 1977 wedding at the club, John graciously took the pictures because I was too poor to hire a professional. In 1979, rumors spread that this wild man millionaire named the ?Mouth of the South,? Ted Turner, was going to start up a 24 hour news cable channel called CNN, and was looking to hire a full time Asia correspondent. We both jumped at the job, and Lewis won out. Everyone was impressed, but kept their fingers crossed.

I was left part time stringing for NBC news, reporting to the late Bruce McDonald, who had worked his way up from writing for Johnny Carson?s Tonight show to the network producer for Asia, which is a big deal. And you wonder where I got my wicked sense of humor.

I often ran into John in the field, he covering the typhoons, floods, and wars, and me the business angle, which often blended into the same story. So we covered the corrupt Marcos regime in the Philippines, the assassination of Indira Gandhi in India, and the opening up of China. We never missed an opportunity to swap contacts and war stories at dingy, dubious bars from Seoul to New Delhi, and all points in between.

We parted ways in the eighties when my career made a sharp jag to the right with my joining Morgan Stanley in New York. John shot to international fame when he ignored Chinese orders to cease covering the Tianamen Square massacre in 1989, and kept beaming reports abroad until the heavies cut the power off. Gutsy move, John.

I heard that John died of a heart attack at 63. Foreign correspondence did not exactly offer a healthy lifestyle, with all the smoking, drinking, and general carousing that went on. There were also the occupational hazards of the occasional stray bullet, bouts of amoebic dysentery, and stints in jail at the behest of some third world dictator. It was a larger than life existence, but not exactly conducive to a family life, so I moved on. John stuck with it, but what a price! I was appalled when I saw his recent picture. The years had not been kind.

John was one of a dying breed of journalist whose sole interest was to get the story right and get it fast. There was no pandering to a particular political viewpoint, stealth marketing on products, or surreptitious product placement that has regrettably become endemic in the trade today. His was really an old fashioned kind of reporting, almost quaint in its principles.

He will be missed.

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Come join me for lunch for the Mad Hedge Fund Trader?s Global Strategy Update, which I will be conducting in London on Monday, July 8, 2013. A three-course lunch will be followed by a PowerPoint presentation and an extended question and answer period.

I?ll be giving you my up to date view on stocks, bonds, currencies commodities, precious metals, and real estate. And to keep you in suspense, I?ll be throwing a few surprises out there too. Enough charts, tables, graphs, and statistics will be thrown at you to keep your ears ringing for a week. Tickets are available for $249.

I?ll be arriving an hour early and leaving late in case anyone wants to have a one on one discussion, or just sit around and chew the fat about the financial markets.

The lunch will be held at a private club on St. James Street, the details of which will be emailed to you with your purchase confirmation.

I look forward to meeting you, and thank you for supporting my research. To purchase tickets for the luncheons, please go to my online store.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.