As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. This is your chance to ?look over? John Thomas? shoulder as he gives you unparalleled insight on major world financial trends BEFORE they happen. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points.

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points.

Global Market Comments

September 6, 2013

Fiat Lux

Featured Trade:

(MAD HEDGE FUND TRADER HITS NEW ALL TIME HIGH)

(SAN FRANCISCO STRATEGY LUNCHEON POSTPONED TO NOVEMBER 1),

(THE TAX RATE FALLACY),

(THE COOLEST TOMBSTONE CONTEST)

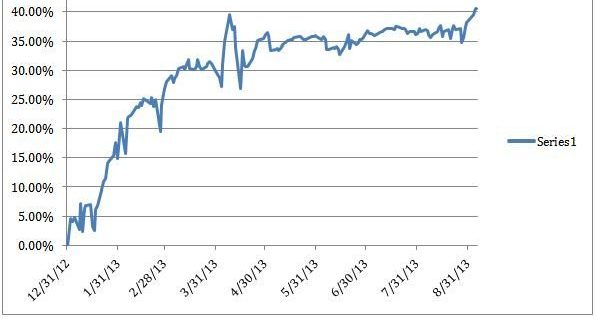

The Trade Alert service of the Mad Hedge Fund Trader has posted a year-to-date gain of 40.53%, a new all time high. Performance since inception 33 months ago soared to 95.58%. This pegs the average annualized return at 34.75%.

Some 71% of all Trade Alerts since the beginning have been profitable. Carving out the closed 2013 trades alone, 41 out of 50 have made money, a success rate of 82%. It is a track record that most big hedge funds would kill for.

The performance spike brings to a close months of sideway action when the markets provided no clear trends. This summer seemed quieter than most. But I have had a hot hand since returning from my European Strategy Tour. Anticipating seasonal strength in the US dollar, I piled on short positions in the Japanese yen and the Euro. A long position in gold proved profitable. My short in the oil market has been volatile, and now sits close to my breakeven point.

The coming autumn promises to deliver a harvest of new trading opportunities. On the menu are the taper, a new Fed governor, a debt ceiling crisis, a possible war with Syria, and the death of the bull market in bonds. The Trade Alerts should be coming hot and heavy.

Global Trading Dispatch, my highly innovative and successful trade-mentoring program, earned a net return for readers of 40.17% in 2011 and 14.87% in 2012. The service includes my Trade Alert Service and my daily newsletter, the Diary of a Mad Hedge Fund Trader. You also get a real-time trading portfolio, an enormous trading idea database, and live biweekly strategy webinars, and Jim Parker?s Mad Day Trader service.

To subscribe, please go to my website at www.madhedgefundtrader.com, find the ?Global Trading Dispatch? box on the right, and click on the lime green ?SUBSCRIBE NOW? button.

Come join me for lunch at the Mad Hedge Fund Trader?s Global Strategy Update, which I will be conducting in San Francisco on Friday, November 1, 2013. An excellent meal will be followed by a wide-ranging discussion and an extended question and answer period.

I?ll be giving you my up to date view on stocks, bonds, currencies, commodities, precious metals, and real estate. And to keep you in suspense, I?ll be throwing a few surprises out there too. Tickets are available for $191.

I?ll be arriving at 11:00 and leaving late in case anyone wants to have a one on one discussion, or just sit around and chew the fat about the financial markets.

The lunch will be held at a private club in downtown San Francisco near Union Square that will be emailed with your purchase confirmation.

I look forward to meeting you, and thank you for supporting my research. To purchase tickets for the luncheons, please go to my online store.

When anyone starts lecturing you that the US has the highest tax rate in the industrialized world, just turn around, walk away, and pretend you never heard them. This person is either ignorant about this country?s taxation system, or is deliberately trying to deceive or mislead you.

According to a report released by the Internal Revenue Service, America?s tax collection agency, the top 400 individual tax returns filed in 2009 reported an average gross income of $358 million each. The average amount of tax paid by these individuals came to under 17%, less than half the maximum Federal rate of 39.5%, which kicks in on annual income over $388,350 (click here for the 2012 tax tables). This explains why Warren Buffet pays a much lower tax rate than his secretary. It really is true that in America, only the poor people pay taxes.

Look at any international comparison of taxes to GDP, and one can always find the United States at the bottom of the table. Low American taxes are one of the main reasons why I moved my company here from England 19 years ago, fleeing their hellacious then 15% VAT tax. Take a look at the Fortune 500, where one third of the largest companies pay no tax at all, and many that dominate the top of the list, like the oil majors, pay only token amounts. In 2010, General Electric (GE), one of the most profitable companies in the world, paid a 3% tax rate. However, if any politician wants to pander to voters during election time on a tax cutting platform he will only bluster on about ?tax rates?, not actual taxes paid.

What the US has that other countries lack is the 100,000 pages of the Internal Revenue Code. It is a 100 year accumulation of deductions, accelerated depreciation rates, tax credits, and other tax breaks that are the end product of intensive lobbying efforts and bribes by special interest groups, corporations, unions, and even religious groups. Take a look at the oil industry again. The oil depletion allowance permits drillers to deduct a substantial portion of the cost of a new well in the first year, while spreading the income over the extended life of the well. ?(Click here for its fascinating history, Oil Depletion Allowance.) When I first got into the oil and gas business a decade ago, after reading the relevant sections of the tax code, I couldn?t understand why everyone wasn?t drilling for Texas tea.

I have a very simple solution to the country?s budget deficit problem. Hit the reset button. Eliminate the Internal Revenue Code. Just set it on fire. Keep the existing progressive, hockey stick tax rates on income, but eliminate all deductions. And I mean everything; deductions for dependents, home mortgage interest, medical expenses, charitable contributions, the works. There are no sacred cows. My revised Form 1040 would have only three lines on it:

Income?????? ______________

Tax Rate??? ______________

Tax Due???? ______________

The budget deficit would disappear overnight. Government spending would shrink dramatically, because you could ditch most of the 100,000 who work for the IRS. Some 1.3 million auditors and CPA?s would have to hit the road in search of new work too. The amount of money that is wasted on tax collection in this country is truly staggering. This is not some pie in the sky concept. This is how taxation already works in most countries, and they seem to get along just fine.

In fact, the whole scheme might even pay for itself.

I Think This One Should Be Income, Here

I Think This One Should Be Income, Here

Global Market Comments

September 5, 2013

Fiat Lux

Featured Trade:

(OCTOBER 18 SAN FRANCISCO STRATEGY LUNCHEON)

(TAKING PROFITS ON MY EURO SHORT),

?(FXE), (EURO),

(POPULATION BOMB ECHOES),

(POT), (MOS), (AGU), (WEAT), (CORN), (SOYB), (RJA)

CurrencyShares Euro Trust (FXE)

Potash Corp. of Saskatchewan, Inc. (POT)

The Mosaic Company (MOS)

Agrium Inc. (AGU)

Teucrium Wheat (WEAT)

Teucrium Corn (CORN)

Teucrium Soybean (SOYB)

ELEMENTS Rogers Intl Commodity Agri ETN (RJA)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.