While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points.

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points.

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points.

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points.

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points.

Global Market Comments

October 24, 2013

Fiat Lux

Featured Trade:

(THE CASE AGAINST TREASURY BONDS), (TBT), (TLT),

(MY PERSONAL LEADING ECONMIC INDICATOR),

(HMC), (NSANY), (DXJ)

(A FILM REVIEW OF ?MARGIN CALL?)

ProShares UltraShort 20+ Year Treasury (TBT)

iShares 20+ Year Treasury Bond ETF (TLT)

Honda Motor Co., Ltd. (HMC)

Nissan Motor Co. Ltd. (NSANY)

WisdomTree Japan Hedged Equity (DXJ)

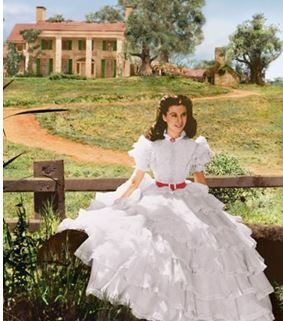

Now it?s time for some cultural edification. I first became aware of ?Margin Call? as a pre-production project four years ago when news leaked out that the principal actors, Kevin Stacey, Demi Moore, Stanley Tucci, and Jeremy Irons, were reading The Diary of a Mad Hedge Fund Trader to learn about the industry and get in character.

The plot covers a 24-hour period on the eve of the 2008 financial crisis at a fictitious Wall Street house obviously modeled on Lehman Brothers. A strategic downsizing sacks the firm?s risk manager, Stanley Tucci, who casually mentions to a young associate as he carries his cardboard box down the elevator that the firm is on the verge of getting wiped out in the subprime securities market.

A series of emergency, all night meetings ensue. At the last minute, the CEO, John Tuld, not to be confused with Lehman?s Dick Fuld, alights, godlike, on the roof in a helicopter, obviously clueless about what has been going on in his firm, and the securities involved. The decision is made to dump their entire position at a huge loss at the market opening, even if it means causing the failure of many of the firm?s clients and counterparties.

When the sales staff rebel, they are offered extra million dollar bonuses if the positions are gone by noon. On orgy of predatory salesmanship ensues, which I have seen myself on trading floors a thousand times. In an hour, prices for some bonds drop 40%. The firm lives on to fight another day, but only at the cost of wiping out reputations and ending careers. The CEO has a laugh and flies away.

Those in the business will uncomfortably recognize many of the hard hearted practices, half-truths, and ethical lapses endemic on Wall Street. It really is only about making money and survival of the fittest.

Despite being a total flop at the box office on a limited release, the acting is incredible. The movie is still showing on some long distance, intercontinental flights. So if you have some free time, order the DVD on Netflix (but don?t touch the stock!).

And hey, Kevin baby, have your people call my people and let?s do lunch when I?m in Beverly Hills in January!

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points.

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.