As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. Read more

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. This is your chance to ?look over? John Thomas? shoulder as he gives you unparalleled insight on major world financial trends BEFORE they happen. Read more

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points.

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points.

Global Market Comments

February 6, 2014

Fiat Lux

Featured Trade:

(THURSDAY FEBRUARY 20 MELBOURNE, AUSTRALIA STRATEGY LUNCH)

(MAD HEDGE FUND TRADER SURGES AHEAD WITH A 5.78%),

(TLT), (UNG), (AAPL)

(DINNER WITH ELIOT SPITZER)

iShares 20+ Year Treasury Bond (TLT)

United States Natural Gas (UNG)

Apple Inc. (AAPL)

The red hot performance of the Mad Hedge Fund Trader?s Trade Alert Service has maintained its blistering pace from last year, picking up another 6.49% profit in the first two trading weeks of 2014.

The Dow Average was down 6.2% during the same period pegging my outperformance of the index at a stunning 12.7%. Since the beginning of 2013, I am up 77%. 2013 closed with a total return for followers of 67.45%.

The three-year return is now an eye popping 132%, compared to a far more modest increase for the Dow Average during the same period of only 26%. That brings my averaged annualized return up to 41.7%.

This has been the profit since my groundbreaking trade mentoring service was launched in 2010. It all is a matter of the harder I work, the luckier I get.

The hot streak continues.

The smartest thing I did in the past year was to let all of my options expire on January 15, and then moved to an 80% cash position. That spared me the angst, the soul searching, and the sleepless night caused by the 10% correction that followed in the Dow Average.

This set me up to cherry pick the most extreme market moves. But this time was different. Instead of returning to call spreads, I adopted an outright put option strategy.

This allowed me to pick up highly leveraged short positions in Treasury bonds and natural gas, while risking only 5% of my capital with each. Don?t people know that polar vortexes only come in pairs? I guess no one studies physics anymore. When the markets broke, a sharp rise in volatility also contributed to the P&L.

To top it all, Steve Jobs chipped in again, even though he has been dead for 2 ? years. My call spread in Apple shares PROFITABLY came home once more.

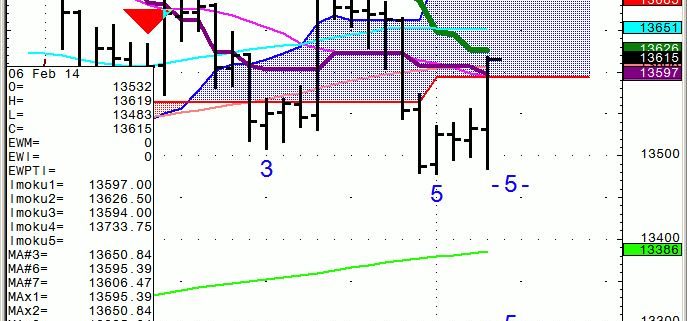

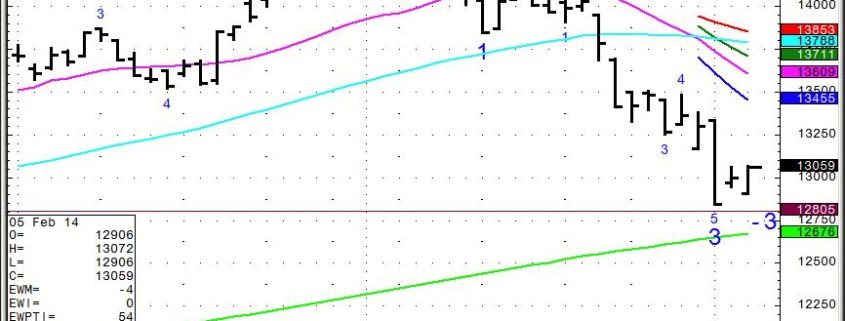

My esteemed colleague, Mad Day Trader Jim Parker, had no small part of this success. Since the market became technically and momentum driven, I have been confirming with him before sending out every Trade Alert. Together, out success rate is 100%.

What would you expect with a combined 85 years of market experience between the two of us? Followers are laughing all the way to the bank.

Don?t forget that Jim clocked an amazing 2013 staggering 374%. That is just for an eight-month year!

The coming year promises to deliver a harvest of new trading opportunities. The big driver will be a global synchronized recovery that promises to drive markets into the stratosphere in 2014.

The Trade Alerts should be coming hot and heavy. Please join me on the gravy train. You will never get a better chance than this to make money for your personal account.

Global Trading Dispatch, my highly innovative and successful trade-mentoring program, earned a net return for readers of 40.17% in 2011, 14.87% in 2012, and 67.45% in 2013.

The service includes my Trade Alert Service and my daily newsletter, the Diary of a Mad Hedge Fund Trader. You also get a real-time trading portfolio, an enormous trading idea database, and live biweekly strategy webinars. ?Upgrade to?Mad Hedge Fund Trader PRO?and you will also receive Jim Parker?s?Mad Day Trader?service.

To subscribe, please go to my website at www.madhedgefundtrader.com, find the ?Global Trading Dispatch? box on the right, and click on the blue ?SUBSCRIBE NOW? button.

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.