While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points.

Global Market Comments

February 26, 2014

Fiat Lux

Featured Trade:

(FRIDAY APRIL 4 INCLINE VILLAGE, NEVADA STRATEGY LUNCHEON),

(ANOTHER HOME RUN WITH NATURAL GAS),

(UNG), (DGAZ), (UNL),

(GET READY FOR YOUR NEXT BIG TAX HIT)

United States Natural Gas (UNG)

VelocityShares 3x Inv Natural Gas ETN (DGAZ)

United States 12 Month Natural Gas (UNL)

It looks like I hit the nail on the head once again with a major short position in the United States Natural Gas Fund (UNG).

After my followers bought the July, 2014 $26 puts at $2.16 on Monday, the (UNG) suffered its worst trading day since 2007, the underlying commodity plunging a breathtaking 11%. The puts roared as high as $3.05, a gain of 42% in mere hours. I wish they were all this easy!

If the (UNG) returns to the February low of $22.50 in the near future, you can expect these puts to soar to $5.00. That?s an increase of 130%, and would add 6.53% to our 2014 performance. Please pray for warmer weather, and dance your best weather dance.

It took a perfect storm of technical and fundamental factors to trigger this Armageddon for owners of the troubled CH4 molecule. One of the coldest winters in history produced unprecedented demand for natural gas.

This happened against a backdrop of a long term structural conversion from coal and oil fired electric power plants to gas. Not only is natural gas far cheaper than these traditional carbon based fuels, burning it generates half the carbon dioxide and none of the other toxic pollutants.

The result for traders was one of the boldest short squeezes in history. The incredibly $6.50 Monday opening we saw in natural gas, and the $28 print for the (UNG) was purely the result of distressed margin calls and panic stop loss covering.

At one point, the February natural gas futures, set to expire in just two days, were trading at a 40% premium to the March futures. Extreme anomalies like this are always the father of great trades.

The extent of the industry short position is evident in the cash flows in the underlying exchange traded notes (ETN?s). As prices rose, the long only (UNG) saw $366 million in redemptions, about 36% of its total assets. The Natural Gas Fund (UNL) has lost more than a third of its capital.

On the flip side, the Velocity Shares 3X Inverse Natural Gas Fund (DGAZ) pulled in some $449 million in new investors. Since the rally in natural gas started in November (DGAZ) has cratered from $18 to $2.5. This is why I never recommend 3X leveraged ETF?s.

This all adds currency to my argument that the natural gas revolution is bringing the greatest structural change to the US economy in a century. The industry is evolving so fast that you can expect dislocations and disruptions to continue.

The current infrastructure reflects the state of the market a decade ago and is woefully inadequate, with a severe pipeline shortage evident.? Gas demand is greatest where supplies aren?t. Infrastructure needed to export CH4 abroad is still under construction (see my piece on Chenier Energy (LNG) by clicking here).

The state of North Dakota estimates that it is losing $1 million a day in tax revenue because excess natural gas is being flared at fracking wells for want of transportation precisely when massive short squeezes are occurring in the marketplace. Needless to say, this is all a dream come true for astute and nimble traders, like you.

The question is now what to do about it.

I just called friends around the country, and it appears that a warming trend is in place that could last all the away into March.

It is time to get clever. It would be wise to enter a limit day order to sell your $26 puts right now at the $5.00 price. Since the first visit to these lower numbers usually happens on a big downside spike, the result of stop loss dumping of panic longs accumulated by clueless short term traders this week, you might get lucky and get filled on the first run.

These happen so fast that it will make your head spin, and you won?t be able to type an order in fast enough. If you don?t get filled keep reentering the limit order every day until it does get done, or until we change our strategy.

This has been one of my best trades in years, and it appears that a lot of followers managed to successfully grab the tiger by the tail.

Good for you.

Now We?re Cooking with Gas

Now We?re Cooking with Gas

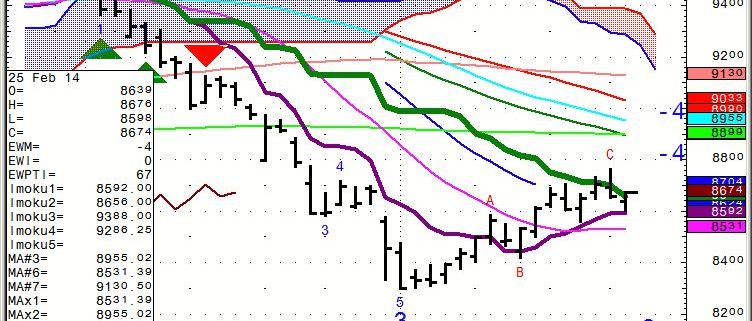

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points.

Come join me for lunch at the Mad Hedge Fund Trader?s Global Strategy Update, which I will be conducting in Incline Village, Nevada on Friday, April 4, 2014. An excellent meal will be followed by a wide ranging discussion and an extended question and answer period.

I?ll be giving you my up to date view on stocks, bonds, currencies, commodities, precious metals, and real estate. And to keep you in suspense, I?ll be throwing a few surprises out there too. Tickets are available for $198.

I?ll be arriving at 11:30 and leaving late in case anyone wants to have a one on one discussion, or just sit around and chew the fat about the financial markets.

The lunch will be held at the premier restaurant in Incline Village, Nevada on the sparkling shores of Lake Tahoe. The precise location will be emailed with your purchase confirmation.

I look forward to meeting you, and thank you for supporting my research.

[button size="large" color=(blue) link="http://madhedgefundradio.com/?p=28652"]Order Luncheon Tickets[/button]

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points.

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points.

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points.

Global Market Comments

February 25, 2014

Fiat Lux

Featured Trade:

(IM BACK FROM THE LAND DOWN UNDER),

(FEBRUARY 26 GLOBAL STRATEGY WEBINAR),

(MAD HEDGE FUND TRADER LEAPS AHEAD WITH A 9.31% 2014 RETURN),

?(UNG), (BAC)

(BUDGET CUTS HIT THE WILD ANIMAL MAKET)

United States Natural Gas (UNG)

Bank of America Corporation (BAC)

I?m half mad with jet lag, and I haven?t pooped in three days. But I?m back from the magical Land Down Under.

It was another one of those incredible, once in a lifetime, bucket list type trips. The highlight was flying my own plane out to a small speck of a coral island 40 miles at sea in the Great Barrier Reef National Park.

There I spotted electric blue starfish, snapping moray eels, a pod of dolphins, rode the back of a giant sea turtle, and swam with giant manta rays and reef sharks. Strangely, I felt right at home with the sharks, perhaps a byproduct of my day job?

I planned to ease my way back into the market, waiting for the next sweet spot to get my feet wet. But what did I get? Natural gas (UNG) opened on a spike at $28. To quote William Shakespeare, ?They must be out of their F?? mind.? Out went the Trade Alert to buy the July puts, this time at the $26 strike. They promptly obliged by rocketing 20% in value in hours, adding an immediate 100 basis points to our performance this year, taking me to yet another new performance all time high. Well, maybe Shakespeare really didn?t say that, but I did.

I followed up with another aggressive long in Bank of America (BAC). After that, a denial of service attack took down our email distribution provider, so that was it for the day. Welcome back to the fast lane.

I will write at greater length in the near future about my adventures in the Antipodes, of which there were many. Until then, I will be working with Mad Day Trader, Jim Parker, on the Wednesday strategy webinar. Suffice it to say that I am now singing Waltzing Matilda in the shower every morning.

Wine Tasting in New Zealand

Wine Tasting in New Zealand

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.