The red hot performance of the Mad Hedge Fund Trader?s Trade Alert Service has maintained its blistering pace from last year, picking up another 9.31% profit in the first seven trading weeks of 2014.

The Dow Average was down 2.3% during the same period, pegging my outperformance of the index at a stunning 11.6%. Since the beginning of 2013, I am up 76.8%. 2013 closed with a total return for followers of 67.45%.

The three-year return is now an eye popping 131.8%, compared to a far more modest increase for the Dow Average during the same period of only 36%. That brings my averaged annualized return up to 41.7%.

This has been the profit since my groundbreaking trade mentoring service was launched in 2010. It all is a matter of the harder I work, the luckier I get.

The hot streak continues.

The smartest thing I did in the past year was to let all of my options expire on January 15, and then moved to an 80% cash position. That spared me the angst, the soul searching, and the sleepless night caused by the 10% correction that followed in the Dow Average.

This set me up to cherry pick the most extreme market moves. But this time was different. Instead of returning to call spreads, I adopted an outright put option strategy.

This paved the way for me to pick up highly leveraged short positions in Treasury bonds and natural gas, while risking only 5% of my capital with each. Don?t people know that polar vortexes only come in pairs? I guess no one studies physics anymore. When the markets broke, a sharp rise in volatility also contributed to the P&L.

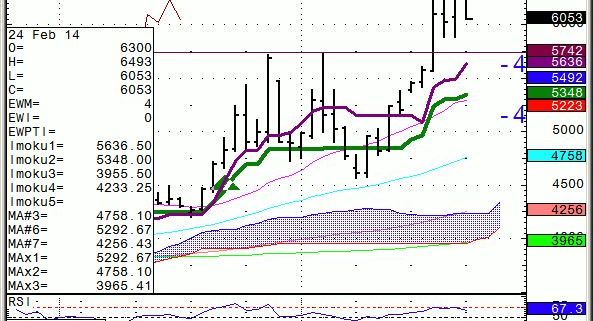

My esteemed colleague, Mad Day Trader Jim Parker, was no small part of this success. Since the market became technically and momentum driven, I have been confirming with him before sending out every Trade Alert. Together, out success rate is 100%.

What would you expect with a combined 85 years of market experience between the two of us? Followers are laughing all the way to the bank.

Don?t forget that Jim clocked an amazing 2013 of a staggering 374%. That is just for an eight-month year! Followers are laughing all the way to the bank.

The coming year promises to deliver a harvest of new trading opportunities. The big driver will be a global synchronized recovery that promises to drive markets into the stratosphere in 2014.

The Trade Alerts should be coming hot and heavy. Please join me on the gravy train. You will never get a better chance than this to make money for your personal account.

Global Trading Dispatch, my highly innovative and successful trade-mentoring program, earned a net return for readers of 40.17% in 2011, 14.87% in 2012, and 67.45% in 2013.

The service includes my?Trade Alert Service?and my daily newsletter, the Diary of a Mad Hedge Fund Trader. You also get a real-time trading portfolio, an enormous trading idea database, and live biweekly strategy webinars.? Upgrade to?Mad Hedge Fund Trader PRO?and you will also receive Jim Parker?s?Mad Day Trader?service.

To subscribe, please go to my website at www.madhedgefundtrader.com, find the ?Global Trading Dispatch? box on the right, and click on the blue ?SUBSCRIBE NOW? button.