Long-term readers of this letter are well aware of my antipathy towards General Motors (GM). For decades, the company turned a deaf ear to customer complaints about shoddy, uncompetitive products, arcane management practices, entitled dealers, and a totally inward looking view of the world that was rapidly globalizing. It was like watching a close friend kill himself through chronic alcoholism.

During this time, Japan?s share of the US car market rose from 1% to 42%. The only surprise when the inevitable bankruptcy came was that it took so long. This was traumatic for me personally, since for the first 30 years of my life General Motors was the largest company in the world. Their elegant headquarters building in Detroit was widely viewed as the high temple of capitalism. I was raised to believe that what was good for GM was good for the country. Oops!

I opposed the bailout because it interfered with creative destruction, something America does better than anyone else, and gives us a huge competitive advantage in the international marketplace. Probably 10% of the listed companies in Japan are zombies that should have been killed off 20 years ago. Without GM a large part of the US car industry would have moved to California and gone hybrid or electric.

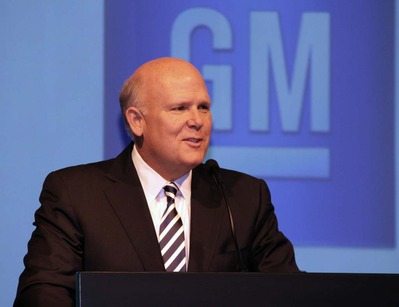

When an opportunity arose to spend a few hours with the new CEO, Dan Akerson, I gratefully accepted. After all, he wasn?t responsible for past sins, and I thought I might gain some insights into the new GM. Besides, he was a native of the Golden State and a graduate in nuclear engineering from the Naval Academy at Annapolis and the London School of Economics. How bad could he be?

When I shook hands, I remarked that his lapel pin looked like the hood ornament on my dad?s old car, a Buick or Oldsmobile. He noticeably winced. So to give the guy a break, I asked him about the company?s outlook.

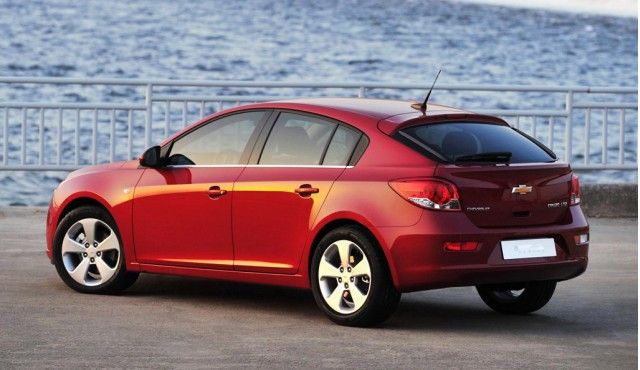

It was the best in the 104-year history of the company. It is now the world?s largest car company, with the biggest market share. The 40-mpg Chevy Cruze is the number one selling sub compact in the US. GM competed in no less than 117 countries, and was a leader in the fastest growing emerging market, China.

I asked how a private equity guy from the Carlyle Group was fitting in on the GM board. He responded that all of the Big Three Detroit automakers were being run by ?non-car guys? now, and they generated profits for the first time in 20 years. However, it was not without its culture clashes. When he publicly admitted that he believed in global warming, he was severely chastised by other board members. He wasn?t following the official playbook.

When I started carping about the bailout, he cut me right off at the knees. Liquidation would have been a deathblow for the Midwestern economy, killing 1 million jobs, and saddling the government with $23 billion in pension fund obligations. It also would have deprived the Treasury Department of $135 billion in annual tax revenues. It was inevitable that in the last election year the company became a political punching bag. Akerson said that he was still a Republican, but just.

GM was now selling 1,000 Chevy Volts a month. The cars are so efficient, running off a 16kWh lithium ion battery charge for the first 25-50 miles that many are still driving around with the original tank of gas they were delivered with a year ago. Extreme crash testing by the government and the bad press that followed forced a relaunch of the brand. Despite this, I often get emails from readers saying they love the car.

The summer production halt says more about GM?s more efficient inventory management than it does about the hybrid car. GM?s recent investment in California based Envia Systems should succeed in increasing battery energy densities threefold (click here for the website http://enviasystems.com/announcement/).

However the Volt is just a bridge technology to the Holy Grail, hydrogen fuel cell powered cars, which will start to go mainstream in four years. These cars burn hydrogen, emit water, and cost about $300,000 a unit to produce now. By 2017, GM hopes to make it available as a $30,000 option for the Chevy Aveo.

Another bridge technology will be natural gas powered conventional piston engines. These take advantage of the new glut of this simple molecule and its 85% price discount per BTU compared to gasoline. The company announced a dual gas tank pickup truck that can use either gasoline or compressed gas. Cheap compressors that enable home gas refueling are also on the horizon. Fleet sales will be the initial target.

Massive overcapacity in Europe will continue to be a huge headache for the global industry. There are just too many carmakers there, with Germany, England, Italy, France, and Sweden each carrying multiple manufacturers. Governments would rather bail them out to save jobs and protect entrenched unions than allow market forces to work their magic. GM lost $700 million on its European operations last year, and Akerson doesn?t see that improving now that the continent is clearly moving into recession.

Akerson said that a cultural change had been crucial in the revival of the new GM. Last year, the Feds announced an increase in mileage standards from 25 to 55 mpg by 2025. Instead of lawyering up for a prolonged fight to dilute or eliminate the new rules, as it might have done in the past, it is working with the appropriate agencies to meet these targets.

Finally, I asked Akerson what went through his head when the top job at GM was offered him at the height of the crisis. Were they crazy, insane, delusional, or all the above? He confessed that it offered him the management challenge of a generation and that he had to rise to it.

Spoken like a true Annapolis man.

Shifting GM from This?.

To This?.

And This