Feed the ducks while they are quacking. That is one of the oldest nostrums heard on Wall Street, and feed them they have, to the point of absolute gluttony.

This year we have seen the market for new initial public offerings for newly listed companies explode to life. There have been 46 so far in 2014, some 26 from the biotechnology area alone. Last Friday, there were an astounding seven in one day. When the demand is there, investment bankers are more than happy to run the printing presses overtime to meet it, creating new stock as fast as they can.

This morning saw the debut of King Digital Entertainment (KING), maker of the kid?s digital game ?Candy Crush?. Much to the chagrin of the bankers and the existing shareholders, the stock immediately traded down -10%. You know that when you see huge, dancing lollypops on the floor of the New York Stock Exchange, it is time to get out of the market, post haste.

It all seems frighteningly familiar, like d?j? vu all over again. The last time things were this hot was in April of 2000. Then, an onslaught of IPO?s put in the top for NASDAQ, igniting the great Dotcom crash. Share prices have yet to recover those heady levels a decade and a half later.

Looking at the quality and quantity of the new companies being floated, with minimal earnings, sky high multiples, and market capitalizations in the tens of billions of dollars, a similar outcome is assured. Wall Street never fails to kill the golden goose. There is no limit on greed.

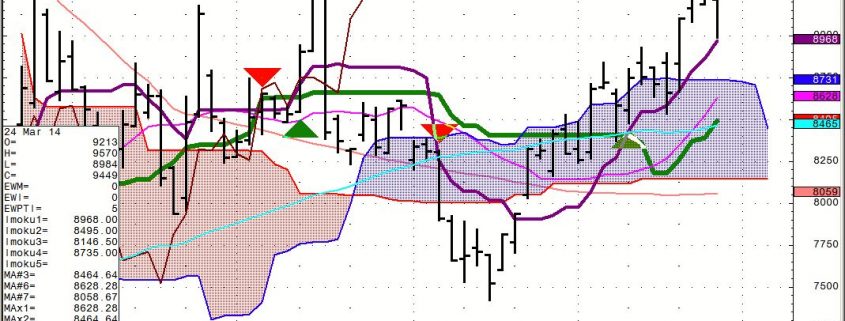

As a result, the IPO market is threatening to take the main market down with it. The number of short-term indicators that I am seeing roll over and die is nothing less than astounding. At the very least, I think we are in for the kind of 5%-7% correction of the sort that we saw in January and February. I?ll give you two big ones.

The scary tell here is the strength of the bond market (TLT), which just broke out to a new seven-month high. Today?s Treasury five-year bond auction went like a house on fire. Stocks and bonds rarely go up in unison, and bonds usually end up being right.

Another is the elevating bottom in the volatility Index (VIX). During November and December, the (VIX) put in rock solid bottoms at the $12 level. After the January dump, the support rose to $14. This means that investors are now more nervous, willing to pay a premium for downside protection, and intend to unload shares at the first sign of trouble. As much fun as rising bottoms can be, you never want to see them in volatility if you own stocks.

The only question is whether they can hold the market up until Friday, March 28, the month end on Monday, March 31, or the new start to the quarter on Tuesday, April 1.

So how best to participate in the coming debacle? Cut back any leveraged long positions that you have. If you want to keep your stocks for tax or other reasons, then write front month call options against them, known as ?buy writes.?

Use the good days to lay on positions in long dated put options for the S&P 500 (SPY), the NASDAQ (QQQ), and the Russell 2000 (IWM). Long dating heads off the time decay problem, reducing the volatility of your position, and helps preserve capital.

Traders can also buy volatility through the iPath S&P 500 VIX Short Term Futures ETN (VXX), an exchange traded note, which rises when stocks fall.

The set up here for the iPath S&P 500 VIX Short Term Futures ETN (VXX) is a no brainer. If we get the modest weakness that we saw in early March, the (VXX) should rise 10% from current levels to the $48 handle. If we get a January replay, that is worth 20% for the (VXX), potentially boosting it to $55. If we finally get the long overdue 10% correction, the (VXX) should rocket by 30% or more.

If the selloff decides to wait a few more days or weeks you can afford to be patient. Since this is an ETN, and not an option play, a flat lining or rising market isn?t going to cost you much money. The February low in the (VXX) at $42.25 looks pretty safe to me in a rising volatility environment. A revisit would only cost us pennies.

Take your pick, but all paths seam to lead skyward for the (VXX), sooner or later.