While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

December 10, 2014

Fiat Lux

Featured Trade:

(UPDATE ON LINN ENERGY), (LINE),

(THE MYSTERY OF THE MISSING $100 BILLION), (TLT),

(MY FAVORITE SECRET ECONOMIC INDICATOR)

Linn Energy, LLC (LINE)

iShares 20+ Year Treasury Bond (TLT)

After the catastrophic 25% fall in the units of Linn Energy (LINE) over the past three days, I thought I?d better take another look at the company. The company?s units have now crashed by an eye popping 55% since the May $31 high.

The units have been trading as if the company is imminently going bankrupt. The contradiction is that it clearly isn?t. This is basically a healthy company that is undergoing some volatility typical for the sector.

Is this logical or rational?

No, not at all. But when a real panic hits, you sell first, and ask questions later. That has clearly been happening in the oil patch for the past month.

At the $14 low on Monday, the units were yielding a spectacular 20.7% annualized. This is not some imaginary pie in the sky estimate. This is what the actual $0.24 monthly cash payout announced by the company as recently as December 1 works out to for holders of record as of Thursday, December 11.

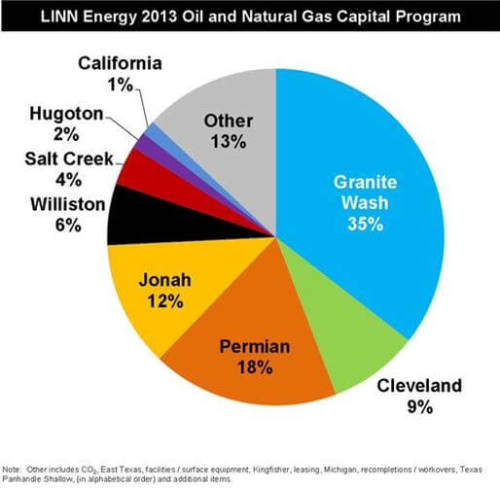

Nor are these spectacular yields based on some wild leveraged bets in the financial markets. (LINE) is predominantly a natural gas company, a commodity which has seen its price go largely unchanged for the past two years, hovering above $3.50. And much of its production has already been hedged against any downside risk with offsetting positions in the futures market.

I always try to use every loss as a learning opportunity, or the lesson goes wasted, and is doomed to repetition.

The reasons above were why I shot out a quick Trade Alert last week to buy (LINN) at $16.67. It was an uncharacteristically cautious position for me. But calling bottoms in major trends is always a risky enterprise, so I went small, very small. I bought the underlying units, not the options, and then in unleveraged form.

Initially things went great, rocketing 13% right out the door. Short term, smart traders, like Mad Day Trader Jim Parker, then put in tight stop losses below. That way, he was playing with the house?s money in any further upside, and is assured against loss during any rapid reversal.

I, unfortunately was too slow to do so, and had to bear the cost of the sudden 25% drop. Remember, being right 80% of the time means that I am wrong 20% of the time. But with only a 10% position, my loss never exceeded 1.60% of my total portfolio, something I can live with, and ride out until any recovery.

My guess is that many (LINE) holders violated my ?Sleep at night rule,? lured by the hefty dividend payout into owning too many units.

Once burned, twice forewarned.

My advice to you now is ?Hang on.? You?ve already taken the hit. Don?t bail here and miss the recovery, which will probably begin in earnest next year.

Now you see it, now you don?t.

That was the question observers of international monetary flows were asking after last week?s data release from the Federal Reserve. These showed that some $104.5 billion in Treasury securities held in custody accounts were withdrawn.

It doesn?t mean that these bonds were sold. You certainly would have noticed this in the Treasury market, where a liquidation of this size could have moved prices down and yields up as much as 20 basis points. In fact prices went up and yields down during the week in question.

They were simply transferred from one custodian to another. Why this matters in an age when securities are only issued in electronic, not physical form, is beyond my pay grade.

Of course, all fingers pointed to Russia, who was thought to have made the move to avoid coming economic sanctions in the wake of their annexation of Crimea. The sanctions did come, but were primarily imposed on the oligarchs, not on governmental institutions, as a way of singling out Vladimir Putin?s political and financial backers.

Do the oligarchs own this much US government paper? Probably.

The Russians have valid concerns. The United States has seized more sovereign assets than any other country in history.

It did so against Japan and Italy, and Germany twice during WWI and WWII. Few know this, but the Bayer Company of aspirin fame in the US, is separate from Bayer in Germany, the former seized by the US and sold off as an alien asset during the Second World War. Today, the US is sitting on $100 billion worth of Iranian assets.

In the global scheme of things, this is not that big of a deal. Russia ranks only 11th among foreign holders of Treasury debt, with $139 billion, far behind China ($1.26 trillion) and Japan ($1.18 trillion). The great irony in these numbers is that they show that if the US wants to protect anyone from a Chinese attack, they have to borrow money from China to do it.

This could be part of a broader trend of cash rich countries withdrawing their savings from the US. Much was made of this when Germany asked for the return of the bulk of its gold bullion holdings held by the Federal Reserve Bank of New York at 33 Liberty Street, NY, NY last year (former Treasury Secretary Tim Geithner?s old hang out).

I?ve been in that vault. There, behind steel bars, are dozens of pallets piled high with 100 ounce gold bars, each labeled with the country of ownership. When gold reserves are transferred from country to country, they are simply carried (with white gloves to avoid friction) from one pallet to the next.

This has been the fuel for endless conspiracy theories on the internet, which over the years anticipated a dollar crash, a default of the US government, a takeover by the Trilateral Commission, or a complete collapse of the global financial system.

The reality is a little more mundane. The Fed took deposit of European gold reserves after WWII in case The Russian Army overran Western Europe. In the end, they didn?t. We had nukes, and they had none.

However, given the machinations of Putin in Crimea in recent weeks, the Germans might think about sending their gold bullion back to the New York Fed, post haste.

Now Who Do These Belong To?

Now Who Do These Belong To?

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.