While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points.

Global Market Comments

June 2, 2014

Fiat Lux

Featured Trade:

(MAD HEDGE FUND TRADER PUNCHES THROUGH TO NEW ALL TIME HIGH),

(AAPL), (GOOG), (TLT), (FXY),

(JUNE 17 NEW YORK STRATEGY LUNCHEON),

(TESTIMONIAL)

Apple Inc. (AAPL)

Google Inc. (GOOG)

iShares 20+ Year Treasury Bond (TLT)

CurrencyShares Japanese Yen Trust (FXY)

The industry beating performance of the Mad Hedge Fund Trader?s Trade Alert Service has finally punched through to a new all time high for the first time in seven weeks.

The total return for my followers so far in 2014 has reached 15.50%, compared to a feeble 1.3% for the Dow Average during the same period. May alone is up a blistering 4.61%.

I managed to pull this off during some of the most difficult trading conditions in market history. Turnover across all asset classes is hitting decade lows (see chart below), and volatility has crashed through the floor.

The three and a half year return is now at an amazing 138%, compared to a far more modest increase for the Dow Average during the same period of only 34%.

That brings my averaged annualized return up to 39.40%. Not bad in this zero interest rate world. It appears better to reach for capital gains than the paltry yields out there.

This has been the profit since my groundbreaking trade mentoring service was first launched in 2010. Thousands of followers now earn a full time living solely from my Trade Alerts, a development of which I am immensely proud of.

Like most of the industry, I expected May to be a poor month for risk assets. The market has had a tremendous run over the last two years, and the spring historically heralds a period of seasonal weakness.

It was not to be.

One of the toughest things to do in this business is to admit you?re wrong, and then execute an immediate risk reversal in your portfolio.

In the end, the failure of the market to fall meant that it could only go up. We got additional help from month end window dressing, calming events in the Ukraine, and an imminent 7:1 share split at Apple. A massive short squeeze in the Treasury bond market added further fuel to the fire.

That?s all I needed to pile into long positions in Apple (AAPL) and Google (GOOG), and short positions in the Japanese yen (FXY) and the Treasury bond market (TLT). Every Trade Alert I sent out to readers turned immediately profitable.

Quite a few followers were able to move fast enough to cash in on the move. To read the plaudits yourself, please go to my Testimonials page. They are all real, and new ones come in almost every day.

My esteemed colleague, Mad Day Trader Jim Parker, was no small part of this success. Since the market became technically and momentum driven, I have been confirming with him before sending out every Trade Alert. Together, our success rate is 100%.

What would you expect with a combined 85 years of market experience between the two of us? Followers are laughing all the way to the bank.

Don?t forget that Jim clocked an amazing 2013 with a staggering 374% trading profit. That was just for an eight-month year!

The Opening Bell With Jim Parker, a quickie webinar giving followers an instant snapshot of the market opening every day, has been an overwhelming success. Many customers have already reported dramatic improvements in their trading results.

Watch this space, because the crack team at Mad Hedge Fund Trader has more new products and services cooking in the oven. You?ll hear about them as soon as they are out of beta testing. Our business is booming, so I am plowing profits back in to enhance our added value for you.

The coming year promises to deliver a harvest of new trading opportunities. The big driver will be a global synchronized recovery that promises to drive markets into the stratosphere by the end of 2014.

Global Trading Dispatch, my highly innovative and successful trade-mentoring program, earned a net return for readers of 40.17% in 2011, 14.87% in 2012, and 67.45% in 2013.

Our flagship product, Mad Hedge Fund Trader PRO, costs $4,500 a year. It includes my Global Trading Dispatch, my trade alert service and daily newsletter. You get a real-time trading portfolio, an enormous research database, and live biweekly strategy webinars. You also get Jim Parker?s Mad Day Trader service and The Opening Bell with Jim Parker.

To subscribe, please go to my website at www.madhedgefundtrader.com, find the ?Global Trading Dispatch? or ?Mad Hedge Fund Trader PRO? box on the right, and click on the blue ?SUBSCRIBE NOW? button.

The Gunslinger For Hire

The Gunslinger For Hire

Come join Mad Day Trader Jim Parker and I for lunch at the Mad Hedge Fund Trader?s Global Strategy Luncheon, which we will be conducting in New York, NY on Tuesday, June 17, 2014. An excellent three course lunch will be provided. A PowerPoint presentation will be followed by an extended question and answer period.

I?ll be giving you my up to date view on stocks, bonds, foreign currencies, commodities, precious metals, and real estate. And to keep you in suspense, I?ll be throwing a few surprises out there too. Enough charts, tables, graphs, and statistics will be thrown at you to keep your ears ringing for a week. Tickets are available for $248.

The formal luncheon will run from 12:00 to 2:00 PM. I?ll be arriving an hour early and leaving late in case anyone wants to have a one on one discussion, or just sit around and chew the fat about the financial markets.

The event will be held at a prestigious private club on Central Park South, the details of which will be emailed to you with your purchase confirmation.

I look forward to meeting you, and thank you for supporting my research. To purchase tickets for the luncheons, please go to my online store.

Jim's new Opening Bell feature provides exactly what I was looking for:

greater clarity on what to look for each day, including insights into longer-term patterns when he sees them. Bravo!

So based on this excellent addition alone, I'd like to renew my subscription for my PRO subscription. I'm visiting the site now and re-upping.

Best to John and Jim for the best financial advisory service in the world...and for "re-upping" their own efforts to make it more helpful and profitable than ever. No way I want to go forward in these unpredictable markets without these two stars on my team.

All good wishes,

Gary B.

Long Island, New York

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points.

Global Market Comments

May 30, 2014

Fiat Lux

Featured Trade:

(JUNE 4 GLOBAL STRATEGY WEBINAR),

(JULY 18 BARCELONA, SPAIN STRATEGY LUNCHEON)

(WHY I?M SELLING SHORT TREASURY BONDS),

(TLT), (TBT), (SPY), (VIX), (VXX)

iShares 20+ Year Treasury Bond (TLT)

ProShares UltraShort 20+ Year Treasury (TBT)

SPDR S&P 500 (SPY)

VOLATILITY S&P 500 (^VIX)

iPath S&P 500 VIX ST Futures ETN (VXX)

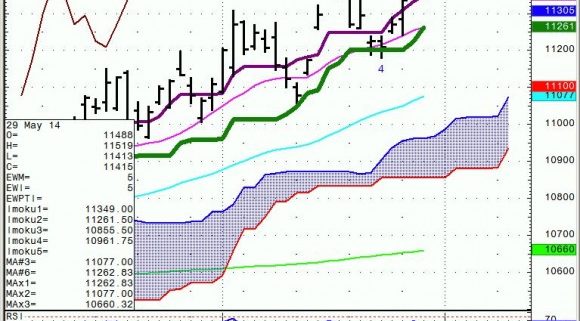

This has really been one of those incredible, jaw dropping, knock your socks off kind of years. It seems like every asset class is doing exactly the opposite of what it should do.

A slowing economy delivered a huge move up in bonds, which is fine. The extent of the damage the harsh winter wrought on the economy was confirmed this morning, with a full one-point drop in Q1 GDP. But does this mean that stocks should go to all time highs as well?

Look at the volatility index, (VIX) (VXX), which is also sitting at multiyear lows. You would expect it to rise as we go into a traditional ?RISK OFF? season. It does truly seem that this time it?s different.

That is, until they are not different anymore. I believe that after five months of markets that are unpredictable, extraordinary, and difficult to trade, they are about to become predictable, ordinary, and easier to trade.

What does that mean for you and me? Buy stocks and sell bonds. We are about to shift from a reach for yield world to one where investors are reaching for capital gains. There isn?t much yield to reach for anyway.

We?ve just had a four point run in the latest leg up in the incredible bull market in bonds. So I am strapping on here the iShares Barclay 20+ Year Treasury Bond Fund (TLT) July, 2014 $118-$121 in-the-money bear put spread (see yesterday?s Trade Alert).

We could be in for some month end profit taking. The upper $118 strike works out to a ten year Treasury bond yield of 2.27%. The breakeven point in yield terms goes all the way down to 2.24%.

As long as yields stay above that by the July 18 expiration, we will keep the entire profit on this trade, a gain of some 1.76% for your total portfolio. Better yet, get a three point dip anywhere along the way, and we will immediately reap 75% of the potential profit, as we did with our last (TLT) bear put spread.

Sounds like a no brainer to me.

I think this week flushed out a lot of the hotter short-term money from the market in the humongous short squeeze that I warned you was coming. Positioning is now flatter. It is now time to digest.

Mad Day Trader Jim Parker also thinks we could be in for a major trend reversal with next week?s Friday nonfarm payroll report. Bonds rallied on the last six consecutive reports. This time they may disappoint, as bond prices are at such nosebleed levels. We could be setting up for a big ?buy the rumor, sell the news? move here in bonds.

In the meantime, the (TLT) could rise as much as a point higher to $116. That still gives me plenty of breathing room with this new position, which has a breakeven point at $118.45. That sounds like a pretty good bet, now that we are headed into the slower summer months.

For us to lose money on this trade, the world would have to end first, at which point we won?t care about our trading books.

For those who don?t have options coursing through their veins, please buy the ProShares UltraShort 20+ Year Treasury ETF (TBT), a 2X short Treasury bond fund.

As for stocks, it is looking like we are just completing a five month long ?time? correction. The ?price? correction never extended beyond 6%. We are about to enter nine months of increasingly positive economic data, as most of the growth lost in Q1 gets rolled forward to Q2, Q3, and Q4. That should take the S&P 500 (SPX) up to 2,100 by year-end.

In the meantime, the Mad Hedge Fund Trader?s Trade Alert service is now up 15.3% on the year, and is inches from a new all time high. Watch this space.

It?s Really Been One of Those Kinds of Years

It?s Really Been One of Those Kinds of Years

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. This is your chance to ?look over? John Thomas? shoulder as he gives you unparalleled insight on major world financial trends BEFORE they happen.

Further Update to: Trade Alert -(TLT)

Buy the iShares Barclay 20+ Year Treasury Bond Fund (TLT) July, 2014 $118-$121 in-the-money bear put spread at $2.55 or best

Opening Trade

5-29-2013

expiration date: July 18, 2014

Portfolio weighting: 10%

Number of Contracts = 39 contracts

We?ve just had a four point run in the latest leg up in the incredible bull market in bonds. We could be in for some month end profit taking. The upper $118 strike works out to a 10 Year Treasury Bond yield of 2.27%.

As long as yields stay above that by the July 18 expiration, we will keep the entire profit on this trade. Better yet, get a three point dip anywhere along the way and we will immediately reap 75% of the profit, as we did with our last (TLT) bear put spread.

I think this week flushed out a lot of the hotter short term money from the market in the humongous short squeeze that I warned you about. Positioning is now flatter. Mad Day Trader Jim Parker also thinks we could be in for a major trend reversal with next week?s Friday nonfarm payroll report.

In the meantime, the (TLT) could rise as much as a point higher to $116. That still gives me plenty of breathing room with this position, which has a breakeven point at $118.45, or a ten year Treasury yield of 2.25%. That sounds like a pretty good bet for me, now that we are headed into the slower summer months.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep in-the-money spread trades can be enormous. Don?t execute the legs individually or you will end up losing much of your profit.

Keep in mind that these are ballpark prices only. Spread pricing can be very volatile on expiration months farther out.

Here are the specific trades you need to execute this position:

Buy 39 July, 2014 (TLT) $121 puts at?????$6.90

Sell short 39 July, 2014 (TLT) $118 puts at..??.$4.35

Net Cost:??????????????????.....$2.55

Potential Profit: $3.00 - $2.55 = $0.45

(39 X 100 X $0.45) = $1,755 or 1.76% profit for the notional $100,000 portfolio.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.