While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

February 10, 2015

Fiat Lux

Featured Trade:

(WHY THE JANUARY NONFARM PAYROLL WAS A BIG DEAL),

(IWM), (DXJ), (HEDJ), (FXE), (FXY),

(THE BIPOLAR ECONOMY),

(TESTIMONIAL)

iShares Russell 2000 (IWM)

WisdomTree Japan Hedged Equity ETF (DXJ)

WisdomTree Europe Hedged Equity ETF (HEDJ)

CurrencyShares Euro ETF (FXE)

CurrencyShares Japanese Yen ETF (FXY)

Economists were blown away by the January nonfarm payroll numbers, announced on Friday.

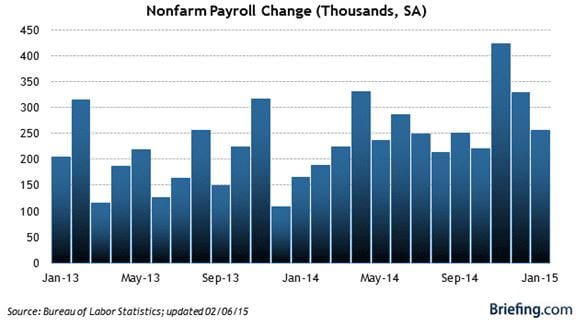

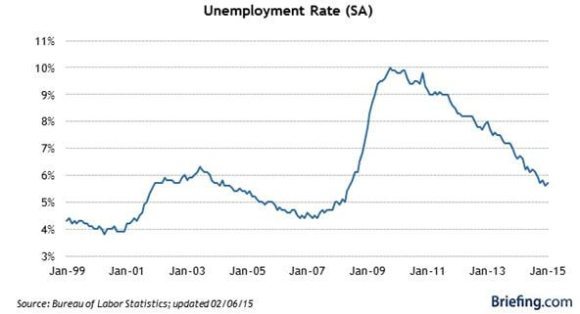

Some 257,000 jobs were added the previous month, holding the headline unemployment figure at 5.7%. Far more important were the revisions for earlier months, which saw December increased to a robust 329,000 and November bumped up to a breathtaking 423,000.

These numbers are almost back to ?normal.? Are ?normal? interest rates to follow?

All told, the January report, the revisions and the additions to the work force means that 703,000 jobs were added to the economy, taking the year on year increase to a positively boom time 3 million. The last quarter has seen the fastest jobs growth rate since 1997. Yikes!

A major part of the new jobs were in retail, proof that our windfall tax cut in the form of falling gasoline prices is finally kicking in.

Needless to say, this is all a bit of a game changer.

It totally vindicates the high-end forecasts for the US economy of 3% plus I made in my New Year forecasts (click here for my ?2015 Annual Asset Class Review?).

The data confirms my thesis that investors are substantially underestimating the strength of the US economy. Furthermore, they have yet to understand the enormously positive impact of cheap energy prices.

It also means that the bull market in stocks is alive and well. It is only resting.

To understand why, let me highlight the major points brought to the fore by the Bureau of Labor Statistics report.

1) The US Economy Has Entered a Self Sustaining Recovery

The trend line for many economic data points are now moving so convincingly upward that they can no longer be treated as statistical anomalies. Nor can they be ascribed to temporary artificial overstimulation by the Federal Reserve in the form of quantitative easing.

Count on Treasury Secretary, Jack Lew, to announce ?mission accomplished? when he address congress later on this week (click here for my one-on-one with Jack, ?Riding With the Treasury Secretary?).

My bet is that this is not our last blockbuster revision. Next to come will be the Q4 GDP, from the just reported flaccid 2.6% annual rate back towards the red hot 5% seen in Q3.

2) The Date for the Next Fed Rate Hike has Been Moved Up

The bond market certainly believed this last week, giving up 9 full points in a couple of days, taking yields from 2.62% to 2.92% in a heartbeat.

I still think this is a 2016 story. The pernicious effects of deflation are still advancing, not retreating, and are not exactly an argument for raising interest rates. But there is no doubt that the desire among the Fed governors to return rates to normal levels is growing, especially if the impact on the economy will be minimal. So call the next rate rise an early, rather than a later, 2016 eventuality.

3) The Strong Dollar is Becoming a Factor With Earnings

The Euro (FXE) has depreciated 31% against the dollar from its 2008 peak, and the yen (FXY) 38% from its 2011 apex. Yet the impact on corporate earnings so far has been marginal at best.

Where will it really start to hurt?

When these currencies approach my final targets of 87 cents and 150, or down another 22% and 18%. It is safe to say that a strong dollar will command an increasing amount of our attention going forward.

This is the argument for investing in small cap US stocks (IWM), where the currency exposure is minimal. Hedge European (HEDJ) and Japanese (DXJ) stocks start to look pretty good too.

4) Wages May Finally Be Rising

The biggest structural impediment facing the US economy has been wage inequality, where virtually all of the benefits of growth accrue to the risk investors of the 1% at the expense of the working class. Hyper accelerating technology and dreadfully imbalanced tax policies are to blame.

January brought us an increase in wages that was miniscule, incremental and modest at best, but it was an increase nonetheless. Average hourly earnings fell by 5 cents in December and then rose by 12 cents the following month.

If this continues, consumer spending will see a big revival, giving us yet another leg to a rising stock market, and creating a win-win situation for all.

One can only hope.

5) More Americans Are Looking for Work

The really amazing thing about the January numbers that they occurred in the face of a large increase in the work force. The participation rate, which has been plummeting for a decade, rose smartly. Long-term U-6 unemployment stayed high, but is down a quarter from peak levels.

To me, this is all a warm up for my ?Golden Age? in the 2020?s. The best is yet to come.

Suddenly, the Line is Getting Shorter

Suddenly, the Line is Getting Shorter

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

February 9, 2015

Fiat Lux

Featured Trade:

(THE 12 NEW TRADING RULES FOR 2015),

(AN ENVIRONMENTAL ACTIVISTS TAKE ON THE MARKETS),

(DBA), (MOO), (PHO), (FIW)

(FRIDAY, APRIL 3 HONOLULU, HAWAII STRATEGY LUNCHEON)

PowerShares DB Agriculture ETF (DBA)

Market Vectors Agribusiness ETF (MOO)

PowerShares Water Resources ETF (PHO)

First Trust ISE Water ETF (FIW)

1) Dump all hubris, pretentions and stubbornness. It will only cost you money.

2) The market is always right, even if all the prices appear wrong.

3) Only buy the puke outs and sell the euphoria. Do anything in the middle, and you will get whipsawed.

4) Outright calls and puts are offering a better risk/reward right now than bull and bear vertical call and put spreads, which have a built in short volatility element. It is also better to buy stocks and ETF?s outright with a tight stop loss. This won?t last forever.

5) If you do trade spreads, you can no longer run them into expiration. If you have a nice profit take it, don?t hang on to the last 30 basis points, even if it means paying more commission. The world could end three times, and then recover three times, before the monthly expiration date rolls around.

6) Tighten up your stop loss limits. Not losing money is the key to winning in this market. There is nothing worse than having to dig yourself out of a hole. Don?t run hemorrhaging losses, like the (TBT) from $57.56 down to $43.11. It will get easy again some day.

7) Buy every foreign crisis and sell every recovery. It really makes no difference to assets here in the US.

8) Several asset classes are becoming untradeable for long periods (bonds, oil, ags). Stay away and stick to the asset classes that are working (stocks, foreign exchange).

9) Keep positions small. The doubled volatility will make up for your reduced risk. This is not the time to get greedy and bet the ranch.

10) Turn off the TV and just look at your screens and data. Public entertainers have no idea what the market is going to do, especially if their last job was sports reporting. Their job is to get you to watch the ads for General Motors and TD Ameritrade.

11) As the bull market in stocks enters its sixth year, too many traders, analysts and strategists have become complacent. You are going to have to work for your crust of bread this year. This is an earnings, technology and productivity driven bull, not a QE driven one.

12) It is clear that more money was allocated to high frequency traders this year. That is driving the new, breakneck volatility, increasing stop outs. A sneeze now generates a 250-point intraday move. It is no coincidence that they announced this week the end of pit trading in Chicago. The traders all retired, or went off to programming school. Get used it.

Better change your password to, from 12345 to DKFGGIDKFOKBJGELXPEVJBKDLKFBBJFCJCKVLBKGTY69!, and hope that the 69 doesn?t give you away.

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. This is your chance to ?look over? John Thomas? shoulder as he gives you unparalleled insight on major world financial trends BEFORE they happen. Read more

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.