Global Market Comments

April 10, 2015

Fiat Lux

Featured Trade:

(LAS VEGAS WEDNESDAY MAY 8 GLOBAL STRAGEGY LUNCHEON)

(WEDNESDAY APRIL 15 GLOBAL STRATEGY WEBINAR),

(A DAY WITH TOM FRIEDMAN OF THE NEW YORK TIMES)

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. Read more

Global Market Comments

April 9, 2015

Fiat Lux

Featured Trade:

(FRIDAY, APRIL 17 INCLINE VILLAGE, NEVADA STRATEGY LUNCHEON),

(MY UPDATED VIEW OF THE STOCK MARKET),

(SPY), (TLT), (IWM), (DXJ), (FXE),

?(PANW), (GS), (AAPL), (FB), (BABA)

SPDR S&P 500 ETF (SPY)

iShares 20+ Year Treasury Bond (TLT)

iShares Russell 2000 (IWM)

WisdomTree Japan Hedged Equity ETF (DXJ)

CurrencyShares Euro ETF (FXE)

Palo Alto Networks, Inc. (PANW)

The Goldman Sachs Group, Inc. (GS)

Apple Inc. (AAPL)

Facebook, Inc. (FB)

Alibaba Group Holding Limited (BABA)

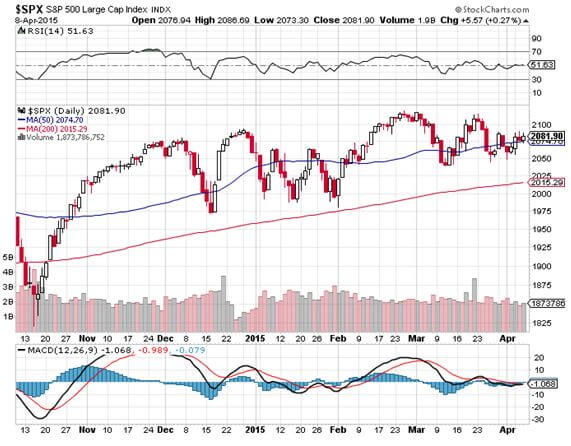

Sooner, and not as high. Those are the adjustments that I am making to my forecast this year for the performance of the US stock markets for the year.

You may recall that in my 2015 Annual Asset Class Review (click here), that I thought the S&P 500 might appreciate from 2,060 to 2,350 by the end of 2015, a gain of 14%, and that stocks might reach an average multiple of 18.5 times earnings.

I am now cutting that expectation by two thirds. My top end target is now a much more modest 2,150, or 4.4% increase. Add in 2% for dividends, and you will earn a paltry 6.4% on you indexed stock investments.

Shares may still achieve 18.5 earnings, but from here, that is looking like a stretch, as euphoria is in short supply.

My aggressive expectations for stocks this year were based on the business and economic conditions that existed a short three months ago.

But oh, how the world has changed since then.

For a start, the euro (FXE), (EUO) reached my yearend downside target in a mere three weeks. In all, the beleaguered continental currency has plunged an awesome 25% since the summer high, a Titanic move in the foreign exchange markets (sorry, reading Dead Wake by Erik Larson now).

The speed of the descent has many consequences. It means currency translation losses will occur much sooner, and be far larger than even the most wild-eyed pessimist was expecting. It also shut out companies from hedging against future losses in the currency markets.

This will affect the Dow Average and the S&P 500 (SPX) the most. It will have almost no impact on the Russell 2000 (IWM), which is composed of small caps. This is why my long US equity positions are focused in the (IWM) along with a few rifle shots in cyber security (PANW) and financials (GS).

A big chunk of my stock risk is also in Japan (DXJ), which benefits from a strong greenback.

You can also expect technology to continue to do well, which obtains some 80% of sales from domestic sources, and will therefore miss much of the dollar?s damage.

Any sector that trades at a 10% discount to market multiple, but enjoys 10% better earnings growth than rest of market has my vote. Think Apple (AAPL), Alibaba (BABA), and Facebook (FB).

The other big factor toning down my US stock hopes is that oil (USO) looks like it is going to stay down lower for longer. The approaching storage Armageddon, now only weeks away, is ominous in the extreme.

The Iran peace deal also tosses in one million barrels of supply on the global markets, right when producers need it the least.

Energy companies? earnings, which account for a hefty 10% of the (SPX), are already down by 60% in the recent quarter, and more pain is to follow.

As a result, the Q1, 2015 earnings reports, which started yesterday with Alcoa?s (AA) sickly $120 million revenue miss, are expected to be the worst in years.

However, don?t go slit your wrists yet. The growth we lost to a strong dollar, the west coast port strike and a horrendous winter in Q1 will roll over into Q2, setting up April as a stock great buyers month.

Don?t forget also that several hundred billion dollars worth of refund checks start appearing in the mail after April 15, much of which ends up in the stock market.

The markets will also slowly come around to the view that the Mad Hedge Fund Trader has been right all along, and that there will be no interest rate rise from the Federal Reserve until 2016.

This factor will co-conspire to drive stocks up to 2,150 or a little more by midyear.

After that, watch out below!

Did I hear ?Sell in May and go away??

The flip side of my interest rate view is that interest rates will increase early in the New Year. And that will be a lot to worry about. The worst-case scenario is that the US stock markets then give up all their gains to end up with a flat year.

That is, unless you read this newsletter and, as a result, carried a heavy overweight position in Japanese and European equities. Whatever the US loses in the second half, Europe and Japan may well pick up.

Don?t worry yourself over the prospect of a stock market crash. Corporate earnings now highest in history, boasting 9% margins, thanks to lower tax rates, ultra low interest rates, bargain energy costs, offshoring and just in time inventories.

The scenario I am painting here calls for no more than a 10% correction this year.

Then GDP growth will return to a heady 3% rate by the end of the year, and it will be off to the races once again.

And one more thing: The Mad Hedge Fund Trader?s model trading portfolio performance hit a new all time high today, up an eye popping 15.03% so far in 2015, and up an unbelievable 167.84% over the past four and a half years.

Urahh!

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. This is your chance to ?look over? John Thomas? shoulder as he gives you unparalleled insight on major world financial trends BEFORE they happen. Read more

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. This is your chance to ?look over? John Thomas? shoulder as he gives you unparalleled insight on major world financial trends BEFORE they happen. Read more

Global Market Comments

April 8, 2015

Fiat Lux

Featured Trade:

(FRIDAY, MAY 8 LAS VEGAS STRATEGY LUNCHEON)

(CYBER SECURITY IS ONLY JUST GETTING STARTED),

(PANW), (SNE), (GOOG), (CSCO), (FEYE), (FTNT), (CHKP), (JNPR),

(A TRIBUTE TO A GIANT OF JOURNALISM, ROY ESSOYAN)

Palo Alto Networks, Inc. (PANW)

Sony Corporation (SNE)

Google Inc. (GOOG)

Cisco Systems, Inc. (CSCO)

FireEye, Inc. (FEYE)

Fortinet Inc. (FTNT)

Check Point Software Technologies Ltd. (CHKP)

Juniper Networks, Inc. (JNPR)

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. Read more

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.