While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

August 31, 2015

Fiat Lux

Featured Trade:

(OCTOBER 12 PORTLAND, OREGON GLOBAL STRATEGY LUNCHEON),

(THE BOND CRASH HAS ONLY JUST STARTED),

($TNX), (TLT), (TBT)

10 Year Tresury Note Yield INDX ($TNX)

iShares 20+ Year Treasury Bond (TLT)

ProShares UltraShort 20+ Year Treasury (TBT)

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. This is your chance to ?look over? John Thomas? shoulder as he gives you unparalleled insight on major world financial trends BEFORE they happen. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

August 28, 2015

Fiat Lux

Featured Trade:

(STRESS TESTING THE MAD HEDGE FUND TRADER STRATEGY),

(SPY), (VIX), (FXY), (TLT), (LEN)

(IS THE 30-YEAR MORTGAGE AN ENDANGERED SPECIES?)

SPDR S&P 500 ETF (SPY)

VOLATILITY S&P 500 (^VIX)

CurrencyShares Japanese Yen ETF (FXY)

iShares 20+ Year Treasury Bond (TLT)

Lennar Corporation (LEN)

It is always a great idea to know how bomb proof your portfolio is.

Big hedge funds have teams of MIT educated mathematicians that constantly build models that stress test their holdings for every conceivable outcome.

WWIII? A Global pandemic? A 1,000 point flash crash? No problem. Analysts will tell you to the decimal point exactly how trading books will perform in every possible scenario.

The problem is that these are just predictions, which is code for ?educated guesses.?

The most notorious example of this was the Long Term Capital Management melt down where the best minds in the world constructed a portfolio that essentially vaporized in two weeks with a total loss.

S&P 500 volatility (VIX) exceeding $40? Never happen!

Oops. Better get those resumes out!

That?s why events like the Monday, August 24 1,000 flash crash are particularly valuable. While numbers and probabilities are great, they are not certainties. Nothing beats real world experience.

As markets are populated by humans, they will do things that no one can anticipate. Every machine has its programming shortcoming.

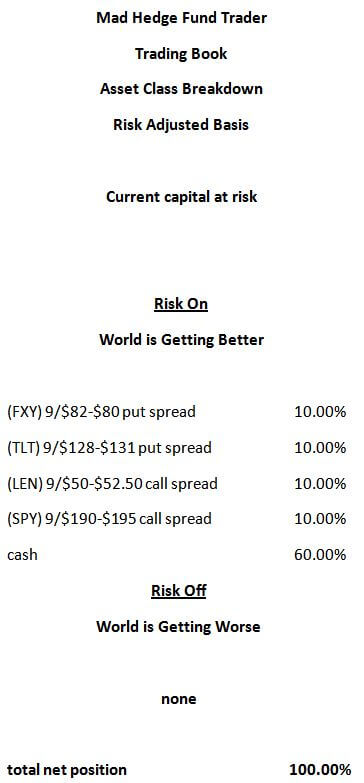

Given that standard, I think the Mad Hedge Fund Trader?s strategy did pretty well in the downdraft. I went into Monday with an aggressive ?RISK ON? portfolio that included the following:

The basic assumptions of this book were that the long term bull market has more to run, the housing sector would lead, interest rates would rise going into the September 17 Federal Reserve meeting, the dollar would remain strong, and that stock market volatility would stay within a 12%-20% range.

What we got was the sharpest one-day stock decline in history, a 28 basis point spike up in interest rates, a complete collapse in the dollar, and stock market volatility at an eye popping 53.85%.

Yikes! I couldn?t have been more wrong.

Now here?s the good news.

When we finally got believable options prices 30 minutes after the opening I priced my portfolio, bracing myself. My August performance plunged from +5.12% on Friday to -10%.

Hey, I never promised you a rose garden.

But that only took my performance for the year back to my June 17 figure, when I was up 23% on the year. In other words, I had only given up two months worth of profits, and that was at the low of the day.

I then sat back and watched the Dow rally an incredible 800 points. Now it was time to de risk. So I dumped my entire portfolio. The assumptions for the portfolio were no longer valid, so I unloaded the entire thing.

This was no time to be stubborn, proud, and full of hubris.

By the end of the day, I was down only -0.48% for August, and up +32.65% for the year.

Ask any manager, and they would have given their right arm to be down only -0.28% on August 24.

Of course, it helped that I had spent all month aggressively shorting the market into the crash, building up a nice 5.12% bank of profits to trade against. That is one of the reasons you subscribe to the Diary of a Mad Hedge Fund Trader.

The biggest hit came from my short position in the Japanese yen (FXY), which was just backing off of a decade low and therefore coiled for a sharp reversal. It cost me -4.85%.

My smallest loss was found in the short Treasury bond position (TLT), where I only shed 1.52%. But the (TLT) had already rallied 9 points going into the crash, so I was only able to eke out another 4 points to the upside on a flight to safety bid.

Lennar Homes gave me a 2.59% hickey, while the S&P 500 long I added only on Friday (after all, the market was then already extremely oversold) subtracted another 1.61%.

The big lesson here is that my short option hedges were worth their weight in gold. Without them, the losses on the Monday opening would have been intolerable, some two to three times higher.

You can come back from a 10% loss. I have done so many times in my life. A 30% loss is a completely different kettle of fish, and is life threatening.

For years, readers complained that my strategy was too conservative and cautious, really suited for the old man that I have become.

Readers were able to make a lot more money following my Trade Alerts through just buying the call options and skipping the hedge, or better yet, buying the futures.

I didn?t receive a single one of those complaints on Monday.

I?ll tell you who you didn?t hear from on Monday, and that was friends who pursued the moronic trading strategies you often find touted on the Internet.

That includes approaches like leveraged naked shorting of puts that are always advertising fantastic track records...when they work.

You didn?t hear from them because they were on the phone pleading with their brokers while they were forcibly liquidating portfolio showing 100% losses.

Any idiot can look like a genius shorting puts until it blows up in their face on a day like Monday and they lose everything they have. I know this because many of these people end up buying my service after getting wiped out by others.

I work on the theory that I am too old to go broke and start over. Besides, Morgan Stanley probably wouldn?t have me back anyway. It?s a different firm now.

Would I have made more money just sitting tight and doing nothing?

Absolutely!

But the risks involved would have been unacceptable. I would have failed my own test of not being able to sleep at night. That is not what this service is all about.

In any case, I know I can go back to the market and make money anytime I want. That makes the hits easier to swallow.

You can?t do this without any capital.

With the stress test of stress tests behind us, the rest of the years should be a piece of cake.

Good luck, and good trading.

Sometimes It Pays to Be Old

Sometimes It Pays to Be Old

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.