While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

October 28, 2015

Fiat Lux

Featured Trade:

(LAST CHANCE TO ATTEND THE FRIDAY, OCTOBER 30 SAN FRANCISCO STRATEGY LUNCHEON),

(GENERAL ELECTRIC?S IMAGINATION REALLY IS AT WORK),

(GE), (ELUXY), (SYF)

(TEN REASONS WHY BONDS WON?T CRASH)

General Electric Company (GE)

Electrolux AB (ELUXY)

Synchrony Financial (SYF)

Come join me for lunch at the Mad Hedge Fund Trader?s Global Strategy Update, which I will be conducting in San Francisco on Friday, October 30, 2015. An excellent meal will be followed by a wide ranging discussion and an extended question and answer period.

I?ll be giving you my up to date view on stocks, bonds, currencies, commodities, precious metals, and real estate. And to keep you in suspense, I?ll be throwing a few surprises out there too. Tickets are available for $208.

I?ll be arriving at 11:00 and leaving late in case anyone wants to have a one on one discussion, or just sit around and chew the fat about the financial markets.

The lunch will be held at a private club in downtown San Francisco near Union Square that will be emailed with your purchase confirmation.

I look forward to meeting you, and thank you for supporting my research.

To purchase tickets for the luncheons, please click here.

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

October 27, 2015

Fiat Lux

SPECIAL ENERGY ISSUE

Featured Trade:

(IS THIS THE BOTTOM FOR OIL?),

(USO), (XOM), (COP), (OXY), (KOL)

United States Oil ETF (USO)

Exxon Mobil Corporation (XOM)

ConocoPhillips (COP)

Occidental Petroleum Corporation (OXY)

Market Vectors Coal ETF (KOL)

There have been two sources of oil information this year.

The producers saw nothing but endless supply stretching over the horizon, and sold every rally with both hands.

The speculators and futures traders have been overwhelmingly positive, buying every dip because their charts told them to, and getting stopped out more times than I have had hot meals.

Clearly, it has been the producers who have been right. That?s because they had to sell to go flat in order to hedge production already in the pipeline. It is much easier to go from long to flat than it is to go from flat to net short.

As a result, there are a lot of oil and commodities traders who are looking for jobs right now on Craig?s List. They?ll probably find them!

And you know what? They?ll probably be right next time.

The stock market certainly thinks so, with energy far and away the best performing sector of the month. Exxon Mobil (XOM) up 17%? Occidental Petroleum rocketing 19%? ConocoPhillips (COP) picking up an astounding 24%?

These have been moves for the ages.

Energy is still one of my three core industries in which to invest over the next two decades.

The share prices for this sector got so low, they started to redefine the meaning of ?bargain?. The major integrated oil companies are now trading under book value with single digit multiples.

They essentially fell to liquidation values, assuming that the fall in the price of Texas tea halts at $38. Those are valuations almost as low as Apple (AAPL) saw two years ago. And you know what happened after that!

The absence of my Trade Alerts in this fertile field is happening because things could get worse for oil before they get better.

There is now a war for market share occurring between the world?s second and third largest producers, Saudi Arabia and Russia (the US is now number one).

Both countries desperately depend of rising prices and export volumes to maintain domestic political stability. When that doesn?t happen, budget deficits explode, spending gets cut, revolutions occur, and governments fall.

Saudi Arabia is now borrowing for the first time in modern history. Sanctions have shut Russia out of western debt markets. That?s why it has moved into Syria, to distract voters for domestic economic collapse.

And these aren?t countries that send former leaders to country clubs to practice their golf swings in retirement. Firing squads are more the order of the day.

Until recently, I would have said that China would step in and put a floor under the market to fuel their insatiable demand for energy. But they have run out of storage, and are unable to take more.

There is just no place to put it. They have even resorted to long-term charters of ultra large tankers, like the 434,000 tonne TI Europe, purely to build reserves.

The shake out is especially bad in the offshore sector, the planet?s most expensive source of crude. The same is true for Arctic exploration, with projects cancelled left and right.

A glut of new drilling rigs is about to hit the market, ordered during more prosperous times years ago, while existing ones can be snapped up for 40 cents on the dollar.

Oil suffers from the additional damnation in that it is being dragged down by the global commodity collapse. Unless an asset class is made out of paper and pays an interest rate or a dividend, it is getting dissed to an unbelievable degree.

All of this means that the price of oil could churn around current levels for a little while longer before putting in a convincing bounce. The low $40?s should hold, but we might see a one day spike down to $38 a barrel one more time.

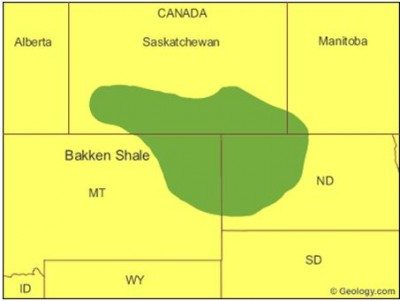

If you had told me when I was fracking for natural gas in the Barnett Shale 16 years ago that this process would ultimately cause the collapse of Russia and Saudi Arabia, me and my roustabout buddies would have said you were nuts.

Yet, that is precisely what seems to be happening.

So many railcars have been diverted to the oil trade that farmers are now having trouble getting a record grain crop to market. This is why railroads have been booming (click here for ?The Railroads Are making a Comeback?.

The energy research house, Raymond James, recently put out an estimate that domestic American oil production (USO) would rise to 9.1 million barrels a day by the end of 2015.

That means its share of total consumption will leap to 46% of our total 20 million barrels a day habit. These are game changing numbers.

Names like the Eagle Ford Shale, Haynesville Shale, and the Bakken Shale, once obscure references on geological maps, are now a major force in the country?s energy picture.

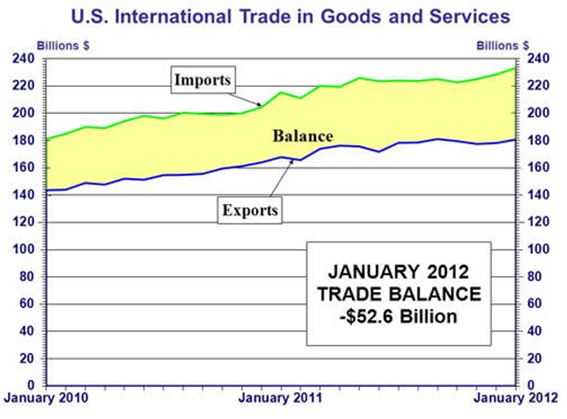

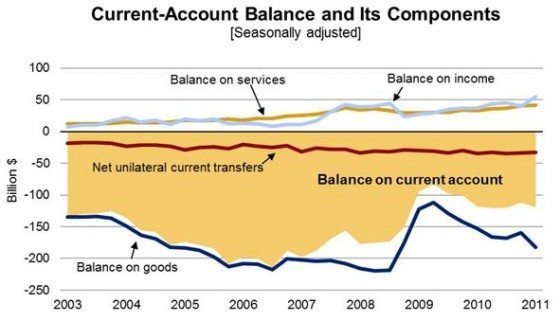

The value of this extra 3.5 million barrels/day works out to $47.5 billion a year at current prices (3.5 million X 365 X $45). That will drop America?s trade deficit by nearly 15% over the next three years, and almost wipe out our current account deficit.

Needless to say, this is a hugely dollar positive development, and my own Trade Alerts have profitably been reflecting that.

This 3.5 million barrels will also offset much of the growth in China?s oil demand for the next three years. Fewer oil exports to the US also vastly expand the standby production capacity of Saudi Arabia.

If you want proof of the impact this will have on the economy, look no further that the coal (KOL), which has been falling in a rising market.

Power plant conversion from coal to natural gas (UNG) is accelerating at a dramatic pace. That leaves China as the remaining buyer, and their economy is slowing.

It all makes the current price of oil at $45 look inviting. Cushing, Oklahoma is awash in Texas tea, and the Strategic Petroleum Reserve stashed away in salt domes in Texas and Louisiana is at its maximum capacity of 727 million barrels.

It was concerns about war with Syria, Iran, ISIL, and the Ukraine that took prices to $107 in the spring last year. My oil industry friends tell me this fear premium added $30-$40 to the price of crude. That premium is now gone.

It seems that every time a new group grabs an oil field in the Middle East, they ramp up production, rather than destroy it, so they can milk it for the cash. This is why 15 tankers are afloat around the world carrying Kurdish crude to sell on the black market.

Once Europe and Asia return to a solid growth track, oil will recover to $70 a barrel or more.

Until then, discretion is the better part of valor, and I?ll be sitting on those Trade Alerts.

It is also why I am keeping oil companies with major onshore domestic assets, like Exxon Mobil (XOM) and Occidental Petroleum (OXY), in my long-term model portfolio.

Sorry, but We?re Full

Sorry, but We?re Full

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

October 26, 2015

Fiat Lux

Featured Trade:

(OLD TECH IS BACK!),

(MSFT), (AMZN), (INTC), (GOOGL), (AAPL),

(AMERCIA?S DEMOGRAPHIC COLLAPSE AND YOUR STOCK PORTFOLIO)

Microsoft Corporation (MSFT)

Amazon.com, Inc. (AMZN)

Intel Corporation (INTC)

Alphabet Inc. (GOOGL)

Apple Inc. (AAPL)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.