As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

November 13, 2015

Fiat Lux

Featured Trade:

(NOVEMBER 18 GLOBAL STRATEGY WEBINAR),

(WOE THE AUSTRLIAN DOLLAR!),

(FXA), (BHP), (KOL), (GLD), (USO), (BABA), (BIDU), (JD)

(AMERICA?S DEMOGRAPHIC TIME BOMB), (EEM),

(TESTIMONIAL)

CurrencyShares Australian Dollar ETF (FXA)

BHP Billiton Limited (BHP)

Market Vectors Coal ETF (KOL)

SPDR Gold Shares (GLD)

United States Oil (USO)

Alibaba Group Holding Limited (BABA)

Baidu, Inc. (BIDU)

JD.com, Inc. (JD)

iShares MSCI Emerging Markets (EEM)

If I warned them once, I warned them 1,000 times!

The Australian dollar (FXA) is going to fall.

That?s why I cautioned my Aussie friends to sell their homes, get the money the hell out of the country, and pay for their overseas vacations in advance.

As long as it is a de facto colony of China, the fortunes of the Land Down Under are completely tied to economic prospects there.

It is almost a waste of time looking at the Reserve Bank of Australia?s data releases. They have become a deep lagging, and really irrelevant indicators. You are better off going to the source, and that is in Beijing.

And therein lies the problem.

It is highly unlikely that the government in China has any idea what their economy is actually doing. Sure, they pump out the usual figures on a reliable basis like clockwork. These are educated guesses, at best.

Even in a perfect world, collecting numbers from 1.3 billion participants is a hopeless task. The US is unable to do these with any real accuracy, and we have one quarter of their population and vastly superior technology.

For what it is worth, Chinese President Xi Jinping has promised that his country?s GDP growth will not fall below a 6.5% annual rate for the next five years. At this pace, China is still creating more economic activity that any other country in the world.

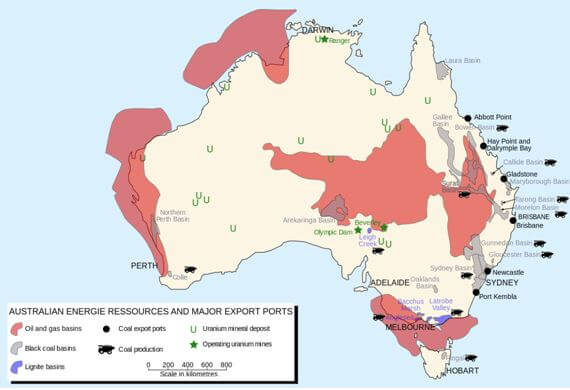

Which leaves us nothing else to rely on but commodity prices to look at, far an away Australia?s largest earner. These are suggesting that the worst has yet to come.

Virtually the entire asset class hit new six year lows yesterday. I had to go to the weekly charts to see how ugly things really are.

Australia?s largest exports are iron ore (26%, or $68.2 billion worth), coal (KOL) (16%), gold (GLD) (8.1%), and petroleum (USO) (5.7%). When the world?s largest consumer of these slows down, so does demand for these commodities.

BHP Billiton Ltd. (BHP), the largest producer of iron ore, has seen its shares plunge 57% from last year?s high.

But wait! It gets worse.

I have written at length about the transition of China from an industrial to a services based economy. You would expect this, as the Middle Kingdom has virtually no commodity resources of its own, but lots of smart people.

In a nutshell, they wish they had America?s economy. Where services now account for a staggering 68% of all economic activity.

This is why China?s future lies with Alibaba (BABA), Baidu (BIDU), and JD.com (JD). It does NOT lie with its steel factories and coalmines, which by the way, recently announced layoffs of 100,000, the largest in history.

To learn more about the structural remaking of China, please click here for ?End of the Commodities Super Cycle?.

There is one bright spot to mention. Australia is making a transition to a services based economy of its own. Tourism is rocketing, as is the influx of flight capital from the Middle Kingdom.

Walk the streets of Brisbane these days, and you are overwhelmed by the abundance of Asians coming here to learn English, attain a high education, or start a new business. When I came here 40 years ago, they were virtually absent.

How low is low?

It doesn?t help that the governor of the Reserve Bank of Australia, Australia?s central bank, Glenn Stevens, despises his nation?s currency.

He has used every rally this year to talk down the Aussie, threatening interest rate cuts and quantitative easing.

The hope is that a deep discount currency will allow the exporters to maintain some pricing edge on the commodities front.

The market chatter is that the Aussie will take a run as low as $0.55, the 2008-09 Great Recession low.

Whether we actually get that far or not is a coin toss.

And will even $0.55 below enough for Glenn Stevens?

Noted Aussie Dollar Hater

Noted Aussie Dollar Hater

Holy smokes! You really did it with the UNG trade. Up 25% in two hours? How did you do that? It was the best trade you?ve ever done. It?s the best trade I?ve ever done.

It was the right thing to do at the right time. And you had the balls to put it on after the (UNG) opened down a dollar. The follow up report was one of your best ever written as well. I will never again doubt your advice.

The next chicken fried steak at Billy Bob?s is on me. Thank?s a million.

George

Tampa, Florida

?

?Investing and investment is the one sphere of life where victory, security, and success are always to the minority and never to the majority. When you find anyone agreeing with you, change your mind,? said the famous economist, John Maynard Keynes.

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. This is your chance to ?look over? John Thomas? shoulder as he gives you unparalleled insight on major world financial trends BEFORE they happen. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

November 12, 2015

Fiat Lux

Featured Trade:

(NEW TRAINING VIDEO ON VERTICAL BEAR PUT SPREADS),

(HAPPY BIRTHDAY IRS!)

Some taxpayers have been sending birthday cards in with their tax returns this year. That?s because the International Revenue Service, the collector of America?s tax revenues, is 102 years old this year.

Although the wealthy have been paying income taxes since the 1861-65 Civil War, they did not apply to the rest of us until the passage of the 16th Amendment.

The original form 1040, of which I have included a copy below, was one page long and imposed a starting tax rate of 1% over incomes of $3,000. The maximum tax rate was 7%. It included a deduction for shipwrecks.

When WWI broke out, that rate was taken up to 77%. Only 3% of the population had tax liabilities, compared to 54% today.

Since 1913, the pages of instructions and deductions have soared from one to over 73,000. Today, some 6.6 billion man hours are spent preparing US tax returns. That works out to keeping 3.3 million people on the job full time. Talk about a growth business!

According to the Pew Research Center, 56% of Americans dislike taxes, but 71% feel they have a moral responsibility to pay what they owe. Yet, 34% say they pay more than their fair share of taxes, while 60% believe they are paying the right amount.

In 1775, the American Revolution first started as a tax revolt, with American merchants protesting the special exemptions enjoyed by British ones. That led to the Boston Tea Party whereby Americans masquerading as Indians dumped competing duty free imports overboard.

Fairness of the system has been a recurring theme ever since. That is why Mitt Romney?s 13.9% tax rate was such a big deal in the 2012 presidential election.

About 1% of taxpayers are audited each year, with the wealthiest 12 times more likely to get audited than the middle class. This brings a famous Willy Sutton quote to mind: ?Why rob banks? Because that?s where the money is.?

Where are residents least like to be audited by the IRS? The Aleutian Islands in Alaska. And the most likely? Beverly Hills, California. Small businesses top the list, with those in the real estate and construction industries dominating.

The Justice Department brings about 1,000 criminal tax evasion cases a year. Jail times have only been required since 1987 (thank you Ronald Reagan!).

That works out to one return out of every 150,000, so play audit roulette if you will. Their success rate in obtaining convictions is a mathematically impossible 98.5%. Some 70% of jurors believe the defendant is guilty before the case is even heard.

Today is probably the best time ever to cheat on your taxes. The IRS is wilting from millions of fraudulent tax returns returns filed by Internet scammers to obtain stolen refunds. I got hit by one of these myself, and it took six months for me to get my rightful refund (click here for ?The Letter From the IRS You Should Dread?).

There is also a major offensive underway to close down illicit offshore bank accounts. The agency is gaining traction on this with a reward program that offers snitches 10% of the funds recovered.

If you have one of these operated by a shell company in the British Virgin Island or Belize, you?re better off fessing up now. Remember that the Justice Department can track the movement of a dollar anywhere in the world at any time, whether a foreign country cooperates or not.

The burden to deliver the data always traces back to an American bank, when funds are transferred, even between foreign countries.

What is the most common error committed on tax returns? Divorced parents both claiming the same children as dependents. The mistake is automatically caught by electronic filing with the earliest filer getting the tax savings. So don?t bother.

Now how much did I lose on that shipwreck last year?

Equalizing the Tax System

Equalizing the Tax System

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.