While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

May 8, 2015

Fiat Lux

SPECIAL FIXED INCOME ISSUE

Featured Trade:

(FRIDAY, MAY 15 SAN FRANCISCO STRATEGY LUNCHEON),

(THE LIQUIDITY CRISIS COMING TO A MARKET NEAR YOU),

(TLT), (TBT), (MUB), (LQD),

(TAKE A RIDE IN THE NEW SHORT JUNK ETF),

(SJB), (JNK), (CORN)

(TESTIMONIAL)

iShares 20+ Year Treasury Bond (TLT)

ProShares UltraShort 20+ Year Treasury (TBT)

iShares National AMT-Free Muni Bond (MUB)

iShares iBoxx $ Invst Grade Crp Bond (LQD)

ProShares Short High Yield (SJB)

SPDR Barclays High Yield Bond ETF (JNK)

Teucrium Corn ETF (CORN)

Come join me for lunch at the Mad Hedge Fund Trader?s Global Strategy Update, which I will be conducting in San Francisco on Friday, May 15, 2015. An excellent meal will be followed by a wide ranging discussion and an extended question and answer period.

I?ll be giving you my up to date view on stocks, bonds, currencies, commodities, precious metals, and real estate. And to keep you in suspense, I?ll be throwing a few surprises out there too. Tickets are available for $207.

I?ll be arriving at 11:00 and leaving late in case anyone wants to have a one on one discussion, or just sit around and chew the fat about the financial markets.

The lunch will be held at a private club in downtown San Francisco near Union Square that will be emailed with your purchase confirmation.

I look forward to meeting you, and thank you for supporting my research. To purchase tickets for the luncheons, please go to my online store.

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. This is your chance to ?look over? John Thomas? shoulder as he gives you unparalleled insight on major world financial trends BEFORE they happen. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

May 7, 2015

Fiat Lux

Featured Trade:

(JUNE 22 WASHINGTON DC GLOBAL STRATEGY LUNCHEON)

(WHY I?M GETTING CAUTIOUS ON THE MARKET),

(SPY), (QQQ), (IWM), (UVXY), (FXE), (USO), (TLT),

(POPULATION BOMB ECHOES),

(POT), (MOS), (AGU), (WEAT), (CORN), (SOYB), (RJA)

SPDR S&P 500 ETF (SPY)

PowerShares QQQ Trust, Ser 1 (QQQ)

iShares Russell 2000 (IWM)

ProShares Ultra VIX Short-Term Futures (UVXY)

CurrencyShares Euro ETF (FXE)

United States Oil ETF (USO)

iShares 20+ Year Treasury Bond (TLT)

Potash Corp. of Saskatchewan, Inc. (POT)

The Mosaic Company (MOS)

Agrium Inc. (AGU)

Teucrium Wheat ETF (WEAT)

Teucrium Corn ETF (CORN)

Teucrium Soybean ETF (SOYB)

ELEMENTS Rogers Intl Cmdty Agri TR ETN (RJA)

Let?s face it. We?ve had a great run since the stock market bottomed in a furious selling climax on October 15.

Since then, the large cap S&P 500 (SPY) had tacked on some 18%, while the high tech NASDAQ (QQQ) has gained an impressive 23.6%, and the small cap Russell 2000 (IWM) flew 24.4%.

My Own Trade Alert service performance improved by a positively steroidal 27.7%, as the onslaught of testimonials from ecstatic readers confirms (click here).

Therefore, I have cut the size of my trading book by half, and over hedged what I have left, leaving me with the first net short position since the darkest days of 2014.

Why am I running for the sidelines? Am I getting cautious in my old age? Have I suddenly become a wimp?

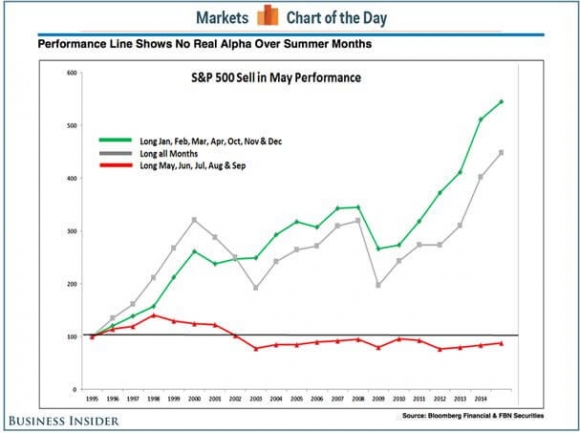

For a start, we have just entered a period in the calendar when it is notoriously difficult to make money in the market. You?ve heard of ?Sell in May and go away?? This year, it may work with a turbocharger.

Take a look at he chart below provided by my friends at Business Insider. It shows that active managers make all of their money during January to April and October to December. Those who are long during the May to September period reliably lose money.

Hey, isn?t that April I see rapidly receding in my rear view mirror?

You may have noticed that the price of oil (USO) has been going up. In fact, the price of Texas tea has added 43% in seven weeks, the sharpest gain since the 1979 oil crisis. As a result, we have just lost 29% of the de facto tax cut for the economy since prices peaked last year at $107 a barrel. You probably have already noticed the double digit rises in the price of gasoline at your local pump.

Not good, not good.

It also appears that the free lunch on interest rates is coming to an end ($TNX). Even if you believe that the Federal Reserve will not act until 2016, that date with destiny is approaching by the day.

You see this is in the steadily rising cost of home mortgages and car loans, neither of which bode well for the economy.

Some may have noticed the meteoric rise on the Euro (FXE) against the US dollar in recent weeks. An aggressive program of quantitative easing seems to be turning around the economy there much faster than expected.

No doubt, businesses on the continent are inspired by the wildly successful results of the same strategy that was employed in the US six years ago. This has led some to assume that Euro QE may end sooner than expected, definitely taking the wind out of the stock markets there.

How about the dollar? Although it has given up half its gains against the Euro this year, it is still high enough to hurt the profits of big multinationals.

We saw evidence of this this morning with the release of the US trade deficit, worst since the crisis days of 2008. The red ink has bubbled up from $34.9 billion in February to $51.4 billion in March, up a staggering 41% month to month.

Clearly, foreign exporters are using their cheaper currency to flood the US market with their goods.

Politics? Did I hear someone mention politics? New candidates are announcing their intentions to run for the top office daily.

What do they all have in common? The need to spend billions of dollars convincing you how terrible the economy is.

This is despite the fact that the stock market has tripled, unemployment is at a decade low, and home prices have doubled off the bottom (at least they have in San Francisco).

Yes, these campaigns only work on people who don?t look at numbers. But there are a lot of people who don?t look at numbers, eroding confidence, creating confusion and postponing spending decisions until after the November, 2016 election.

All of the above me makes me a better seller of rallies than a buyer of dips for the time being. It is certainly is worth a 5% drawdown, if not a 10% hickey later on this summer, when no one is looking.

However, we are not entering a new bear market, and the long term strength of the economy augurs for otherwise. We?re just taking a vacation from the bull market.

It all makes a trip to Europe, some 20% cheaper than last year thanks to the Euro collapse, look all the more enticing.

See You in Europe

See You in Europe

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.