While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. This is your chance to ?look over? John Thomas? shoulder as he gives you unparalleled insight on major world financial trends BEFORE they happen. Read more

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

May 6, 2015

Fiat Lux

Featured Trade:

(JUNE 29 LONDON STRATEGY LUNCHEON)

(MAD HEDGE FUND TRADER HITS 23.7% PROFIT IN 2015),

(FXE), (EUO), (FCX), (AAPL), (GS), (PANW), (DXJ), (LEN), (GOOG),

(THE COOLEST TOMBSTONE CONTEST)

CurrencyShares Euro ETF (FXE)

ProShares UltraShort Euro (EUO)

Freeport-McMoRan Inc. (FCX)

Apple Inc. (AAPL)

The Goldman Sachs Group, Inc. (GS)

Palo Alto Networks, Inc. (PANW)

WisdomTree Japan Hedged Equity ETF (DXJ)

Lennar Corp. (LEN)

Google Inc. (GOOG)

I am sitting here in my luxury suite atop the Bellagio Hotel in Las Vegas. The vast expanse of the southern Nevada desert sprawls out before me, stretching all the way out to the red rock mountains.

Fluffy clouds dot the horizon, and the weather is perfect. Reports say it will only be 95 degrees today.

Nearby, the flashing LED?s of the Nevada strip continue their never ending, multi colored light show. It?s nice to be back.

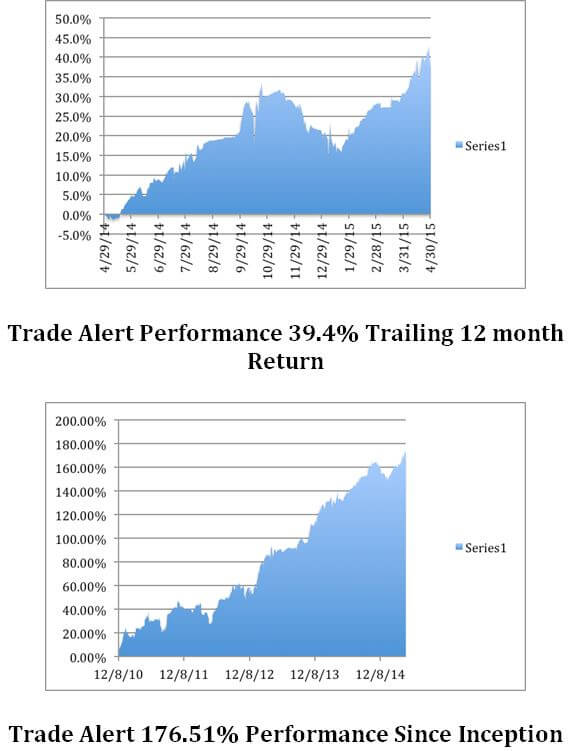

After surviving a meat grinder of a January, putting the pedal to the metal in February, and dodging the raindrops of March, the model-trading portfolio of the Mad Hedge Fund Trader has posted a year-to-date gain of 23.7%.

We have generated profits for followers every month this year, and on our best day were up an eye popping 12.44% at the April high. We have been posting new all time performance highs almost every day for the past three weeks.

Mad Day Trader, Jim Parker, and myself have performed like tag team wrestlers, delivering winners for our paid subscribers one right after the other. Some 25 out of my last 30 Trade Alerts have been profitable.

I managed to nail the collapse in the euro (FXE), (EUO) big time, backing that up with profitable long positions in the Apple (AAPL), Gilead Sciences (GILD), Goldman Sachs (GS), Japan Hedged Equity ETF (DXJ) Freeport McMoRan (FCX) and Palo Alto Networks (PANW).

These more than amply cover modest loses in Lennar Homes (LEN) and Google (GOOG).

Jim has been on an absolute hot streak in 2015, shaking the Bull Run in biotech?s for all it is worth (ZIOP), (THRX), (ZTS), and executing some perfectly timed shorts in oil (USO).

This is compared to the miserable performance of the Dow Average, which is up a pitiful +1.6% during the same period.

To top it all, I even bet on the winners last Saturday of the Kentucky Derby (American Pharoah, the favorite), and the Mayweather/Pacquiao fight in Las Vegas.

When it rains, it pours.

The four and a half year return of my Trade Alert service is now at an amazing 173%, compared to a far more modest increase for the Dow Average during the same period of only 51%.

That brings my averaged annualized return up to 38.4%. Not bad in this zero interest rate world. It appears better to take on some risk and reach for capital gains and trading profits, than surrender to the paltry fixed income yields out there.

This has been the profit since my groundbreaking trade mentoring service was first launched in 2010. Thousands of followers now earn a full time living solely from my Trade Alerts, a development of which I am immensely proud.

What saved my bacon this month was my instant and accurate decoding of Fed chairman Janet Yellen?s cryptic comments on the future of possible interest rate hikes, or the lack thereof.

We got to eat our ?patience? and have it too.

Wall Street gets so greedy, and takes out so much money out for itself, there is now nothing left for the individual investor any more. They literally kill the goose that lays the golden egg.

The Mad Hedge Fund Trader seeks to address this imbalance and level the playing field for the average Joe. Looking at the testimonials that come in every day, I?d say we?ve accomplished that goal.

It has all been a vindication of the trading and investment strategy that I have been preaching to followers for the past seven years.

Quite a few followers were able to move fast enough to cash in on my trading recommendations. To read the plaudits yourself, please go to my testimonials page by clicking here.

Watch this space, because the crack team at Mad Hedge Fund Trader has more new products and services cooking in the oven. You?ll hear about them as soon as they are out of beta testing.

Our business is booming, so I am plowing profits back in to enhance our added value for you.

The coming year promises to deliver a harvest of new trading opportunities. The big driver will be a global synchronized recovery that promises to drive markets into the stratosphere by the end of 2015.

Global Trading Dispatch, my highly innovative and successful trade-mentoring program, earned a net return for readers of 40.17% in 2011, 14.87% in 2012, and 67.45% in 2013, and 30.3% in 2014.

Our flagship product,?Mad Hedge Fund Trader PRO, costs $4,500 a year. It includes?Global Trading Dispatch (my trade alert service and daily newsletter). You get a real-time trading portfolio, an enormous research database and live biweekly strategy webinars. You also get Jim Parker?s?Mad Day Trader?service and?The Opening Bell with Jim Parker.

To subscribe, please go to my website, ?www.madhedgefundtrader.com, click on the ?Memberships? located on the second row of tabs.

By the way, those of you who ran up huge profits with your euro shorts in January and February, and the overnight 25% killing I scored with Freeport McMoRan (FCX) last week all owe me new testimonials.

Ship em in!

Looking for the Next Great Trade

Looking for the Next Great Trade

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. This is your chance to ?look over? John Thomas? shoulder as he gives you unparalleled insight on major world financial trends BEFORE they happen. Read more

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.