While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

April 26, 2016

Fiat Lux

Featured Trade:

(APRIL 27 GLOBAL STRATEGY WEBINAR),

(HEARD ON THE ROAD PART I),

(IT?S ALL ABOUT YIELD),

(SPY)

SPDR S&P 500 ETF (SPY)

Every Global Strategy Luncheon was a real blast. It?s as if the dozen smartest people in each city got together to exchange notes and jokes. They then formed their own local community of Mad Hedge Fund Trader followers.

I love doing these things.

Last year, my flight to Houston cost $600. This year it was $99. What a difference a year, and $50 in the price of oil, makes.

Not to be missed on the trip from the airport were giant storage yards filled with hundreds of pieces of rusting oil drilling equipment.

A big energy hedge fund manager told me that Schlumberger (SLB) just pulled all their people out of Venezuela because they haven?t been paid. Oil production there will go to zero, taking prices up to $70/barrel by yearend.

As for natural gas, its price is going to negative numbers.

The Tampa Marriott Waterside was jammed to the gills with two conferences, one for veterinarians, the other for the Florida girls? high school volleyball championships. So the lobby was constantly filled with hundreds of very tall teenage girls wearing tight shorts.

Water, water everywhere?.

Had lunch with Harry Dent, whose unmatched demographic research I have been following for decades. He agrees that in a NIRP world stocks could stagnate, moving sideways, within a tight 15% band. That would be slow death for we traders.

I spent my day off in Charleston, South Carolina, where the Civil War began with the Confederates firing on Fort Sumter in 1861.

It is a big wedding destination now, with young couples pouring in from all over the South to tie the knot. Saturday night on Market Street saw at least a dozen bachelor and hen parties going bar to bar and getting wasted, the women falling off their platform shoes.

I attended Sunday church services at the Mother Emanuel African Methodist Episcopal Church, where 15 people were gunned down last year.

They stopped me at the door for 20 minutes where they suspiciously checked me out. Then they invited me in and sat me down next to the only other white person there, a Jewish woman from New York.

The gospel singing was incredible, if not angelic. When I left, an usher thanked me for supporting their cause. Very moving.

Some 11 flights into this trip, and every seat was full, with airlines buying back seats for excess passengers. Where is the recession?

Miami turned into Manhattan South when I wasn?t looking. Prices for $20 million penthouses are said to be in free fall as the Russians and Chinese have pulled out because of greater disclosure rules and trade sanctions.

It was back to back meetings with my $10,000 a year Concierge Service clients all day. I didn?t even get out of the hotel. However, I did manage to meet up with an old pal though, a former Navy carrier F-18 pilot, and now a serious options trader.

I guess glide path and angle of approach easily translates into implied volatility and time decay.

Things have certainly changed in the Deep South.

When I first hitch hiked through here to join the civil rights movement, I got rides from guys driving to their local Klu Klux Klan meeting. They always invited me to come along.

I answered ?No, I?m going to another Klan meeting further down the road, but thanks anyway,? and they let me out.

Today, Atlanta has a black mayor with a white wife. Confederate flags abound in the countryside, but every one of these guys will tell you that some of their best friends are African American. The stars and bars are really more of a Declaration of Independence.

The South will rise again.

A lunch guest gave me a bottle of Glenmorangie scotch in thanks for his many profitable Trade Alerts. Another gave me a book describing his father?s participation in the CIA during the Cold War.

In my free one hour I managed to squeeze in visits to the Jimmy Carter Presidential Library, vaguely looking for a picture of myself, and the Coca Cola Museum.

The cherry blossoms were still blooming in Washington DC.

When I checked into the Army & Navy Club in Washington DC, the young clerk asked if I stayed there before. I replied, ?I stayed here once during the Civil War. Do they still have that painting of me leading a charge on the fourth floor??

Ran into a dozen visitors from the Saudi Air Ministry. Guess what that?s all about?

Nothing else to say about Washington DC but that Obama?s presidential helicopter, Marine One, is incredibly loud, but is the coolest metallic green color.

Back in Boston, and the clam chowder is to die for. I have read so much about the Revolutionary War history that it is fascinating to visit the actual locations at which these events took place.

Of course, most of the local population is clueless about their past, and I ended up explaining their history on multiple occasions.

In my free hour I visited the USS Constitution, or ?Old Ironsides,? the oldest ship in the US Navy. The 219-year-old vessel is in dry dock getting new masts and copper plating for its hull. It sank four British warships during the War of 1812.

Looking for the Next Great Trade

Looking for the Next Great Trade

Then I shot over to Harvard Yard to practice my Mandarin. At the bookstore I picked up ?50 Essays That Got Accepted to Harvard? for my girls. It?s never too early to start.

Tiring of the TSA, I took Amtrak from Boston to New York. Rhode Island appears to be one big yacht harbor. They are just emerging from winter here, with the bare pale green shoots of leaves on the trees.

Nothing like arriving in the Big Apple by train, with the Empire State Building, the Chrysler Building, and Liberty Tower looming out of the evening mist.

To be continued?.

If you are an investor, trader, or financial advisor, there is only one word in the English language today:

Yield

That is my conclusion after speaking to readers on my 12 day, 11 state, 8 city US tour.

Having underperformed the indexes and posted negative returns for the last two years, many money managers are now facing the bleak prospect of delivering losses for a third year in a row.

That is, unless, they have the good fortune to read the Diary of a Mad Hedge Fund Trader. However, even I have been hard pressed to deliver my usual double-digit returns. This year I have delivered the slowest start to a year since I started the business eight years ago.

Brokerage clients are fed up. They would rather earn nothing on their cash than write another check to the market. That means firing their manager, dumping their ETFs, and running up the white flag of surrender.

That is why the bounce back in shares in February was so frenetic and violent. The window for a good entry point opened so briefly that if you blinked, you missed it.

US stocks are now the world?s preeminent high yield asset, with top quality shares boasting 2-5% dividend yields. The bottom line is that portfolio managers have to buy stocks or lose their jobs.

This is no easy task. S&P 500 earnings multiples at 19X are at a decade high. This is against a postwar range of 9-24X.

They have achieved this lofty height while Q1 GDP growth forecasts have been chopped from 2.3% to a mere 0.50%, thanks to the weakness imported from Europe, China, and Japan.

If you recognize this as an ugly picture you would be right. Managers have the choice now of buying stocks and committing suicide, or not buying stocks and committing suicide.

And Solomon thought he had a hard time making a decision!

This is why I am employing every risk avoidance measure I know of, like keeping 80%-90% of my assets in cash, and playing the indexes instead of single names.

Fortunately,it is not like the world is completely devoid of opportunities. Gold has been a reliable earner. Buy every $50 dip in the barbarous relic.

High quality REIT?s and Master Limited Partnerships are still offering double digit yields, and some of the biggest spreads over cash in history.

Emerging markets and commodities have probably entered new long term bull markets, but I wouldn?t necessary buy them today.

Blame our current conundrum on negative interest rates, which are blowing up traders? models everywhere. It?s not like you can say ?Well, the last time we had negative interest rates? because we?ve never had them before.

Even though NIRP isn?t in the US yet, the effects from Europe and Japan are being felt around the world.

To end this letter on an upbeat note, I think the markets are setting up for a monster rally in the fall. Removal of election uncertainty will be a big factor. The last time a Clinton was elected, stocks rose 400% in eight years.

Hillary could do the same, especially with a huge demographic tailwind of big spending Millennials kicking in in a few years.

The move to a carbon free economy that eventually leads to nearly free energy, hyper accelerating technology and health care advances will give all risk assets more of a push than Bill ever got.

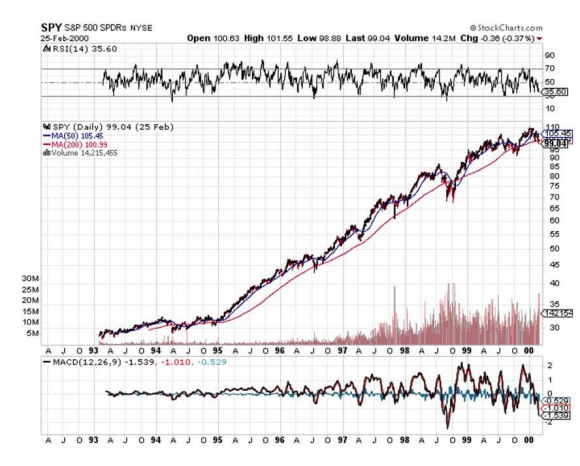

Ready for a Repeat?

Ready for a Repeat?

?He worked as if he would live forever. He lived as if he would die tomorrow?, said a note found in Franklin Delano Roosevelt?s private papers after he died.

?

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

April 25, 2016

Fiat Lux

Featured Trade:

(WHY THE BULL MARKET HAS TWO YEARS TO RUN),

(SPY), (TLT),

(TESTIMONIAL),

(QUANTITATIVE EASING EXPLAINED TO A 12 YEAR OLD)

SPDR S&P 500 ETF (SPY)

iShares 20+ Year Treasury Bond (TLT)

?

The bull market has at least two years to run, and possibly more.

This is the prediction that I have been hammering away at listeners with at my many speaking engagements, webinars, and global strategy luncheons all year.

But don?t take my word for it.

This also happens to be the opinion of my friend, Leon Cooperman, the legendary hedge fund manager at Omega Advisors.

I ran into my aged mentor in New York where we jointly analyzed and dissected our investment future.

Leon thinks that at a 17.5X earnings multiple, valuation are OK. He expects a total return for the S&P 500 (SPY) of 7-9%, including a 2% dividend. His outlook for all fixed income investments (TLT) is extremely negative.

There are only four possible causes of a recession from here:

1) Corporate earnings fall. But they are, ex energy,? in fact increasing at a respectable pace.

2) Stocks become overvalued. However, 16.5X is in the middle of its historic earnings multiple range. Many of the largest firms are trading at big market discounts. Apple (AAPL) is the prime example. It is the most widely owned stock in the world, and sells at a very modest 11X current cash earnings.

During the 2000 dotcom bubble top, Apple sold for 34X earnings (which today would value the company at a staggering $2.3 trillion, or 14% of US GDP!).

3) A hostile Federal Reserve would certainly take the punch bowl away. With deflation running amok globally, it is unlikely that the Fed moves until later this year. When they do, the action will be modest.

4) A geopolitical crisis would certainly throw a spanner in the works. These are unforecastable, and all the current ones (ISIS, Iran, Syria, Afghanistan, and the Ukraine) are inconsequential.

Cooperman observes that bear markets don?t arise from an immaculate conception, but a visible turn in the economic data flow. Given that, of the hundreds of data points Leon tracks on a weekly or months basis, not a single one is pointing towards recession.

That said, he cautions that the market historically peaks an average of seven months before every recession. Stock markets also rise an average of 30 months after the first Fed rate hike, taking in a typical 9.5% in the first year, which brings us to his two year upside target.

Don?t get too excited. The high returns of recent past years are now firmly in the year view mirror. The years ahead are more likely to bring a couple of yards forward and a cloud of dust, much like we witnessed in 2015.

Leon is urging his clients to take the most negative stance possible regarding their bond holdings. That means shortening duration (maturities), and moving up the credit curve. Shorter and safer is the way to go.

Avoid junk bonds like the plague, which are among the most overvalued in history.

A 2% GDP growth rate and a 2% inflation rate should give us a 4% yield on ten year Treasury bonds, not the lowly 1.89% we see on our screens today.

Look out below!

Cooperman is one of the few individuals I drop everything to listen to. He spent 25 years at Goldman Sachs (GS), eventually rising to the head of research.

He took off to start his own hedge fund in 1991, Omega Advisors, the same year I did, and became an early investor in my own fund. His returns have since been stellar, and Leon is regularly ranked as one of the top ten investment strategists in the country.

Ignore Leon at your peril.

Before we parted, Leon have me his short list of favorite stocks to own, many of which you already know and love from reading the Diary of a Mad Hedge Fund Trader. They include Google (GOOG), (GM), Citibank (C), (PCLN), (AER).

As a ringer, he also threw in (GULTU:US on NASDAQ), a high yield royalty trade spun off by none other than Freeport McMoRan (FCX), one of my biggest earnings last year.

With that, I thanked Leon for his always sage and prescient advice, and promised to revisit these issues with him in New York next month.

?If you advertise an interest in buying collies, a lot of people will call hoping to sell you their cocker spaniels,? said Oracle of Omaha, Warren Buffet.

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.

Looking for the Next Great Trade

Looking for the Next Great Trade

Ready for a Repeat?

Ready for a Repeat?