While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

May 27, 2016

Fiat Lux

Featured Trade:

(THE MAD HEDGE DICTIONARY OF TRADING SLANG),

(MY PERSONAL ECONOMIC INDICATOR),

(HMC), (NSANY), (GM), (F), (TSLA)

Honda Motor Co., Ltd. (HMC)

Nissan Motor Co. Ltd. (NSANY)

General Motors Company (GM)

Ford Motor Co. (F)

Tesla Motors, Inc. (TSLA)

"If you work forever, you can live forever,? said my friend and mentor, Blackrocks?s Byron Wien.

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

May 26, 2016

Fiat Lux

Featured Trade:

(WHY I LOVE THE BANKS),

(JPM), (WFC), (C), (XLF), (GS), (MS), (CMA), (BAC),

(SO WHAT IS YOUR ?INFLUENCER? SCORE)

JPMorgan Chase & Co. (JPM)

Wells Fargo & Company (WFC)

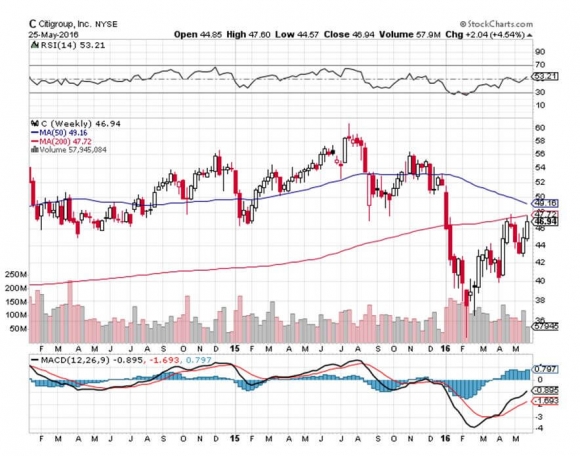

Citigroup Inc. (C)

The Select Sector SPDR Trust - The Financial Select Sector SPDR Fund (XLF)

The Goldman Sachs Group, Inc. (GS)

Morgan Stanley (MS)

Comerica Incorporated (CMA)

Bank of America Corporation (BAC)

I love banks, especially American ones.

I like those imposing, monumental edifices. I am attracted to those smooth marble surfaces. Those wrought iron grills at the teller windows are not to be trifled with.

They all reek of safety, stability, and certainty. What better place to park your life savings.

And I never hesitate to grab one of those free breath mints on the way out the door.

What?

They got rid of those during a 1980?s cost cutting binge? You always know that when they have to dump the breath mints to preserve their profit margin, there?s a problem.

The airlines did it 40 years ago, and look what happened to them.

However, today, banks and financial shares in general offer some unique investment opportunities.

What is a manager to do when the stock market is at a decade high valuation? You only buy cheap stuff.

What do you do when stock markets move in a narrow sideways range with no net movement? You only buy more cheap stuff.

What is a trader to do in a stock market characterized by rapid sector rotation? You only buy, you guessed it, cheap sectors.

Enter the banks.

You remember the banks, don?t you? That was the sector that was priced for perfection in anticipation of eight consecutive quarter point interest rate raises starting in December.

It only took a 10% stock market correction to rain on that parade, as the prospect of any further rate hikes was put on ice. Bank stocks plunged 40% in a heartbeat.

Now that the April Open Market Committee minutes have put a rate rise back on the table, we?re seeing that movie replayed one more time.

Banks stocks have already recovered half their January losses, except for JP Morgan Chase (JPM), which has already made back all the lost ground.

Nice trade Jamie Diamond!

This time around, banks have attractions that were missing in past cycles.

Oversight is now at record levels of intensity.

Nearly a decade of new share issues has brought bank capital to record levels, and liquidity is at an all time high.

Book values are growing at a decent pace.

Energy loan losses were wildly over exaggerated by the rumor mill.

Share valuations are discounting a full scale recession that, worst case, is at least 2-3 years off. Earnings are coming off the floor.

Efficiencies are growing by leaps and bounds. One of the reasons that New York City has had the worst residential real estate market for the past couple of years is that bank layoffs have reached the hundreds of thousands.

Bank subleasing of office space has been so prodigious that it is even starting to drag on the red hot San Francisco commercial real estate market.

In fact, you could write off an entire new housing crisis now and still have more capital left over than last time.

Stocks could double over the next interest rate cycle. They offer a double discount in price to book value (70%) and earnings multiple to the main market multiple (9X versus 19X). Dividend yield are the highest in history.

Even Facebook (FB) and Apple (AAPL) are unlikely to beat that.

The fines and penalties that came out of the financial crisis are now a distant memory. They are even getting reversed, as was the case with Bank of America last week.

Banks share are in fact a levered put on the bond market (TLT) and a call option on interest rates ($TNX).

There has been a lot of uninformed chatter about fintech eating the banks? lunch. But the reality is that the staggering regulation imposed on the banks by Dodd-Frank and the Treasury will act as an unassailable moat protecting the industry.

My guess is that entrepreneurs, developers, and coders will take one look at the morass of new rules and walk away to find some other industry to prey upon (real estate brokerage?).

The long promised breakups of the big banks will never happen, lest the US give away its competitive advantage with the rest of the world. If they do, it will unlock massive shareholder value, enabling the shares to double yet again.

You can buy any of the big household names, like (BAC), (JPM), Citibank (C), Wells Fargo (WFC), Morgan Stanley (WFC), or Goldman Sachs (GS) and do fine.

Or you could diversify and buy the basket through the Financial Select Sector ETF (XLF)? (click here for their prospectus at https://www.spdrs.com/product/fund.seam?ticker=XLF .

The smart regional bank play here is Comerica (CMA).

As a result of all of this, bank stocks are offering the lowest entry point in a generation.

After the January meltdown, I announced that banks and energy would become the top performing stock market sectors of 2016.

So far, I have been dead right on both calls.

The big question is if this is yet another bull trap and fake out with the banks, or whether this is the beginning of a long-term sustainable trend up.

We may well find out on Friday, May 27 at 10:30 PM EST, when chairman Janet Yellen addresses an economics forum at Harvard University.

Will her commentary be hawkish, dovish, neither, or both?

If?s she?s smart, she?ll talk about the weather.

?Negative interest rates are highly supportive of bonds and stocks. This could remain for quite some time,? said Dan Ivascyn, CIO of bond giant PIMCO.

?

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. This is your chance to ?look over? John Thomas? shoulder as he gives you unparalleled insight on major world financial trends BEFORE they happen. Read more

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.