At long last, Hillary Clinton has started to make public key planks of her post election policies, which may become law if she is successful in her 2016 presidential bid.

Until now, her run for the Democratic nomination has largely been about what she had for breakfast, her hairstyle, how nice her mom was, or how tough her dad was.

I have known Hillary Clinton for more than 20 years, since not long after she moved into the White House. It is no secret what she stands for, and none of her proposed policies should come as a revelation to anyone.

If you are a member of the ?1%? you are in for some bad news. You are target number uno.

If you own a home, work for a large company, save for your retirement, earn money from capital gains, and toss in a check when they pass the dish around at church every Sunday, you are the biggest beneficiary of the current tax system, by miles.

Therefore, you are about to take a big hit.

I have been compiling data for this piece for months, piecing together conversations with her staff and policy wonks, as well as pulling from her public speeches.

The tax policies will do nothing less than remake the United States of America over the coming decade, beyond all recognition.

The implications for your trading and investment portfolio are huge. I have outlined a summary of coming tax changes below, along with her (not my) rationale behind them.

1) Energy

Moving capital out of carbon based energy sources and into alternative ones will be a big priority for the new President Clinton. The elimination of century old tax breaks for the oil industry will be used to finance a massive expansion into alternative energy, primarily solar.

Her big goal is the oil depletion allowance, long despised by environmentalists, which diverts about $60 billion a year from the US Treasury onto the bottom lines of oil companies.

This measure, pushed through by a Texas senator during the Great Depression, permits energy investors to write off all capital expenses during the first year, while realizing the income over the full life of a well, usually 20-30 years.

After all, why should we be subsidizing more production during a burgeoning oil glut?

Call it a carbon tax by another name.

Hillary? ultimate goal is to increase America?s share of alternative energy production from the present 7% to 33% by 2030. Add in nuclear power, and that raises non-carbon energy to 50% of the US total. She has specifically mentioned installing 500 million solar panels in a decade.

Gee, do you know anyone who has been pounding the table about solar stocks, like Solar City (SCTY) and First Solar (FSLR)?

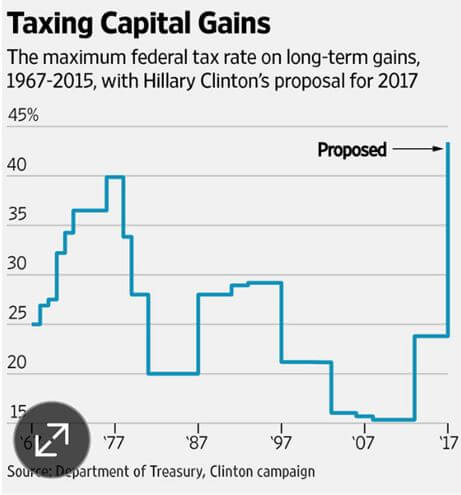

2) Capital Gains

Hillary?s proposal to raise capital gains rates, effectively taxing all short term gains as regular income will have major implications for all traders and investors alike.

Profits realized on investments held for more than 365 days are currently taxed at a 20% rate for those couples earning over $466,951. This special treatment of investment profits also dates back to the 1930?s. President Carter lowered it to 20%, then George W. Bush took it down to 15%..

Clinton wants to treat short-term gains as ordinary income, thus boosting the tax rate to 43.4%. She also wants to extend the minimum holding period to qualify for long-term gains from one year to two.

Her attack on what she calls ?quarteritis?, the excessive focus by corporate America on short-term results at the expense of long term goals, is laudable.

It could also deal a deathblow to high frequency traders, never popular people, whose holding period of securities rarely extends beyond a nanosecond.

These measures are expected to raise $36 billion a year in new revenues for the federal government.

3) Carried Interest

Instituted by President Carter during the late 1970?s to encourage venture capital investment, the use of the carried interest loophole has grown far beyond its original intention.

It essentially enables hedge fund and private equity managers to convert high tax ordinary income into long-term capital gains, thus creating the famed 15% maximum tax rate for the wealthy.

Carried interest does not have a big impact on federal revenues. Its elimination will raise only about $25 billion. It is more of a ?fairness? issue, targeting the 1%, and leveling the playing field for the middle class.

If you don?t believe that ?fairness? is such a big deal, remember that the American Revolution was ignited over exactly this kind of matter, the preferential treatment of British importers over US ones.

4) Home Mortgage Deduction

Should renters be subsidizing homeowners? Kiss that home mortgage interest deduction goodbye for high-end properties. Ditto for the real estate market as a whole.

Hillary wants to limit home mortgage interest deductibility to loans of only $500,000, half of the present $1 million.

This will have the effect of taxing the coasts, east and west, where the expensive homes are, to the benefit of cheaper housing in the Midwest. That great ocean view is about to get more expensive.

?

Ironically, it will funnel cash from blue states to red states. Is Clinton cutting off her nose to spite her face?

Still, it is another ?fairness? issue. It is also a biggie. The move would raise $100 billion in new federal revenues.

5) Ending the Tax Deductibility of Charitable Contributions

Should those who don?t go to church subsidize those who do? Should the public be financing extremist, toxic political campaigns? That?s what ending the tax deductibility of charitable contributions would prevent.

In fact, some 90% of this money currently goes to the fine arts patronized by the well off. Think of this as another tax the rich measure. Universities, churches, and political fund raising will go begging.

But this is another elephant, picking op a further $100 million a year for the feds.

6) Ending 401k Contributions

Should those without savings subsidize those salting away money for retirement? This is the argument that will be made to end tax deductibility of 401k contributions.

Originally engineered by the Reagan administration as a get rich quick scheme for Wall Street, it has proved wildly successful.

Such a measure would boost government revenues by $55 billion a year, and would act as another income leveler for the middle class.

However, don?t expect this to get much traction with the public. A trial balloon was sent up for this a few years ago, and the hue and cry were deafening.

7) Phase Out the Stepped Up Cost Basis

Another Reagan measure, the stepped up cost basis allows surviving spouses to mark their homes to market and use that as their new cost basis, this avoiding punitive capital gains taxes.

It was enacted because high inflation during the seventies and eighties was raising home values so fast that widows and widowers had to sell their homes when bereaved because they couldn?t afford the estate taxes.

I must admit that I cashed in on this when my own spouse passed away, effectively earning millions from the great California property bubble tax free.

The measure will create some $40 billion in new government income. She doesn?t need that McMansion without you anyway.

8) Tax Dividend Income as Regular Income

Guess who this one targets? Approximately 80% of all stocks are owned by Republicans. Treating dividends as ordinary income would raise the rate from 20% to 43.4% for high-income earners.

If you are still breathing, you can now pick yourself up off the floor so I can add a few conditions and provisos.

It will be politically impossible for President Clinton to get any of these changes through a divided congress.

While recapturing th

e Senate is a slam-dunk in 2016 thanks to a friendly calendar, Democratic control of the House is an open issue, thanks to extensive gerrymandering. It really all depends on how much air time Donald Trump gets.

Maybe he should host ?Wheel of Fortune? to boost his numbers?

A divided congress means that only one of these measures might get through as a quid pro quo for Republicans to get one of their favorite tax breaks through.

The most likely candidate would be to allow corporations to bring their $2 trillion stash of foreign profits home tax-free.

I want to end on an upbeat note so you don?t run away and jump off the nearest bridge.

None of these hikes would be necessary if the economy grew at a 4% real rate instead of the present 2-2.5%.

This is exactingly what I have been predicting in my many research pieces, thanks to a massive demographic tailwind that begins during the 2020?s (click here for Get Ready for the Coming Golden Age).

Think goodbye 80 million retiring baby boomers who are a drag on the economy, hello 85 million free spending millennials.

That would balance the federal budget very quickly and thus eliminate the need for any tax increases whatsoever.

A new administration with no tax hikes! That would be one popular president!