While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

May 17, 2016

Fiat Lux

Featured Trade:

(TEST DRIVING TESLA?S SELF DRIVING TECHNOLOGY),

(TSLA),

(WILL GOLD COINS SUFFER THE FATE OF THE $10,000 BILL?)

(GLD), (GDX)

(TESTIMONIAL)

Tesla Motors, Inc. (TSLA)

SPDR Gold Shares (GLD)

VanEck Vectors Gold Miners ETF (GDX)

I knew I was on the right track when the salesman told me that the customer who just preceded me for a Tesla Model X 90D SUV was the Golden Bay Warriors star basketball player, Steph Currie.

Well, if it's good enough for Steph, then it's good enough for me.

Last week, I received a call from Elon Musk's office to test the company's self-driving technology embedded in their new vehicles for readers of the Diary of a Mad Hedge Fund Trader.

I did, and prepare to have your mind blown!

I was driving at 80 MPH on CA-24, a windy eight-lane freeway that snakes its way through the San Francisco East Bay mountains. Suddenly the salesman reached over and flicked a lever on the left side of the driving column.

The car took over!

There it was, winding and turning along every curve, perfectly centered in the lane. As much as I hated to admit it, the car drove better than I ever could.

All that was required was for me to touch the steering wheel every five minutes to prove that I was not sleeping.

The cars do especially well in rush hour driving, as it is adept at stop and go traffic. You can just sit there and work on your laptop, read a book, or watch a movie on the built in 4G WIFI HD TV.

When we returned to the garage the car really showed off. When we passed a parking space, another button was pushed, and we perfectly backed 90 degrees into a parking space, measuring and calculating all the way.

The range is 255 miles, which I can recharge at home at night from a standard 220-volt socket in seven hours. The chassis can rise as high as eight inches off the ground so it can function as a true SUV.

The ludicrous mode, a $10,000 option, take you from 0 to 60 mph in three seconds. However, even a standard Tesla can accelerate so fast that it will make the average passenger carsick.

Here's the buzz kill.

Tesla absolutely charges through the nose for extras.

The 22-inch wheels are $5,500, the third row of seats to get you to seven passengers is $4,000, the premium sound is $2,500, leather seats are $2,500, and the self-driving software is $2,500.

A $750 tow hitch will accommodate a ski rack on the back. There is a $1,000 delivery charge, even if you pick it up at the Fremont factory.

It's easy to see how you can jump from an $88,000 base price to a total cost of $130,000, including taxes.

The middle row of seats DOESN'T fold down flat, limiting your cargo space to 6 feet long and 3 1/2 feet wide. So if you are a frequent hauler of surfboards and skis, as I am, you will have to order the six-seat configuration and squeeze them between the two middle row seats.

My company will be purchasing the car under Section 179 of the International Revenue Code. The car qualifies because it weighs over 6,000 pounds and is therefore a truck under tax law.

This allows me to deduct the entire $130,000 cost of the vehicle up front, plus the maintenance and insurance costs for the entire life of the car. However, I will have to maintain a mileage log as a hedge against any future IRS audits.

Ironically, Section 179 was enacted as a subsidy for consumer purchases of the eight mile per gallon Hummer, which was originally built by AM General and owned by General Motors (GM).

After several attempts to sell the division failed, production was permanently shut down. However, the tax subsidies live on for any like designed vehicle.

What was really amazing was to learn how far the technology has moved forward fr0m my four year old Tesla Model S-1.

The range is now 302 miles. Only four-wheel drive versions are now made. And it too has the self-driving software.

It looks like I'll have to buy two Tesla's this year.

As for 'drop dead' curb appeal, nothing beats the Model X. Concerning the stock, not so much.

Thanks for Your Subscription!

The conspiracy theorists will love this one.

Buried deep in the bowels of the 2,000 page health care bill was a new requirement for gold dealers to file Form 1099's for all retail sales by individuals over $600.

Specifically, the measure can be found in section 9006 of the Patient Protection and Affordability Act of 2010.

For foreign readers unencumbered by such concerns, Internal Revenue Service Form 1099's are required to report miscellaneous income associated with services rendered by independent contractors and self-employed individuals.

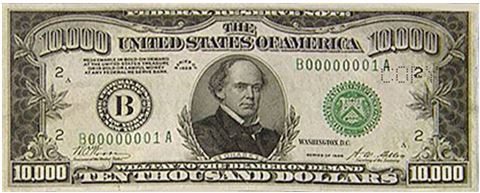

The IRS has long despised the barbaric relic (GLD) as an ideal medium to make invisible large transactions. Did you ever wonder what happened to $500, $1,000, $5,000, and $10,000 bills?

The $100,000 bill was only used for reserve transfers between banks, and was never seen by the public. The other high denomination bills were last printed in 1945, and withdrawn from circulation in 1969.

Although the Federal Reserve claims on their website that they were withdrawn because of lack of use, the word at the time was that they disappeared to clamp down on money laundering operations by the mafia.

IN FACT, THE GOAL WAS TO FLUSH OUT MONEY FROM THE REST OF US.

?

Dan Lundgren, a republican from California's 3rd congressional district, a rural gerrymander east of Sacramento that includes the gold bearing Sierras, has introduced legislation to repeal the requirement, claiming that it places an unaffordable burden on small business.

Even the IRS is doubtful that it can initially deal with the tidal wave of paper that the measure would create.

Currency trivia question of the day: whose picture was engraved on the $10,000 bill? You guessed it, Salmon P. Chase, Abraham Lincoln's Secretary of the Treasury.

Ever Wonder Where The $10,000 Bill Went?

Ever Wonder Where The $10,000 Bill Went?

Thanks for the swift answer about the (UVXY). I got 7% profit in one day, so I'll close. What about the (VXX)? Can that be held for longer?

As for your question about Europe, it is not doing good. The reasons why are so simple. Spain, Portugal, Italy and Greece have very different economies and different business cycles than Germany, France, and Belgium.

Sweden never joined the euro currency because we knew that our business cycle is not the same as Germany and France, Belgium and some other country I have forgotten about.

Hence we knew we needed our own central bank and our own currency to counterbalance these differences. That?s exactly what Spain, Italy, and Greece need.

The problem in the EU can never be solved with QE because Greece, Italy and Spain need the Euro to always be much, much weaker than Germany, which is a net beneficiary of the Euro.

Do you know what happened in Spain after they adopted the Euro? The cost of a beer went from ???2-3 to ?7-8 in many places. As a tourist, it's no longer cheap to go to Spain because it's almost the same price as in Sweden now, and?it used to be half price!! Imagine how bad that is for a tourist-based country.

Regards,

Per

Sweden

John Thomas responds: Yes, Per, the IPath S&P 500 VIX Short-Term Futures ETN (VXX) can be held for longer because I expect an imminent volatility (VIX) spike, and the cost of the contango with a 1X ETF will be much lower.

?US stock performance will be good in 2016, but is set to be outperformed by Japan, Europe, and emerging markets,? said a top manager at bond giant PIMCO.

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. Read more

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. This is your chance to ?look over? John Thomas? shoulder as he gives you unparalleled insight on major world financial trends BEFORE they happen. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

May 16, 2016

Fiat Lux

Featured Trade:

(THE DEATH OF THE FINANCIAL ADVISOR),

(HOW TO USE YOUR CELL PHONE ABROAD)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.