While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

August 18, 2016

Fiat Lux

Featured Trade:

(UPGRADE NOW TO MAD OPTIONS TRADER),

(SEPTEMBER 16th PORTLAND, OR GLOBAL STRATEGY LUNCHEON),

(PETER F. DRUCKER ON MANAGEMENT)

I had planned on formally launching our new Mad Options Trader service at the end of August.

But why wait?

Matt has delivered such blowout results so far this month, up a stunning 20%, that to delay might unfairly deprive subscribers from future profits.

So, as of today, Nancy, in customer support, is taking Mad Options Trader orders. Just put "MOT Upgrade" in the subject line, and she will get back to you shortly.

This is how the upgrade works.

For example, let?s say you have nine months remaining on your existing $3,000 Global Trading Dispatch subscription. You will get a credit for $2,250. Nancy will then bill you $4,500 against this.

That brings the upfront cost for the upgrade to $2,250, but your subscriptions for the GTD + MOT combo now have a full year to run together.

This means that Nancy is going to have to manually calculate the price for each new upgrade to MOT for each of you individually, and then give you a precise amount you can send to us by PayPal or check.

Early action will be rewarded.

Regardless, your free MOT "test flight" will continue until the end of August, as promised, and the new paid MOT subscription will start on September 1st.

The month end coincides with the Labor Day weekend, so the time we can deal with the incoming crush of orders is thus further shortened.

Nancy warned me that I better start processing orders now, or her ?head would explode.?

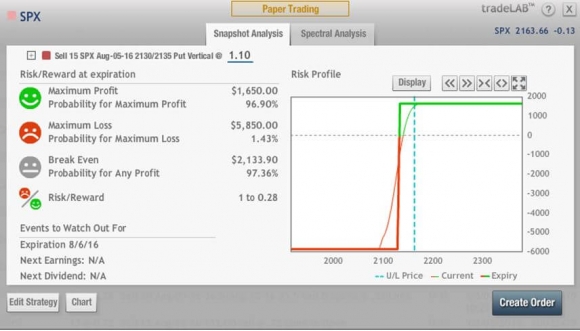

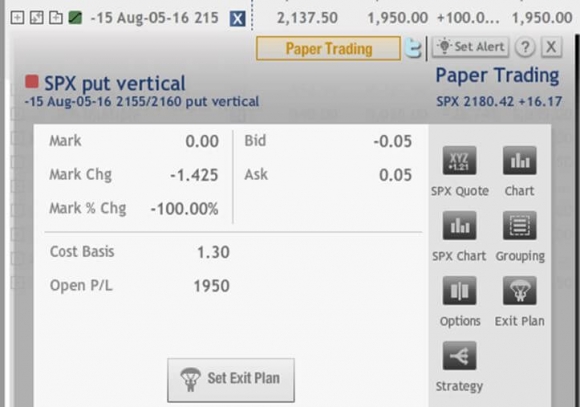

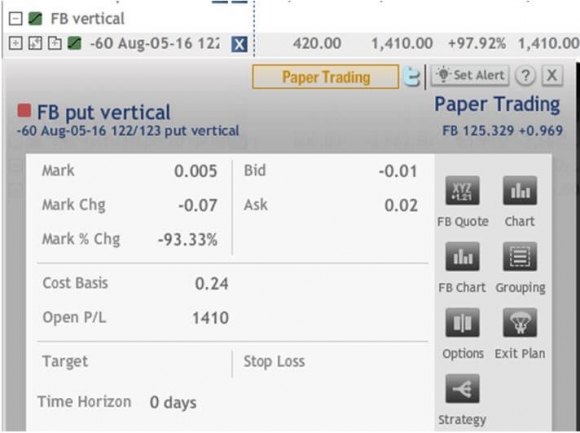

Matt?s unique service focuses primarily on the weekly US equity options expirations, with the goal of making profits at all times.

The trading will take place in the S&P 500 (SPX), major industry ETF?s like the Financials Select Sector (XLF), and large capitalized single names, such as Facebook (FB), JP Morgan Chase & Co. (JPM), and Apple (AAPL).

Matt is my old friend and fellow comrade in arms of Top Gun Options, one of the best performing trade mentoring outfits in the industry.

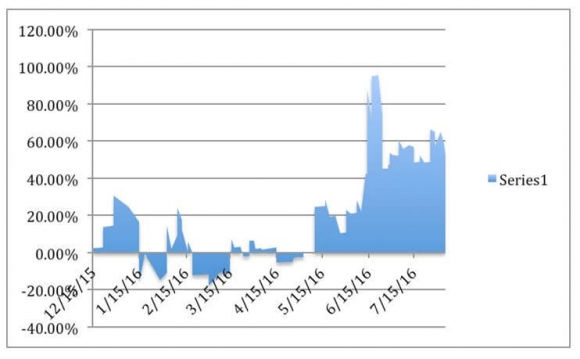

Matt knows what he is talking about. An independent audit shows that he has racked up an incredible 53.03% performance, net of commissions and fees, so far in 2016, one of the most difficult years in trading history.

That works out to an average 7.92% a month, or an incredible 95.09% a year.

Matt, a native of New Jersey, joined the Navy straight out of college, and rose to become an F-18/A fighter pilot. He attended the famed Top Gun school in Coronado, California. During the second Iraq War, Matt flew 44 combat missions.

Matt left the service in 2006, and immediately entered the hedge fund industry. A rapid series of promotions eventually took him to Peak6 Investments, L.P., a prominent Chicago hedge fund.

There, he soaked up the most crucial elements of technical market timing, fundamental name selection, risk control, and options trade execution.

These are the multiple skills that have enabled Matt to post such a blockbuster performance.

Matt, known to his friends by his old pilot handle of ?Whiz?, is an incredibly valuable addition to the Mad Hedge Fund Trader team. I have appointed him Head of Options Trading.

I have known for some time that fortunes were being made in the weekly options expirations, where stories of tenfold returns are not unheard of. It is a strategy that is perfectly suited to these highly volatile, uncertain times, with most options positions expiring within four days.

Matt allows us to fill that gap in our product offerings.

The Mad Options Trader provides essential support for the active trader and will include:

1) Instant Trade Alerts texted out at key technical levels. Alerts will be sent out on the opening and closing of every position.

2) Weekly Market Strategy Webinars held every Monday at 1:00 PM EST to give you a head?s up on the week ahead.

3) A weekly Live Trading Room held every Tuesday from 9:00 to 11:00 AM EST to give members active real time trading experience.

4) Specialized Training Webinars on how to best execute Matt?s trades.

What I love about Matt is that he eats his own cooking. Many of the Trade Alerts he recommends are executed in his own personal retirement account with real dollars.

To see how he has performed so far in 2016, please check out the daily chart below.

Good Luck and Good Trading,

John Thomas

Publisher and CEO of The Mad Hedge Fund Trader

Mad Options Trader 2016 YTD Independently Audited Performance

Come join me for lunch at the Mad Hedge Fund Trader?s Global Strategy Update, which I will be conducting in Portland, Oregon at noon on Friday, September 16, 2016.

A three course lunch will be followed by an extended question and answer period.

I?ll be giving you my up to date view on stocks, bonds, currencies, commodities, precious metals, and real estate. And to keep you in suspense, I?ll be throwing a few surprises out there too.

Enough charts, tables, graphs, and statistics will be thrown at you to keep your ears ringing for a week. Tickets are available for $208.

I?ll be arriving at 11:30 AM and leaving late in case anyone wants to have a one on one discussion, or just sit around and chew the fat about the financial markets. I expect a small group, so there will be plenty of opportunities to exchange ideas.

The lunch will be held at five star downtown Portland hotel the exact location of which will be emailed to you with your confirmation.

I look forward to meeting you, and thank you for supporting my research.

To purchase tickets, please click here.

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

August 17, 2016

Fiat Lux

SPECIAL CYBER SECURITY ISSUE

Featured Trade:

(MORE CASHING IN ON CYBER SECURITY),

(PANW), (FEYE), (HACK), (SNE)

Palo Alto Networks, Inc. (PANW)

FireEye, Inc. (FEYE)

PureFunds ISE Cyber Security ETF (HACK)

Sony Corporation (SNE)

I have covered this exciting sector at length in previous newsletters.

Now we have a fantastic entry point!

Who?s really reading your email? I bet you?d like to know!

Another day, another hack attack.

Today we learned that 5.6 million fingerprint records kept by the Office of Personal Management were recently stolen.

This is the agency that functions as the US government?s human resources department, maintaining records on 21.5 million current and former employees.

The timing couldn?t be more inauspicious, as the announcement was made during a visit by Chinese president Xi Jinping, whose military was almost certainly the origin of the attack.

Great! Now the enemy has the fingerprints of every FBI and CIA agent!

There must be a way to make money out of this.

Wait! There is!

Palo Alto Networks (PANW) is a San Francisco Bay area cyber security company that offers businesses and governments an innovative firewall platform solution for big, network wide security problems.

In the P&L sweet spot they are.

I know the company well, and have been recommending to my followers that they buy the shares for the past year, during which time it tripled.

What? You want me to buy a stock that has just tripled?

No, I have not just started smoking California largest agricultural product (no, it?s not almonds or grapes).

By chance, I happened across a senior officer of the Palo Alto Networks at a dinner party last week. Prospects for the firm are booming, with sales growth running at a torrid 30% YOY rate.

Yet, (PANW) has only 10% market share of an industry that is currently exploding. This is an aggressive, extremely well managed $15 billion company that is about to become a $150 billion company.

Keeping in contact with the Joint Chiefs of Staff on a weekly basis, I am constantly concerned at how serious the cyber security threat has become, yet how little understood it is by the public.

You don?t have to go any further than the management of Sony (SNE), one of the world?s largest multinationals, which was almost wiped out in November 2014 by hackers from one of the poorest and most backward countries in the world.

Upset by the portrayal? of their leader, Kim Jong-un, in a low budget comedy, The Interview, North Korean hackers were able to bring the firm to its knees.

They downloaded the entire contents of Sony?s hard drives, leaking the juicy parts to online journalists (Angelina Jolie?s pay, etc.), and then wiped them clean, destroying some 3,000 computers and 8000 servers. It was the hacking equivalent of a full-scale nuclear attack.

Sony had to revert to snail mail, couriers, and landline telephone calls to survive. They couldn?t even pay their employees. Some $6 billion in market capitalization was wiped out.

Now here is the scary part.

The FBI has confided in me that if the S&P 500 were subjected to a Sony level attack, 90% are unlikely to survive. And the Sony attack was actually a primitive, simplistic, low-level attack.

A lot of countries don?t like the United States for any number of reasons. Now they can do something about it. That is a problem. And a market.

Palo Alto Networks maintains the world?s largest database of viruses and malware. That enabled it to trace the Sony attack to the Hermit Kingdom within hours.

It contained several lines of code that were identical to the ?Dark Soul? attack against South Korean banks in 2013, which incinerated 40,000 bank computers and caused $700 million worth of damages.

What the Sony attack revealed was a long history of massive under investment in cyber security by corporations and governments in the US, Europe, and Asia.

The potential future market for cyber security products and services is being wildly underestimated.

The great irony here is that the attack is not against systems, which are usually pretty secure. It is their human users that have become the problem.

Unfortunately, we are have become familiar with ?spoofing? emails where an innocuous email asks the user to ?click here? for an Adobe upgrade, a notice from Yahoo, or a request from PayPal to update your password.

Do so, and you invite lines of code that will eventually make it to your system administrator. Once they have this password, they can access or do anything.

Don?t think only dummies fall for this.

My friend, retired FBI chief Robert Mueller, had his personal account at the Bank of America cleaned out in a similar fashion. What was unusual in his case is they caught the transgressor, after a huge expenditure of bureau resources.

(Hint: if an incoming email appears the slightest bit suspicious, hover your mouse over the sender?s name, and the sending email address will appear. If it looks anything but belt and braces safe, don?t open it and mark it as SPAM. Especially watch for the last three letter of the address, which are always a tip off).

The FBI estimates that there are up to 10,000 hackers in the world with the capability of a Sony level attack, many operating from China, Russia, Eastern Europe, or other locations beyond the reach of US extradition treaties.

The global cyber war has been going on for about 15 years now, and the public hears very little about it.

In recent years, Iran attacked Saudi Arabia?s Aramco, destroying 30,000 computers, and briefly shutting down a portion of the country?s oil production.

A major attack was launched against the Venetian Hotel in Las Vegas, which is owned by prominent Israel supporter and major Republican Party contributor, Sheldon Adleson.

There is a happy ending to this piece. You don?t need to place your entire wealth into gold bricks and bury them in the backyard to keep it safe.

If North Korea is a bicycle in the hacking arms race, the US is the F-35 Lightening next generation stealth fighter.

We are winning the cyber way hands down, but you?d never know it. This is a war fought silently, online, and in dark shadows.

President Obama in fact authorized a measured counter attack on North Korea?s information infrastructure, which proved devastating. But it was only a pinprick relative to what we could have done.

Our real cyber weapons are reserved for an actual shooting war sometime in the future. That?s to prevent the enemy from learning our true capabilities and preparing for them.

Imagine a country trying to defend itself with snail mail, couriers, and landline telephone calls from an American assault. Think the Sony attack times 10,000. Nothing would work.

It couldn?t be done.

Congress has so far refused to fund a substantial increase in America?s cyber warfare arsenal, referring instead to spend money on old heavy metal weapons systems, like aircraft carriers, tanks, and the above mentioned F-35.

It?s all about sucking money out of Washington to create local jobs in red states to win elections. A stepped up cyber program would focus money almost entirely in Silicon Valley.

Don?t want to do that!

This is how General George Armstrong Custer was sent to the Battle of Little Big Horn with antiquated 16 year old Civil War trapdoor Springfield carbines, while the Sioux had state of the art Winchester ?yellow boy? repeaters.

And we know how that one turned out!

But don?t get mad. Get even. Take another look at Palo Alto Networks (PANW), Fireye (FEYE), and the Pure Funds ISE Cyber Secu

rity ETF (HACK).

Guess Who May Be Looking at Your Records?

While the Global Trading Dispatch focuses on investment over a one week to six-month time frame, Mad Options Trader, provided by Matt Buckley, will focus primarily on the weekly US equity options expirations, with the goal of making profits at all times. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.