While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

February 16, 2016

Fiat Lux

Featured Trade:

(NO ZERO INTEREST RATES HERE!),

(TLT), (BAC), (C), (JPM), (MS), (GS),

(THE NEW COLD WAR),

(THE HISTORY OF TECHNOLOGY)

iShares 20+ Year Treasury Bond (TLT)

Bank of America Corporation (BAC)

Citigroup Inc. (C)

JPMorgan Chase & Co. (JPM)

Morgan Stanley (MS)

The Goldman Sachs Group, Inc. (GS)

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

February 12, 2016

Fiat Lux

Featured Trade:

(JANET LAYS AN EGG)

(SPY), (TLT), (FXY), (GOOGL), (AAPL), (TWTR), (FB),

(WHO THE GRAND NICARAGUA CANAL HAS WORRIED)

SPDR S&P 500 ETF (SPY)

iShares 20+ Year Treasury Bond (TLT)

CurrencyShares Japanese Yen ETF (FXY)

Alphabet Inc. (GOOGL)

Apple Inc. (AAPL)

Twitter, Inc. (TWTR)

Facebook, Inc. (FB)

Financial markets often behave like demanding, spoiled, and fickle children. If they don?t get what they want RIGHT NOW they throw a temper tantrum.

That is exactly what bourses are doing around the world.? The Dow Average rallied 500 points this week in the hope that my former Berkeley economics professor, Federal Reserve governor Janet Yellen, would suddenly turn into an ultra dove.

It was thought that she would totally cave on any interest rate increases for the rest of 2016 at her Wednesday Humphrey-Hawkins testimony in front of a hostile congress.

Instead, Janet laid an egg. Risk markets everywhere suffered cardiac arrest.? The 500-point rally quickly turned into a 700-point loss. Blink, and you lost your last chance to get out.

The Japanese yen rocketed as hedge funds rushed to cover their shorts, which they had been using to fund their rapidly fading ?RISK ON? positions. Panic dumping long positions mean those yen shorts are no longer needed.

What is particularly gob smacking is to see a ten year Treasury yield crater to only 1.50%. As I outlined in last week?s Global Strategy Webinar, the (TLT) is clearly headed for its old all time high of $135, which equates to a parsimonious 1.36% yield.

If you refinanced your home last month to cash in on lower interest rates, better plan on doing it again next month!

Both the Treasury market and global bank shares are now discounting another Great Recession that is absolutely nowhere on the horizon.

It all vindicated my aggressive hedging of my trading book, which I put into place at the beginning of January.? Gotta love those (SPY) April $182 puts! They?re better than Ambien in helping me sleep at night.

February is shaping up to be a very big month for the Mad Hedge Fund Trader?s model trading portfolio.

In the meantime, more data came out this morning confirming the recession that isn?t.

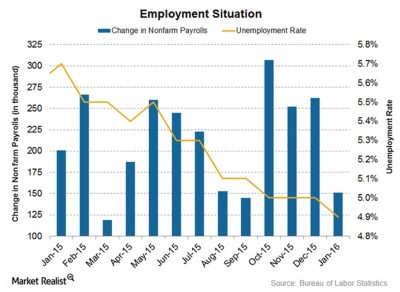

The Thursday weekly jobless claims plunged by 16,000 to 261,000, within spitting distance of a new 14 year low.

This is on the heels on last week?s respectable +175,000 January nonfarm payroll. This compares to a monthly LOSS of -700,000 jobs we saw in 2009.

Sure, the 0.7% US Q4 GDP is nothing to run up the flagpole and salute. But it is still growth. Most industries are reporting record profits.

I have to admit, I have never seen the economy so bifurcated.

In my daily customer calls I hear of Armageddon in the oil patch. But you can?t find office space in the San Francisco Bay area to save your life. And there are several whales looking for a staggering 10,000-20,000 square feet EACH!

These are all operations that started out in a garage only a decade ago. Add up the market capitalization of Google (GOOGL), Apple (AAPL), Facebook (FB), Twitter (TWTR), and Uber and we have created $1 trillion of equity out of thin air in only ten years.

Eventually, all good corrections come to an end. The hot money gets sold out, the margin clerks have taken their pound of flesh, the newbies get wiped out, and we run out of traders willing to chase the move down.

Then the cash rich long-term funds suddenly realize that we have a market that is selling at a 15X multiple in an economy that is about to speed up again. In addition, there is nothing else to buy.

Then it is off to the races to new all time highs by year end.

I am sticking to my New Year forecast of a 15% selloff that takes the S&P 500 down to $1770, which then rallies 20% by the end of December.

Recession? What Recession?

Recession? What Recession?

Janet Lays an Egg

Janet Lays an Egg

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

February 11, 2016

Fiat Lux

Featured Trade:

(THE BATTERY IN YOUR FUTURE), or

(THE GREENING OF EXXON),

(USO), (SNE), (TSLA), (XOM),

(SCAM OF THE MONTH)

United States Oil (USO)

Sony Corporation (SNE)

Tesla Motors, Inc. (TSLA)

Exxon Mobil Corporation (XOM)

Yesterday, I provided to you the evidence that oil may never again reach a triple digit price click here for ?Oil: It?s Different This Time? .

Today I am going to tell you what will replace it.

Sony Corp. (SNE) invented the lithium ion battery in 1991 to power its high end consumer electronics products. It is now looking like that was a discovery on par with Bell Labs? invention of the transistor in 1947 and Intel?s creation of the microprocessor in 1971, although no one knew it at the time.

Until then, battery technology was essentially unchanged since the first one was invented by Alessandro Volta in 1800 and Gaston Plante upgraded it to the lead acid version in 1859. That is the same battery that today starts your conventional gasoline powered car every morning.

The Sony breakthrough proved the springboard for a revolution in battery power. It has fed into cheaper and ever more powerful iPhones, electric cars, and even large scale utilities.

In 1995, the equivalent of today?s iPhone 6 battery cost $20. Today it can be had for $1.40 if you buy in bulk, which Apple does by the shipload. That?s a cost reduction of a mind blowing 93%.

Electric car batteries have seen prices plunge from $1,000/kilowatt in 2009 to only $200 today.

Tesla (TSLA) expects that price to drop to $150 when its $6 billion new ?gigafactory? comes online in Sparks, Nevada next year. The facility will produce cookie cutter off the shelf batteries made under contract by Japan?s Panasonic (Matsushita).

That will pave the way for the Tesla 3 in 2018, a low end $35,000 vehicle with a 200-mile range that will take over the global car market.

If you took existing battery technologies and applied them as widely as possible, it would have the effect of reducing American oil consumption from 22 to 18 million barrels a day. That?s what the oil market seems to be telling us, with prices at a 13-year low at $26 a barrel.

Improve battery capabilities just a little bit more and that oil consumption drops by half very quickly.

Both national and state governments are doing everything they can to make that happen.

The US is taking the lead here and now has a commanding technology lead over the rest of the world (I can?t believe the Germans fell so far behind on this one).

In 2009, President Obama chipped in $2.4 billion for battery and electric car development as part of his $787 billion stimulus package. He got a lot of bang for the buck.

So far, I have been the beneficiary of not one, but two $7,500 federal tax credits for my purchase of my Nissan Leaf and Tesla S-1. The Feds also chipped in another $13,000 for my new solar roof panels.

A reader told me yesterday that Sweden will ban the sales of gasoline and diesel powered vehicles from 2030. Japan wants electric and hybrids to account for half of its new car sales by 2020.

California has been the most ambitious, investing to obtain 50% of its power from alternative sources by 2030. Some 450,000 homes here already have solar panels, and these are not even counted in the equation.

Solar and wind are already taking over in much of Europe on a nonsubsidized, cost competitive basis.

At the current rate of improvement, electric cars will be cheaper than gasoline powered ones in only a few years. By 2030, a ten-pound battery in your glove compartment (glove box to you in London) will be able to take your car 300 miles. The cost of energy will essentially be free.

And guess what?

In a year, I will be able to use my solar panels to charge my 85-kilowatt Tesla battery during the day and then use it to power my home at night. That is enough juice to keep the lights on for three nights. Then, I will be totally off the grid, with utility bills of zero.

Tesla has denied it has such a program, but there is nothing to stop a third party from coming in and providing the service. All it would require is an app and 30 minutes worth of wiring.

To say this will change the geopolitical landscape would be a huge understatement. The one liner here is that oil consumers will benefit enormously, while the producers will get destroyed. I?m talking Armageddon, mass starvation levels of destruction.

In the Middle East, some 1 billion people with the world?s highest birth rates will lose their entire source of income.

Russia, which sees half its revenues come from oil, will cease to be a factor on the international stage, and may even undergo a third revolution. Take oil away, and all they have left is hacking.

Norwegians will have to start paying for their social services instead of getting them for free.

Venezuela, which couldn?t make it at $100 a barrel, will implode, destabilizing Latin America.

It going to be an interesting decade for we geopolitical commentators.

Further improvements in battery power per dollar will change the US economy beyond all recognition. This will be a big win for the 90% of the economy that consumes energy and an existential crisis for the 10% that produce it.

Public utilities will have to change their business models from power producers to distributors.

No less an authority than former Energy Secretary Dr. Steven Chu (another Berkeley grad) has warned the industry that they must change or get ?Fedexed?, much the same way that overnight delivery replaced the US Post Office.

US oil majors will suffer some very tough times, but won?t disappear. My bet has always been that they will buy the entire alternatives industry the second it becomes profitable.

After all, they are not in the oil business, but in the profit making business, and they certainly have the cash and the management and engineering expertise to pull this off. Exxon (XOM) will turn green out of necessity.

As is always the case, there are very few publicly listed stock plays in a brand new emerging technology like the battery sector. Many of the early stage entrants have already filed for bankruptcy and had their assets taken over for pennies.

It?s a business you want to be in because Citibank expects that giant grid scale batteries alone will be a $400 billion a year market by 2030.

When I visit friends at the oil majors in Houston, I chide them to be kind to that Birkenstock wearing long haired visitor.

He may be their future boss.

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. This is your chance to ?look over? John Thomas? shoulder as he gives you unparalleled insight on major world financial trends BEFORE they happen. Read more

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.