As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. This is your chance to ?look over? John Thomas? shoulder as he gives you unparalleled insight on major world financial trends BEFORE they happen. Read more

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. This is your chance to ?look over? John Thomas? shoulder as he gives you unparalleled insight on major world financial trends BEFORE they happen. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

October 4, 2016

Fiat Lux

Featured Trade:

(LAST CHANCE TO ATTEND OCTOBER 7th INCLINE VILLAGE, NV GLOBAL STRATEGY LUNCHEON),

(11 SURPRISES THAT WOULD DESTROY THIS MARKET),

(SPY), (TLT), (FXE), (USO)

SPDR S&P 500 ETF (SPY)

iShares 20+ Year Treasury Bond (TLT)

CurrencyShares Euro ETF (FXE)

United States Oil (USO)

Come join me for lunch at the Mad Hedge Fund Trader?s Global Strategy Update, which I will be conducting in Incline Village, NV on Friday, October 7, 2016. An excellent meal will be followed by a wide-ranging discussion and an extended question and answer period.

I?ll be giving you my up to date view on stocks, bonds, currencies, commodities, precious metals, and real estate. And to keep you in suspense, I?ll be throwing a few surprises out there too. Tickets are available for $218.

I?ll be arriving at 11:30 and leaving late in case anyone wants to have a one on one discussion, or just sit around and chew the fat about the financial markets.

The lunch will be held at the premier restaurant in Incline Village, Nevada on the sparkling shores of Lake Tahoe. Those who live there already know what it is. The precise location will be emailed with your purchase confirmation.

I look forward to meeting you, and thank you for supporting my research. To purchase tickets for the luncheon, please click here.

While the Global Trading Dispatch focuses on investment over a one week to six-month time frame, Mad Options Trader, provided by Matt Buckley, will focus primarily on the weekly US equity options expirations, with the goal of making profits at all times. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

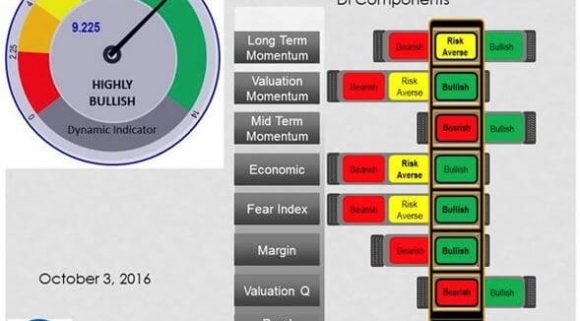

October 3, 2016

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE COMING WEEK),

(SPX), (VIX), (USO), (AAPL),

(WHY TECHNICAL ANALYSIS DOESN?T WORK),

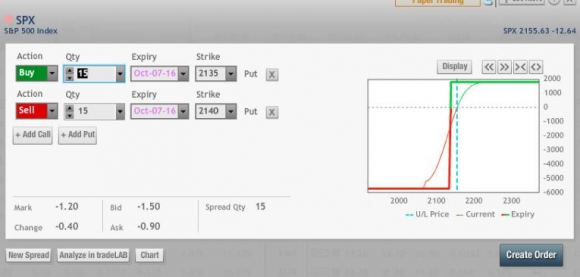

(SPY)

S&P 500 (^GSPC)

VOLATILITY S&P 500 (^VIX)

United States Oil (USO)

Apple Inc. (AAPL)

SPDR S&P 500 ETF (SPY)

It?s a good thing I went to an Oktoberfest last week.

That gave me a chance to get my German up to snuff just in time for Deutsche Bank to run into financial troubles.

Since 2008, the knee jerk reaction to bad news about any major bank is that the Lehman Brothers nightmare is about to repeat itself.

It only took a few calls to Frankfurt and some reminiscing about the good old days in West Berlin for me to figure out that Deutsche Bank is no Lehman. They have tons of liquid cash and a rock solid balance sheet.

A systemic threat it is not.

Do you really think the Germans are going to bail out Greece, but let its largest bank go? I don?t think so.

It is only fear of a 50% dilution from a new capital raise that is driving investors out of the stock.

Not helping is the $14 billion in fines the mega bank still owes the US Justice Department related to abuses committed in the run up to the 2008 crash.

Does that sound remarkably similar to the $14 billion Apple (AAPL) owes the Irish government? I?m sure it?s just a coincidence. And I am equally shocked they allow gambling in the casino.

However, automatic fears like this will probably continue for another generation, much like they did after the great 1929 crash, leaving investors on the sidelines.

That all adds up to a giant SELL for all asset classes. There really is no place to hide.

So far, every puke-out has been met by a wall of buying from underweight, underperforming, performance-chasing investors targeting 2,013 in the S&P 500 (SPX).

If this behavior continues, we could be in for what I call ?The dreaded flat line of death?.

This occurs when markets trade in incredibly tight ranges creating opportunities for virtually no one. That is exactly what we saw during the five-month period during the spring and summer of this year.

This could last all the way until the presidential election on November 8th.

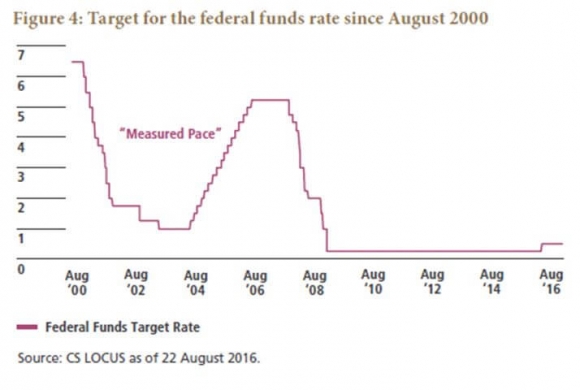

So I have been hiding out with a nice little short position in the bond market (TLT), which delivered a convenient two point dump on the last trading day of the month, just pushing my performance mercifully into the green.

Hey, in these miserable trading conditions, I?ll take a push any time.

Isn?t that what?s supposed to happen when the Fed promises to raise interest rates in December?

You could have made a lot of money last week trading the Volatility Index (VIX) which made two round trips between $12-$15, a 25% range.

When will the next market panic ensue?

When a confident, assured, even tempered, and well prepared Donald Trump, brimming with facts, wins the Sunday, October 9th presidential debate at Washington University in St. Louis, Missouri.

CNN?s Anderson Cooper will be the moderator, and the questions will be randomly posed by individual citizens in a town hall format and via social media.

It will be a real ?think on your feet? challenge for both candidates.

I can?t wait.

Finally, since I am basically a positive person, I like to end on a high note.

San Jose, CA based Nutanix (NTNX) launched the best performing IPO of the year on Friday, up 131% on the first day.

The performance had the airwaves in Silicon Valley burning up.

Yes, I know these deals are engineered to create a structural short squeeze at the beginning.

But is this the deal that gets unicorn giants like Uber and Airbnb off the bench? Are another 100 unicorns behind them ready to go public? Are extravagant IPO parties making a return after a 16-year hiatus?

Most importantly, IS THE DOTCOM BUBBLE BACK?

The possibilities boggle the mind.

On Monday, October 3 at 8:30 AM, we get August Gallup Consumer Spending which should show that Americans are using their credit cards as much as ever.

On Tuesday, October 4 at 8:55 AM EST, we learn the Redbook for the week, tracking the behavior of consumers at chain stores, discounters, and department stores.

On Wednesday, October 5 at 10:00 AM EST, we get September Factory Orders and the ISM non-Manufacturing Index.

On Thursday, October 6 at 8:30 AM EST, we get the Weekly Jobless Claims which should confirm that employment remains at four decade highs.

Friday, October 7 delivers us the September Nonfarm Payroll report at 8:30 AM EST, the big release of the week. Expect a big bounce back from the disappointing 151,000 print last month, as well as substantial upside revisions.

We wind up with the Baker Hughes Rig Count on Friday at 1:00 PM EST. Worryingly, the trend has been up for the past 13 out of the past 14 weeks. Given OPEC?s surprise, and not believed, production cap last week, this report should garner more interest than usual.

All in all, I expect us to continue trading in narrow ranges, with profits accruing only to the quick and the nimble.

?If my analysis about Deutsche Bank proves correct,? all of the volatility could be confined to Friday morning.

Good luck and good trading. Keep your hard hat on.

John Thomas

The Mad Hedge Fund Trader

All is Good With Deutsche Bank

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.