As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. This is your chance to ?look over? John Thomas? shoulder as he gives you unparalleled insight on major world financial trends BEFORE they happen. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

August 19, 2016

Fiat Lux

Featured Trade:

(LAS VEGAS, NV NOVEMBER 18TH GLOBAL STRATEGY LUNCHEON),

(A NOTE ON TODAY?S OPTIONS EXPIRATIONS),

(FXY),

(THANK GOODNESS I DON?T LIVE IN SWEDEN),

(EWD),

(TESTIMONIAL)

CurrencyShares Japanese Yen ETF (FXY)

iShares MSCI Sweden (EWD)

We have one options position that is in-the-money and about to expire at the close of business today, and I just want to explain to the newbies how to best maximize their profits.

This comprises the Currency Shares Japanese Yen Trust (FXY) August $97-$100 in-the-money vertical bear put spread with a cost of $2.70.

As long as the FXY closes at or below $97.00 today, the position will expire worth $3.00 and you will achieve the maximum possible profit of 11.11%.

That is not a bad return in only 11 trading days in this zero interest rate world.

Better that a poke in the eye with a sharp stick, as they say.

In this case, the expiration process is very simple. You take your left hand, grab your right wrist, pull it behind your neck and pat yourself on the back for a job well done.

Your broker (are they still called that?) will automatically use the long put to cover the short put, cancelling out the positions. The profit will be credited to your account on Monday and the margin freed up.

Of course, I am watching these positions like a hawk, as always.

If an unforeseen geopolitical event causes the FXY to take off to the upside once again, such as if Janet Yellen announces that there will never be another interest rate hike again, you should get the Trade Alert in seconds.

If the FXY expires slightly out-of-the-money, like at $97.01, then the situation may be more complicated, and can become a headache.

On the close, your short put position expires worthless, but your long put position is converted into a large, leveraged outright naked short position in the yen with a net cost of? $97.30.

You do not want this position on pain of death, as the potential risk is huge and unlimited, and your broker probably would not allow it unless you put up a ton of new margin.

This is not what moneymaking is all about.

Professionals caught in this circumstance then buy an amount of yen equal to the short position they inherit with the expiring FXY $100 put to hedge out their risk.

Then the long yen position is cancelled out by the short yen position resulting from the exercised put, and on Monday both disappear from your statement.

However, this can be dicey to execute going into the close.

So, for individuals, I would highly recommend just selling the August FXY $97-$100 put spread outright in the market if it looks like this situation may develop and the FXY is going to close very near the $97 strike, even if it as a loss.

The risk control is just too hard for individual traders to handle.

There is another reason to come out early. Some brokers exercise the options in the spread into shares on expiration, and then hit you with an extra commission on the sale of the yen.

So check with you broker to see how they handle options expirations.

To be forewarned is to be forearmed.

Keep in mind also, that the liquidity in the options market disappears and the spreads widen, when a security has only hours or minutes until expiration.

This is known in the trade as the ?expiration risk.?

One way or the other, I?m sure you?ll do OK, as long as I am looking over your shoulder, as I will be.

Now your only problem is to figure out how to spend the money.

Well done, and on to the next trade.

Well Done and On to the Next Trade

?There?s a great quote from Warren Buffet where he says ?You don?t know who?s swimming without a swimsuit until the tide goes out.? "The tide is starting to go out for the unicorns. I don?t know if it is 20% out or 80% out, but you are starting to see which unicorns don?t have great business models, lack solid unit economics, or are over promotional on what they are able to achieve.? said Bill Gurley, general partner of venture capital firm Benchmark Capital.

?

Come join me for lunch at the Mad Hedge Fund Trader?s Global Strategy Update which I will be conducting in Las Vegas, Nevada on Friday, November 18, 2016.

A three-course lunch will be followed by a PowerPoint presentation and an extended question and answer period.

I?ll be giving you my up to date view on stocks, bonds, foreign currencies, commodities, precious metals, and real estate.

And to keep you in suspense, I?ll be throwing a few surprises out there too. Enough charts, tables, graphs, and statistics will be thrown at you to keep your ears ringing for a week. Tickets are available for $212.

I?ll be arriving early and leaving late in case anyone wants to have a one on one discussion, or just sit around and chew the fat about the financial markets.

The lunch will be held at a top restaurant at a major Strip casino. The exact location will be emailed with your purchase confirmation.

I look forward to meeting you, and thank you for supporting my research.

To purchase tickets, please click here.

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

August 18, 2016

Fiat Lux

Featured Trade:

(UPGRADE NOW TO MAD OPTIONS TRADER),

(SEPTEMBER 16th PORTLAND, OR GLOBAL STRATEGY LUNCHEON),

(PETER F. DRUCKER ON MANAGEMENT)

I had planned on formally launching our new Mad Options Trader service at the end of August.

But why wait?

Matt has delivered such blowout results so far this month, up a stunning 20%, that to delay might unfairly deprive subscribers from future profits.

So, as of today, Nancy, in customer support, is taking Mad Options Trader orders. Just put "MOT Upgrade" in the subject line, and she will get back to you shortly.

This is how the upgrade works.

For example, let?s say you have nine months remaining on your existing $3,000 Global Trading Dispatch subscription. You will get a credit for $2,250. Nancy will then bill you $4,500 against this.

That brings the upfront cost for the upgrade to $2,250, but your subscriptions for the GTD + MOT combo now have a full year to run together.

This means that Nancy is going to have to manually calculate the price for each new upgrade to MOT for each of you individually, and then give you a precise amount you can send to us by PayPal or check.

Early action will be rewarded.

Regardless, your free MOT "test flight" will continue until the end of August, as promised, and the new paid MOT subscription will start on September 1st.

The month end coincides with the Labor Day weekend, so the time we can deal with the incoming crush of orders is thus further shortened.

Nancy warned me that I better start processing orders now, or her ?head would explode.?

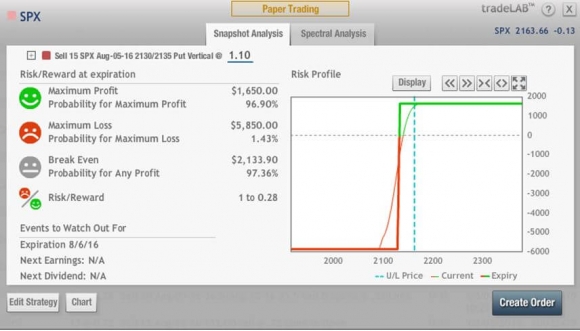

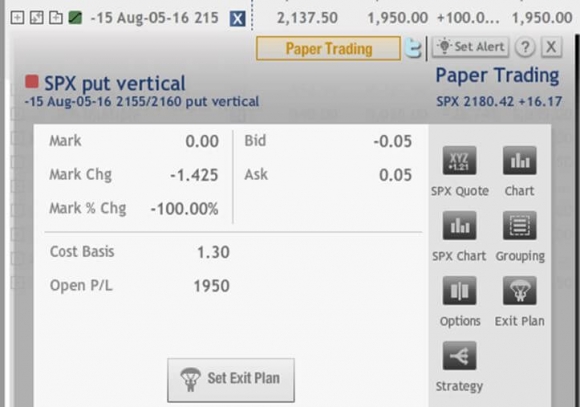

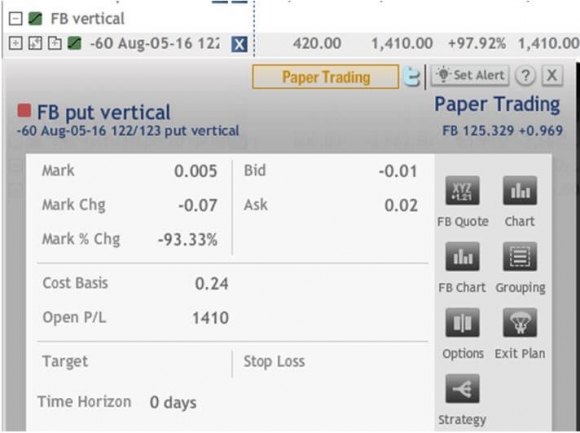

Matt?s unique service focuses primarily on the weekly US equity options expirations, with the goal of making profits at all times.

The trading will take place in the S&P 500 (SPX), major industry ETF?s like the Financials Select Sector (XLF), and large capitalized single names, such as Facebook (FB), JP Morgan Chase & Co. (JPM), and Apple (AAPL).

Matt is my old friend and fellow comrade in arms of Top Gun Options, one of the best performing trade mentoring outfits in the industry.

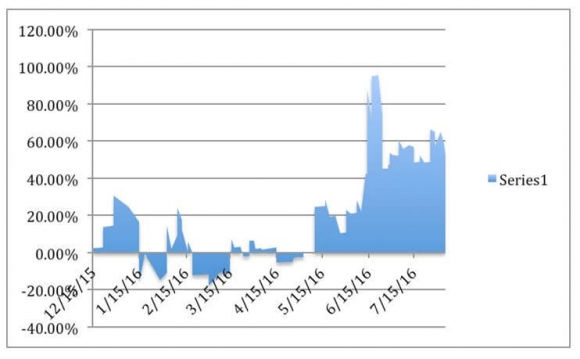

Matt knows what he is talking about. An independent audit shows that he has racked up an incredible 53.03% performance, net of commissions and fees, so far in 2016, one of the most difficult years in trading history.

That works out to an average 7.92% a month, or an incredible 95.09% a year.

Matt, a native of New Jersey, joined the Navy straight out of college, and rose to become an F-18/A fighter pilot. He attended the famed Top Gun school in Coronado, California. During the second Iraq War, Matt flew 44 combat missions.

Matt left the service in 2006, and immediately entered the hedge fund industry. A rapid series of promotions eventually took him to Peak6 Investments, L.P., a prominent Chicago hedge fund.

There, he soaked up the most crucial elements of technical market timing, fundamental name selection, risk control, and options trade execution.

These are the multiple skills that have enabled Matt to post such a blockbuster performance.

Matt, known to his friends by his old pilot handle of ?Whiz?, is an incredibly valuable addition to the Mad Hedge Fund Trader team. I have appointed him Head of Options Trading.

I have known for some time that fortunes were being made in the weekly options expirations, where stories of tenfold returns are not unheard of. It is a strategy that is perfectly suited to these highly volatile, uncertain times, with most options positions expiring within four days.

Matt allows us to fill that gap in our product offerings.

The Mad Options Trader provides essential support for the active trader and will include:

1) Instant Trade Alerts texted out at key technical levels. Alerts will be sent out on the opening and closing of every position.

2) Weekly Market Strategy Webinars held every Monday at 1:00 PM EST to give you a head?s up on the week ahead.

3) A weekly Live Trading Room held every Tuesday from 9:00 to 11:00 AM EST to give members active real time trading experience.

4) Specialized Training Webinars on how to best execute Matt?s trades.

What I love about Matt is that he eats his own cooking. Many of the Trade Alerts he recommends are executed in his own personal retirement account with real dollars.

To see how he has performed so far in 2016, please check out the daily chart below.

Good Luck and Good Trading,

John Thomas

Publisher and CEO of The Mad Hedge Fund Trader

Mad Options Trader 2016 YTD Independently Audited Performance

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.